H-183, Sector 63, Noida

Everyday

H-183, Sector 63, Noida

Everyday

GST Suvidha Kendra® is one step gateway which can help individual/business to earn sustainable income month to month basis by selling in demand services from anywhere - home/shop/office.

If you do not know much about GST, please read here:

GST Invoice Software is a handy software that can help you to generate GST invoices. You will get around 100 licenses of this software that you can give for free or sell to local shop vendors. The advantage of this software is that you can file GST Returns for all the shops. In addition, you get the opportunity to earn commission on a monthly/quarterly basis on GST Returns.

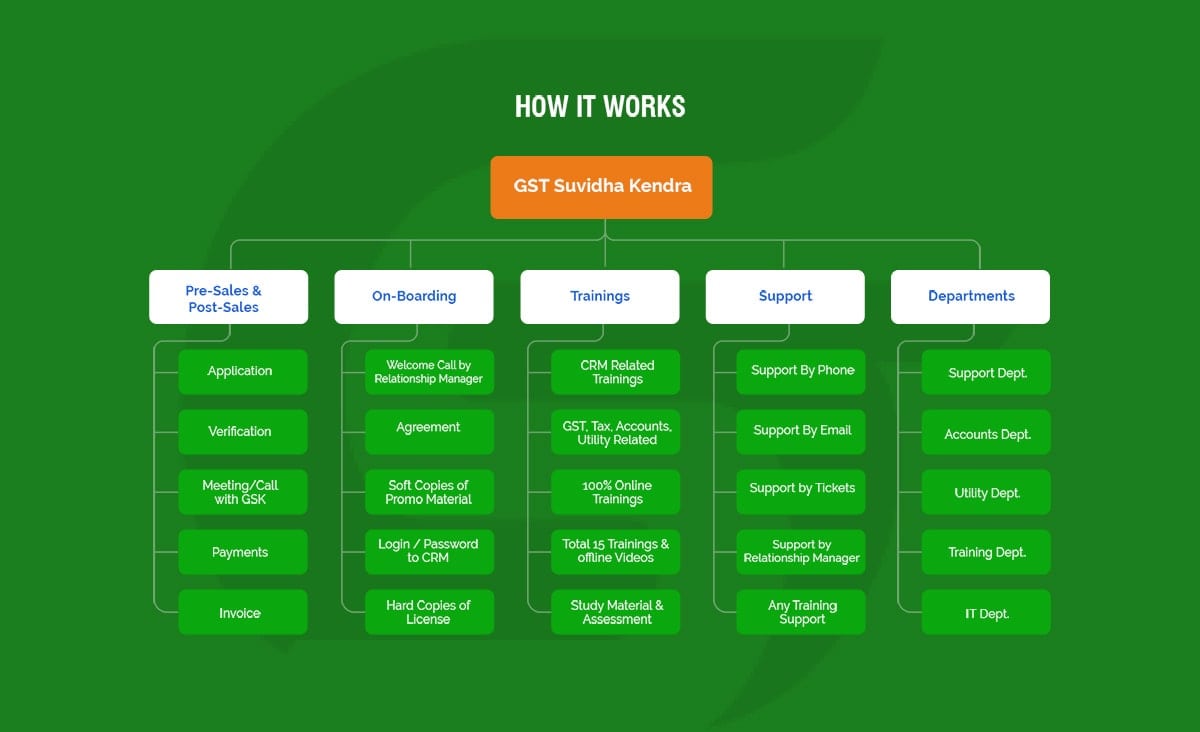

This contains the following sections:

Lead Generation software is an efficient software to find GST Returns clients. You can easily find 20 clients who are filing GST Returns in your local area. You just need to put in a little effort for this.

For instance, if you find 100 clients in a month, you can easily make Rs.300x100= Rs 30,000 within the first month. And if you keep on finding clients every month, you can easily generate income from new as well as previous clients because GST Return filing is a monthly/ quarterly filing process.

The lead generation course is different from our training model. We provide over 50 training through our GST Suvidha Kendra portal. With this course, you can learn how to generate leads for all the verticals which are under GST Suvidha Kendra.

GST Suvidha Kendra empowers its distributorship by enabling you to become a GST Suvidha Kendra Distributor. The entire distributorship of GST Suvidha Kendra works on the principle of making a distributor entitled to strong digitalization of banking and financial services, a diverse form of income sources, and new opportunities to expand their business prospect.

A GST Suvidha Kendra Distributor is authorized to appoint agents/retailers to work under him and sell the cashless services of GST Suvidha Kendra like-

(GSTN – GSP Approved License)

GST Promotional Material ( Hard Copy of GSK Certificate, Soft Copies of Banner, Visiting Card, Letter Head and Phemplat.)

GSK Engagement Services like Money Transfer, AEPS, Travel, Recharge, Bill Payments etc. to gain maximum clients and save initial cost of the GSK Owner.

Ongoing recurring income on GST and other Tax Related services.

24/7 Help-Desk Support & Relationship Manager. Training and Important Announcements.

Interactive CRM to order along with checklist of each service. Commission Payments twice in a month.

Competitive Service Pricing. e.g GST Registration is 100 Rs.

This is only for GST filing – Just one service. There are more than 30 services which you can offer to your clients.

Now, considering the fact that these clients will also need accounting services and you are going to get Y amount for that.

So, after 1 year your earning is 180 ( X+Y)

Services offered at GST Suvidha Kendra®

Any Indian Citizen.

We know that you are eager to know how much is the earning potential of GST Suvidha Kendra® and Which all services you can provide by opening a GST Suvidha Kendra®.

So, list of services is attached herewith along with commission structure :