H-183, Sector 63, Noida

Everyday

H-183, Sector 63, Noida

Everyday

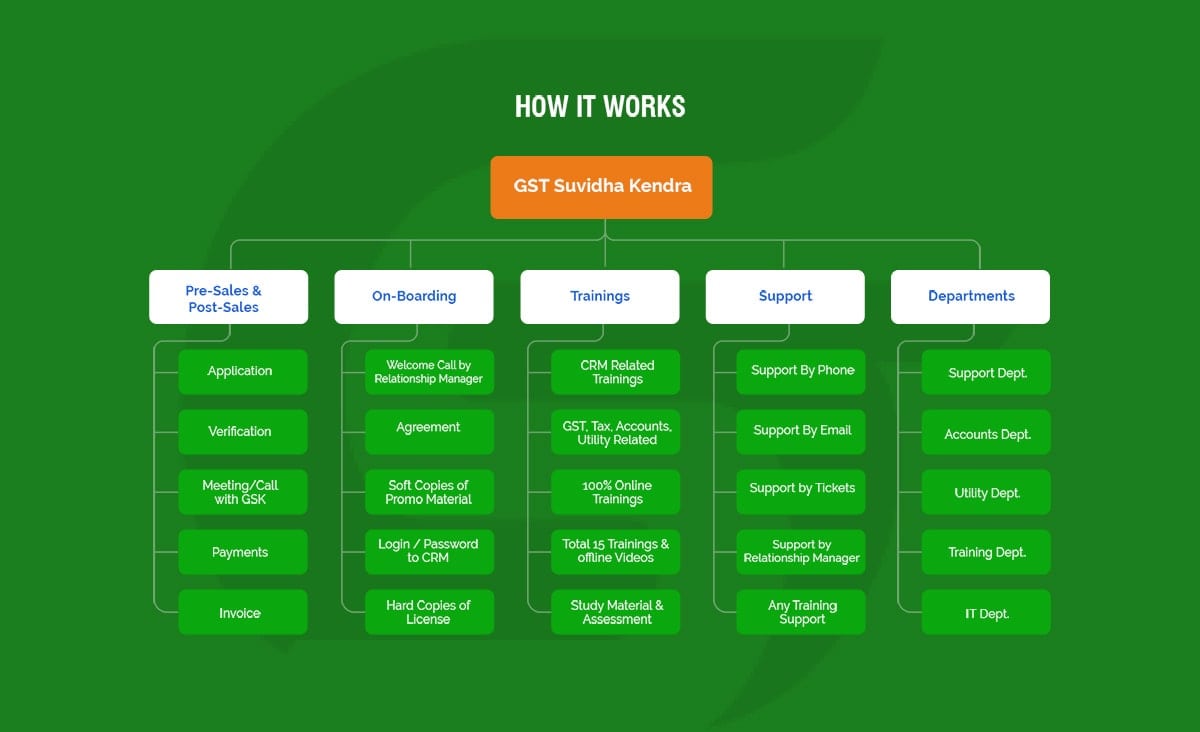

GST Suvidha Kendra® serves as a comprehensive platform offering a golden chance for individuals and businesses to generate a steady income. By partnering with us, you gain access to 400+ high-demand services that you can sell from any location—be it your home, shop, or office.

You have the potential to earn between ₹25,000 and ₹1,00,000 per month.

We equip you with over 50 specialized training modules. Coupled with our attractive commission structure, this prepares you to market more than 400 diverse services effectively.

| FEATURES | BENEFITS |

| 400+ Services | Diverse range of in-demand services to offer |

| Flexible Location | Operate from home, shop, or office |

| Training Modules | More than 50 training sessions for skill enhancement |

| Attractive Commission | Rewarding compensation structure |

| Parterns | Existing 38,000 Franchisees Holders across India. |

| Trademark | Owned by Company Owner- Shri, Mayank Jain |

| Leads | Lead Generation Software |

| Mobile APP | Yes |

| Cloud Portal | Yes |

| Company Name | Prologic web Solutions Private Limited ( Since 2012) |

| Support | By Phone/Email/Tickets |

(GSTN – GSP Approved License)

GST Promotional Material ( Hard Copy of GSK Certificate, Soft Copies of Banner, Visiting Card, Letter Head and Phemplat.)

GSK Engagement Services like Money Transfer, AEPS, Travel, Recharge, Bill Payments etc. to gain maximum clients and save initial cost of the GSK Owner.

Ongoing recurring income on GST and other Tax Related services.

24/7 Help-Desk Support & Relationship Manager. Training and Important Announcements.

Interactive CRM to order along with checklist of each service. Commission Payments twice in a month.

Competitive Service Pricing. e.g GST Registration is 100 Rs.

This is only for GST filing – Just one service. There are more than 30 services which you can offer to your clients.

Now, considering the fact that these clients will also need accounting services and you are going to get Y amount for that.

So, after 1 year your earning is 180 ( X+Y)

Services offered at GST Suvidha Kendra®

Any Indian Citizen.

We know that you are eager to know how much is the earning potential of GST Suvidha Kendra® and Which all services you can provide by opening a GST Suvidha Kendra®.

So, list of services is attached herewith along with commission structure :

1. Become a Travel Agent with GST Suvidha Kendra®

2. Become an Insurance Agent with GST Suvidha Kendra®

3. Become a Money Transfer & AEPS Agent with GST Suvidha Kendra®

4. Become a Loan Agent with GST Suvidha Kendra®

5. Become a GST Expert with GST Suvidha Kendra®