Call Us 1-800-108-8888

info@gstsuvidhakendra.org

GST Suvidha Kendra®

H-183, Sector 63, Noida

09:00 - 21:00

Everyday

Contributing to Indian Economy

info@gstsuvidhakendra.org

H-183, Sector 63, Noida

Everyday

We know that you are eager to know how much is the earning potential of GST Suvidha Kendra® and Which all services you can provide by opening a GST Suvidha Kendra®.

So, list of services is attached herewith along with commission structure :

Now, the question comes how much you can earn every month ?

Let’s say, in first month a New GSK obtain 15 clients. They all need GST Registrations. You also got 15 clients for their accounting (upto 40 Lakh) & lastly , you got 15 clients who wants to file GST returns.

GST registration happens once only. GST return filing is a monthly process and accounting is a monthly process again.

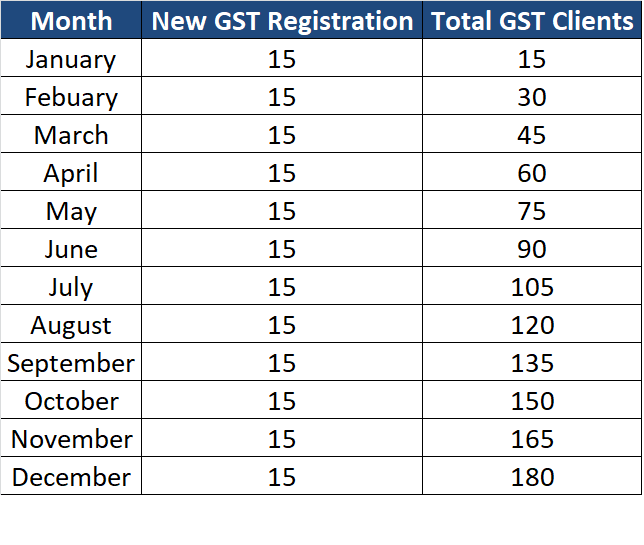

So, if you add new 15 clients every month, it means your GST returns clients and accounting clients are increasing every month.

In Second month, you obtained another new 15 clients, So, in total now you have to do GST returns filing & Accounting for 15+15 = 30 clients.

If you put your efforts to get new clients every month in same manner, you will have 180 clients in a year.

You can understand this by following table :

Now, We need to understand that GST registration is only one time process means you can charge your client once. It means, you will be earning for 15 GST Registration clients only each month. GST registration is just one of our 300 services.

But each of these clients has to file GST Returns which is a month to month process. It means, if you add new 15 clients every month, after 1 year you will be having 180 clients who will be filing GST returns via Your GST Suvidha Kendra®. GST retrun is only one of our 300 services. GST return filing charges 500 INR and your commission is 402 INR.

Also, you need to understand that these clients also need accounting packages which is monthly. Now, consider the minimum accounting package (980 INR) which is up to 20 Lacks, your commission is : 490 INR. So, if you do accounting for all those clients, it means you will be doing accounting for these 180 clients after 1 year.

So, you are just providing only 2 Major services to your clients out of our 300 services. Let’s understand commission structure :

So, you can see for GST Registration, your commission is 900 INR & for GST Filing : 402 INR.

Following table shows how much you can earn by selling only GST Registrations only by adding 15 new clients every month.

This is clear that with GST Registration only you can earn 13,500 Rupees per month and if you keep on adding 15 clients a month, you will be having 180 clients after one year.

Now, the following table shows, how much you can earn from GST Returns filing :

It means, you will earn 6000 Rupees in first month because you had only 15 clients but after 1 year, every month you will have 180 clients & you can earn more than 72000 Rs/month by filing GST Returns.

Total Income by GST Registrations and Returns

You need to understand that, this is ongoing and recurring income which has potential to grow if you work upon client acquisition. The more clients you add the more you will be earning.

If you add more services and sell those to your clients, you can add more monthly revenue. Here is full commission structure.

Now, you can understand how eaisly you can generate recurring income for you and for your family.