EPFO – A Beginner Step by Step Guide

EPFO – A Beginner Step by Step Guide

Ever found yourself caught in the maze of financial planning, staring at terms like 'EPFO' and feeling utterly lost? Well, you're not alone.

It's like being on a roller coaster ride with no map - exhilarating yet overwhelming. You see, EPFO or Employees’ Provident Fund Organisation is more than just an acronym; it’s your ticket to a secure future.

In this post, we'll unravel the mystery behind EPFO – making it as simple as having a cuppa tea! From understanding its essence to checking your balance online and even learning about withdrawal processes – we've got you covered!

A metaphorical torchlight illuminating the winding tunnels of finance management - that's what this guide promises to be. Buckle up for an enlightening journey through the realm of EPF. Are you ready?

Table Of Contents:

- Understanding EPFO: A Comprehensive Guide

- The Intricacies of EPF Balance Check Online

- Navigating Through The Process of EPF Withdrawal

- Demystifying UAN: The Key to Your EPF Account

- Transferring Your EPF Account Made Easy

- The Power of EPF Interest Rate

- The Digital Transformation of EPFO Services

- The Role of EPFO in Employee’s Retirement Planning

- EPFO’s Pension Scheme: An In-depth Analysis

- 10. EPFO for Employers: Compliance and Responsibilities

- Conclusion

Understanding EPFO: A Comprehensive Guide

The Employees' Provident Fund Organisation, or EPFO, is a major player in the financial wellbeing of India's workforce. Let's take a closer look at its functions and significance.

What Is EPFO?

The EPFO is an Indian governmental body that helps workers save for their future. It manages the Employees' Provident Fund (EPF), which acts like a piggy bank where both employees and employers contribute regularly.

This isn't just any old savings scheme though. The funds saved in this account earn interest over time, making them grow faster than they would sitting idle in your pocket.

Why Does EPFO Matter?

A well-padded provident fund can be vital when you retire or if unexpected expenses come up along life’s journey. Think of it as having a sturdy umbrella on hand when there are stormy skies ahead – you’ll thank yourself later.

The government supports this idea so much that they offer tax benefits to encourage people to use these accounts more often - quite similar to putting cherries on top of our favourite dessert.

Beyond Retirement Savings

An important part about understanding the EPF is realising its versatility. Apart from providing financial security during retirement years, it also serves other purposes such as housing loans and medical emergencies – almost like your own personal genie granting wishes when you need help most.

Navigating Through The System

To make sure every worker gets access to these perks, all organisations with 20+ employees must register with EPFO. The EPFO then gives each worker a Universal Account Number (UAN), which is like their personal key to access the benefits of this system.

Thanks to the digital age, keeping track of your account balance or transferring funds has never been easier. Just imagine being able to check on your nest egg from anywhere in the world at any time – that’s exactly what EPF offers.

The Employees' Provident Fund Organisation (EPFO) is a real game-changer for Indian workers, overseeing a savings plan where both bosses and employees contribute. It's not just your everyday savings jar; this money blossoms with interest over time. Besides giving financial stability when you hang up your boots, it also steps in to help with home loans and health crises. To make sure everyone benefits,

The Intricacies of EPF Balance Check Online

Checking your Employees' Provident Fund (EPF) balance online isn't as daunting as it might sound. It's actually quite a simple process, needing only some basic information.

What You Need to Start Checking Your EPF Balance Online

You'll need some essential pieces of information before you start checking your EPF balance online. First up is your Universal Account Number (UAN), which is given by the Employees' Provident Fund Organisation (EPFO). This unique number helps in managing and accessing all services related to your PF account.

Your registered mobile number is another important detail. The one linked with the UAN gets alerts regarding contributions and withdrawals made from the fund. So, make sure this contact information stays updated.

Navigating Through The Process

To check the balance, head over to the official website of EPFO. Once there, look for 'Services', under which you'll find an option for employees called 'Member Passbook'. Click on that link and log in using your UAN and password.

If you've forgotten or lost these credentials, don't panic. There's always an option available to retrieve them via SMS or email tied with your account. Follow this guide here if needed.

Detailed Information Available After Logging In

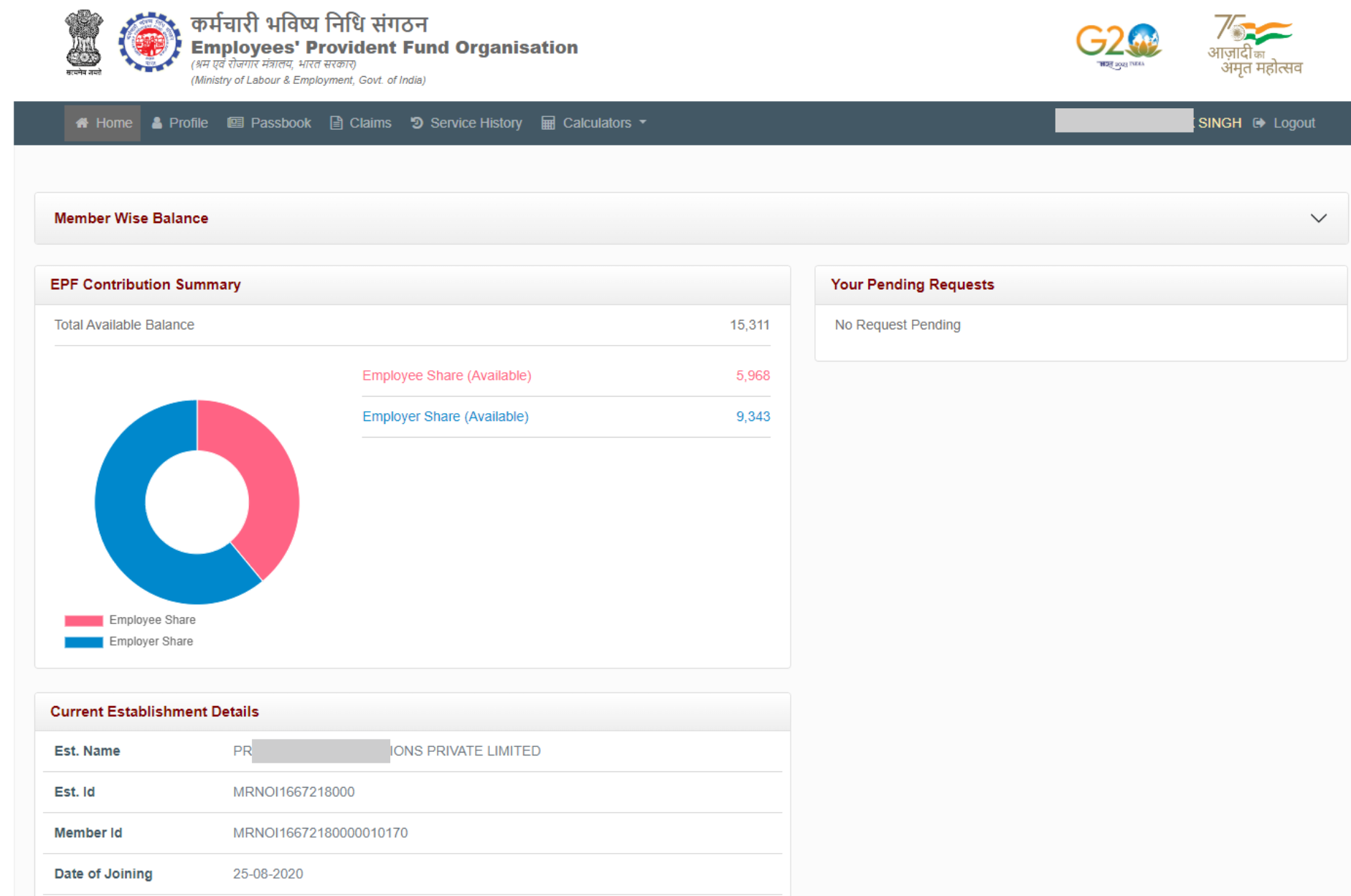

After successfully logging into your account on their portal site, click on ‘View Passbook’. Here you'll find the EPF balance details for your account. This includes both employee and employer contributions, along with any accrued interest.

Not only this, but it also displays a monthly breakdown of these transactions for each year. It's quite helpful to keep track of your savings growth over time.

Beyond Just Checking Your Balance

But the EPFO portal isn't all there is to it.

Getting a handle on your EPF balance online isn't tricky. All you need is your UAN and registered mobile number to start. Hop onto the EPFO's official website, log in with these details, and get access to detailed transaction records for your account - it's as simple as that.

Navigating Through The Process of EPF Withdrawal

Withdrawing your Employees' Provident Fund (EPF) balance is not as complicated as it may seem. In fact, with a bit of know-how and the right tools, you can get access to your hard-earned money smoothly.

When Can You Withdraw Your EPF?

Knowing when you can access your EPF is the first step in being able to withdraw it. Normally, this happens at retirement or if an employee remains unemployed for more than two months.

If certain conditions are met though, partial withdrawals are also possible. For instance, employees can withdraw up to 50% of their contribution for marriage expenses or higher education after seven years in service.

What Documents Do You Need?

To start the withdrawal process, several documents will be needed including:

- Your Universal Account Number (UAN)

- Aadhaar Card details

- PAN card details

Tax Implications Of Withdrawing Your EPF Early

An important aspect often overlooked during withdrawal planning involves taxes. While no tax applies on withdrawals made after five continuous years of service, early withdrawals might attract Income Tax. Think twice before acting hastily.

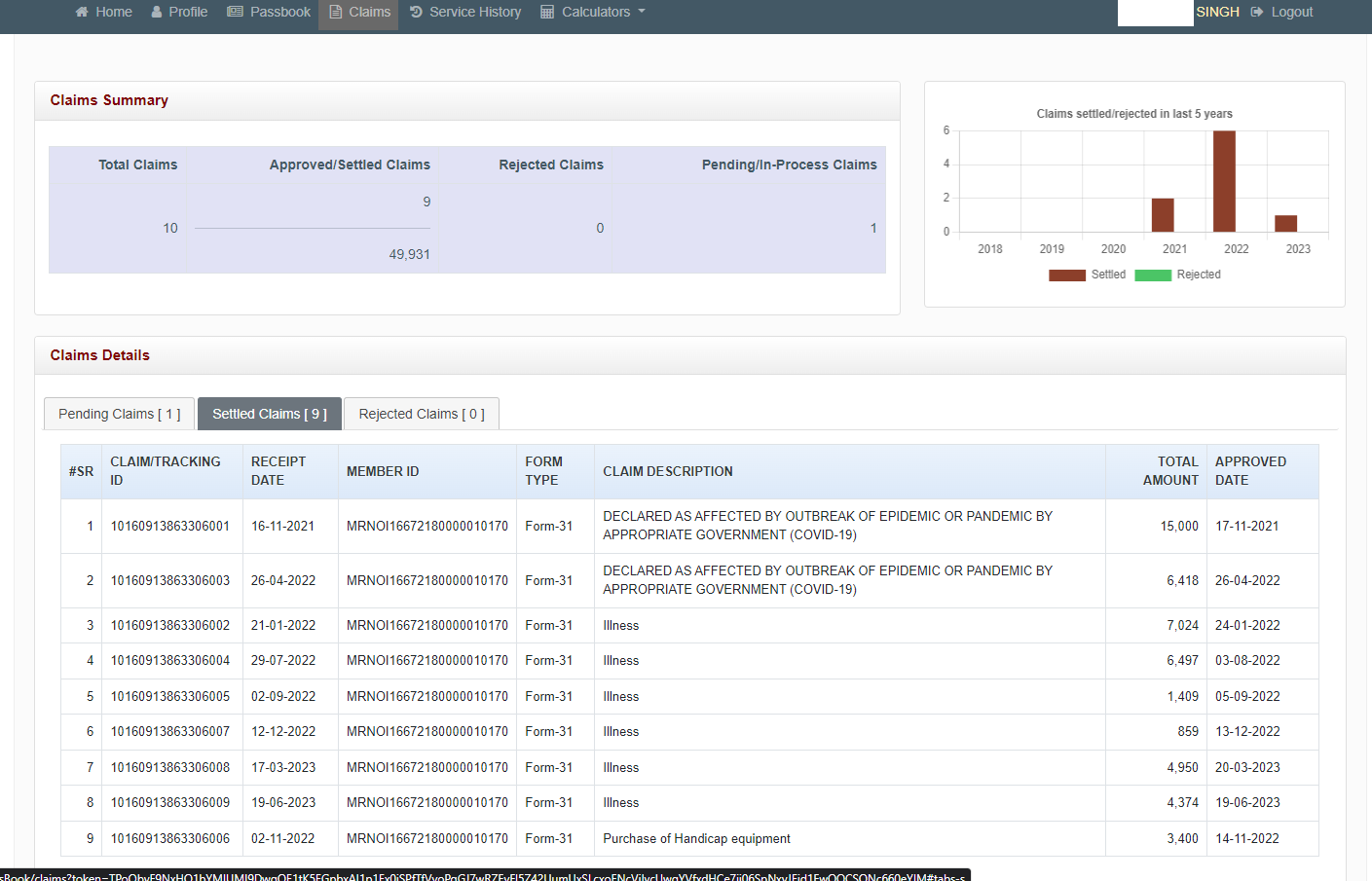

Filing A Claim Online: Making It Easy To Access Your Money

The Employee's Provident Fund Organisation has simplified the claim filing procedure by allowing online submissions through its portal. This is how you can do it:

- Visit the EPFO portal and log in using your UAN and password.

- Select 'Claim' from the 'Online Services' menu.

- Check if your KYC details are correct, then proceed to file a claim for either full withdrawal, partial withdrawal or pension withdrawal under different scenarios.

The entire process might seem daunting at first glance but understanding these key aspects will certainly make it more manageable. Take the reins of your financial future.

Pulling out your EPF isn't a tough nut to crack. Just remember, you can usually dip in at retirement or after being jobless for two months. Also, some situations let you make partial withdrawals. Make sure to have documents like UAN, Aadhaar Card details and PAN card ready to kick things off. Keep an eye on possible tax hits if you withdraw early but don't sweat it too much.

Demystifying UAN: The Key to Your EPF Account

The Universal Account Number (UAN) is like a magic key. It unlocks access to your Employees' Provident Fund (EPF) account, providing a convenient way for you to manage it.

What Is A UAN?

A UAN is a 12-digit number given by EPFO. Each employee gets one, and it sticks with them throughout their career - no matter how many job changes they make.

This unique number helps link multiple Member Identification Numbers (Member Id) that are assigned to an individual by different organisations. Think of these as little jigsaw pieces that all fit together under your UAN umbrella.

The Importance Of A UAN

Your trusty sidekick, the humble yet powerful UAN serves several purposes:

- Makes transferring PF from old accounts easier when changing jobs.

- Gives access to online services such as withdrawal of PF balance and checking EPF status.

- Lets employees check their EPF balance anytime on the go. How cool is that?

Simplifying Management With Your Magic Key – The Process To Activate Your UAN

To start using this magical tool effectively, you need first activate your 'magic key'. Fear not; it's less Hogwarts more mouse-clicks.

- You'll need some basic details like Aadhaar or PAN along with your mobile number handy.

- Navigate over to the EPFO portal and click on 'Activate UAN'.

- Type in your UAN, name, date of birth, mobile number. Don't forget to enter the captcha before hitting ‘Get Authorization Pin’.

- You'll receive an OTP (One Time Password) on your registered mobile number. Type this into the form and hit ‘Validate OTP and Activate UAN’. Voila. Your magic key is now ready for use.

Transferring Your EPF Account Made Easy

Changing jobs can be exciting, but it also means you have to deal with transferring your Employees' Provident Fund (EPF) account. Don't fret. The process isn't as daunting as it sounds.

The Need for Transfer

You might ask, why not just withdraw the funds? Well, withdrawing from your EPF before retirement can lead to a loss of long-term benefits and potential tax implications. So, moving your account is usually the smarter choice when changing employers.

Conditions for Transferring Your Account

To transfer an EPF account successfully, some conditions need to be met. Firstly, both previous and current employers must be registered under EPFO. Secondly, details like Aadhaar and bank accounts should be linked with your Universal Account Number (UAN).

The Process Simplified: Step by Step Guide

- Create or Activate UAN: If you don’t already have a UAN or if it’s not activated yet, start there. This unique number lets you manage all things related to EPFO services online.

- Login: Use this link, enter your UAN and password then click on ‘Sign in’ button after entering captcha code.

- Select Claim : From the top menu bar select 'Online Services', then 'Transfer Request'. Let's get stuck in.

- Details Verification: You'll be asked to verify details of your previous employment. Once verified, you can submit the transfer request online.

- Approval from Employers: Both your past and present employers will need to approve this request. It's a safety measure put in place by EPFO for verification purposes.

Note: Keep an eye on your email or mobile for updates about the status of the transfer process.

A Few Parting Words

Switching jobs isn't a small task, right? It's big. And it needs careful thinking and planning.

Thinking of changing jobs? Don't sweat it - transferring your EPF account is easier than you'd expect. Here's the rundown: first off, check that both employers are in the EPFO system. Also, link your Aadhaar and bank details with UAN. Next up: activate or create your UAN and log into the portal. Hit 'Transfer Request', double-check your past job info, then just follow along.

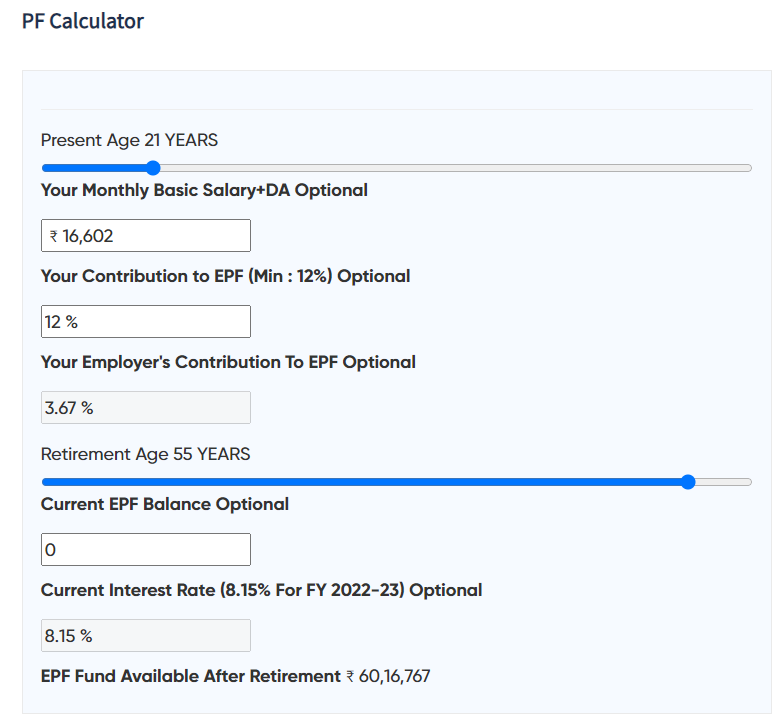

The Power of EPF Interest Rate

Ever wondered why the Employees' Provident Fund (EPF) is often hailed as a smart investment? One major reason is its attractive interest rate. This isn't just any regular interest, but compound interest. Think of it like a snowball rolling down a hill; with each roll, it gathers more snow and gets bigger - that's how your savings grow in an EPF account.

Let's compare the 8.5% rate of EPF to other long-term investments, such as Fixed Deposits (6-7%) and National Savings Certificate (6.8%). The current EPFO declared rate stands at 8.5%. To put this into perspective, compare it to other long-term investments such as Fixed Deposits which offer around 6-7% or even the National Savings Certificate standing at about 6.8%. So right off the bat, you can see how your money works harder for you with EPF.

How Is It Calculated?

The calculation bit might seem tricky initially but bear with me here. Your employer deducts 12% of your basic salary every month towards your PF contribution and matches that amount from their end too – though not all of this goes into your PF fund (more on that later).

Your monthly contributions are then totalled up annually along with previous years’ balance if any – remember our friend compound interest? That’s where he comes back into play. Based on these calculations, by retirement age (58), someone earning INR30k per month could have over INR1 Crore in their PF fund.

A Glimpse Into Compound Interest

In essence, compound interest makes sure each penny saved turns into two over time. Here's an easy analogy to understand it better: Imagine you plant a seed (your initial investment) in fertile soil (EPF account). This seed grows into a tree and starts bearing fruits, which fall back onto the ground, giving birth to more trees. The process continues until there is an entire forest sprung from just one single seed.

Think of compound interest like this - your savings make money, and then that money makes even more.

EPF's high interest rate makes it a smart investment choice. This isn't just simple interest, but compound. The current EPFO rate is 8.5%, which beats other long-term investments like Fixed Deposits or the National Savings Certificate. Your money works harder in an EPF account because of this attractive return and the power of compounding.

The Digital Transformation of EPFO Services

When we think about the EPFO, we often picture lengthy forms and long queues. But with digital technology taking over, that image is changing fast.

Let's look at how tech has reshaped EPFO services to make life easier for you.

A Few Clicks to Access Your PF Details

No more visiting offices or filling out endless paperwork just to know your provident fund balance. Now all it takes is a few clicks on the EPF India website. With this change, tracking your savings becomes as easy as online shopping.

Withdraw Funds Without Hassle

Digital transformation means no longer needing an employer's signature when you want to withdraw funds from your account. It also lets you submit withdrawal requests online - goodbye, tedious processes. This makes getting access to hard-earned money less stressful and quicker than ever before.

Your UAN: A Digital Key

Your Universal Account Number (UAN) isn't just another number; it’s like a key that unlocks multiple doors in the world of EPF management. Activating your UAN allows you access many services such as checking balances and withdrawing funds without breaking a sweat.

- Want some good news? You can now link your Aadhaar Card with UAN digitally via the e-KYC portal.

- This not only saves time but ensures security because everything stays between you and the official portal.

EPFO's Mobile App for the Tech-Savvy

Smartphones have become a part of our lives, and EPFO has embraced this fact. They launched their mobile app, allowing you to check your balance, track claims and even find EPF offices nearby.

- You can now get all these details while lounging on your sofa or travelling in a bus.

In essence, digital technology has given EPFO services an impressive makeover. So why wait?

Say goodbye to the hassle of long lines and endless paperwork with EPFO services, thanks to digital tech. Now, a few clicks let you peek at your provident fund details, pull out money without needing your boss's signature, and link up your Aadhaar Card with UAN online. And don't forget about that handy mobile app for checking balances on-the-move. Stress? What stress?

The Role of EPFO in Employee’s Retirement Planning

Think about your retirement. Picture the freedom, the ease, and all that time for hobbies or travel. But hold on. It's not as simple as daydreaming about golf courses or exotic vacations.

To enjoy a stress-free retired life, you need financial security. That's where India's Employees' Provident Fund Organisation (EPFO) comes into play. So let us delve deeper into how this government body helps you plan for your golden years.

A Steady Income Stream

The primary goal of EPFO is to give workers an income after they stop working full-time. This is done through regular monthly pensions under EPS (Employee Pension Scheme).

This means even when you're enjoying those peaceful mornings without rushing to work, there will be money coming in regularly like clockwork.

Savings Accumulation Over Time

Besides offering a pension scheme, EPFO also lets employees accumulate savings over their working lives through its provident fund system.

You contribute a portion of your salary each month towards this fund and so does your employer – it’s like building up a nest egg together. Moreover, these contributions earn interest which can add up significantly over time because we all know - every little bit counts.

Tax Benefits Galore

Another crucial role played by EPFO in retirement planning involves tax benefits. The amount contributed towards the provident fund enjoys exemption from income tax under Section 80C of the Indian Income Tax Act (source).

This means you get to save more, which ultimately contributes towards a comfortable retirement.

A Safety Net in Times of Need

Life can pitch us some unexpected fastballs, like urgent financial needs stemming from health crises or other surprises. But don't sweat it - EPFO lets you make partial withdrawals from your provident fund when life gets tricky.

Think about kicking back in retirement without any money worries. That's what India's EPFO can give you. It guarantees a consistent income once you've hung up your work boots, through regular pensions and saving up over time. Plus, the cash you put into your provident fund won't be taxed under Section 80C, so it lets you save even more for when every day is a weekend. And if life tosses some surprises your way? You're covered.

EPFO’s Pension Scheme: An In-depth Analysis

The Employees' Pension Scheme (EPS), provided by EPFO, is a key component of the retirement plan for many Indian employees and offers them a monthly pension after retirement. It provides a monthly pension after retirement to all its members.

You might think of EPS as an old-age safety net, just like a trapeze artist has while performing high-risk stunts. The only difference? This net ensures financial security when you decide to step off the work-life circus.

Eligibility and Contributions

To be qualified for this pension plan, you must make payments into it during your working life. But don't worry; it isn't complex maths. A portion of your overall EPF contribution goes into this scheme automatically.

Your employer contributes 8.33% or up to INR 1250 (whichever is less) from their share towards your EPS account each month. Check out more details here.

Pension Calculation Formula

Moving on from eligibility and contributions let's delve into how exactly the EPS amount gets calculated - spoiler alert: it's not rocket science. There are two formulas that can be used:

- If service period is less than 10 years: Monthly Pension = (Total Service Years * Last Drawn Salary)/70.

- If service period is over ten years but below twenty: Monthly Pension = ((Total Service Years * Last Drawn Salary)/70) + Bonus if applicable.

Rules and regulations regarding pension calculation can be accessed here.

Claiming the Pension

For you to get your pension, it's necessary that you've been a member of the EPF for some time.

10. EPFO for Employers: Compliance and Responsibilities

If you're an employer in India, dealing with the Employees' Provident Fund Organisation (EPFO) is a crucial part of your business responsibilities. You need to be well-versed with all compliance rules to avoid penalties and keep things running smoothly.

The Basics of EPF Compliance for Employers

As an employer, you must contribute 12% of basic wages towards the employee's EPF account each month. Here's a handy guide on how it works.

This contribution gets split into two parts - one goes directly into the provident fund, while the other heads towards pension schemes.

Navigating Through Registration Process

To start contributing to your employees' accounts, you first need to register your company with EPFO. This can be done online via EPFO’s official website. The process involves filling out some details about your company and paying requisite fees.

Maintaining Records and Returns Filing

You also have a responsibility as an employer to maintain detailed records regarding employee contributions made through their PF accounts over time. These records should include individual ledger cards for every member employed by you along with monthly returns that are submitted electronically on the E-sewa portal.

Dealing with EPF Compliance Checks

The EPFO conducts periodic inspections to make sure employers are following all compliance rules. So, it's essential to keep all records updated and ready for any potential audits.

Handling Employee Grievances

Should a team member have a question about their PF account, or run into an issue that needs sorting out, it's on you as the

Conclusion

Understanding EPFO isn't a puzzle anymore, is it? You've now got the know-how to check your EPF balance online with ease.

Navigating through the withdrawal process should no longer be daunting. Remember, knowing when and how to withdraw is crucial!

The importance of UAN in managing your EPF account can't be overstated. It's more than just a number; it’s your key to easier fund management.

Transferring an EPF account between employers might seem complicated at first glance but trust me - you’ve got this!

The magic behind the attractive interest rates offered by EPFO – decoded! Let these work for you, amplifying your savings over time.

Digitalisation has made accessing and using various services provided by EPFO smoother than ever before. Don’t forget that convenience comes hand-in-hand with knowledge.

So there we have it: A simple guide shedding light on all things 'EPFO'. Your path towards better financial planning starts here!