Become a Travel Agent with GST Suvidha Kendra

Become a Travel Agent with GST Suvidha Kendra

Looking for a great opportunity with remarkable benefits? Here is one of the best opportunities for you where you just have to invest a minimum and can earn remarkable profits. The most salutary thing is that you do not need any particular career background for becoming a travel agent. You would get proper training with an approved license and you can become a travel agent for GST Suvidha Kendra. Hence if you are seeking a fresh start and want to become a travel agent, this is the platform for you. The quicker you jump into it, the sooner you would get the client base.

Eager to know the eligibility criteria-

Well, the procedure to join us is quite easy but first, check out what is the eligibility criteria for becoming a travel agent with us-

- First thing is that the candidate should be a minimum 12th pass

- Applicant should be an Indian citizen

- Should have a little knowledge of computer or Internet

- Should have a valid photo ID card and get one photo

- Age should be above 18

This is the eligibility criteria, isn’t it too simple for anyone to apply for it. All we need is a person with good skills, efficient and a person who wants to see himself grow with us.

Want to know how simple is it to register-

Just to keep things hassle-free, the registration process has been kept very simple and straightforward. There are just a few details required and then you are ready to become a travel agent. Curious to know the steps that would lead you to success. You would need to fill in this in the below-mentioned information for registering yourself for a travel agent-

- Name

- Mobile Number

- Email address

- Area

- City

- Pin Code

Once you fill in all this information and submit it, after that our GST expert would check your pin code and availability of the GST Suvidha Kendra. But you need not worry, in case they do not find any GST Suvidha Kendra near your pin code, they would get you a call in the next 24 hrs, asking for your PAN, photo, and Aadhar Card copies.

Also, if you have any queries regarding it, you can always call on the registered mobile number or you can also email us.

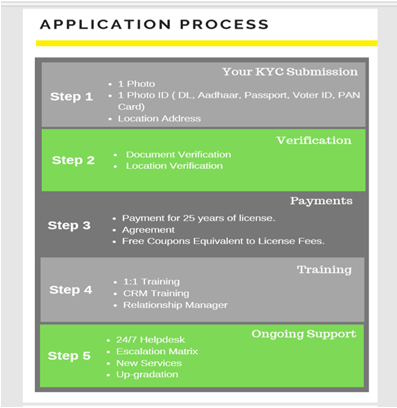

Application Process -

The documents required for the application process of a travel agent are-

- 1 Photo

- 1 Photo ID (Aadhar, Passport, DL, Voter ID, PAN Card)

- Location Address

Once your documents and location are verified then you would have to sign an agreement, pay for the 25 years license and can avail the coupons equivalent to License Fee. Once all this is done then you would get trained for becoming a travel agent.

What would be the Commission Structure-

This is one of the most interesting parts, that each one of us looks for, the big question, what would be the earning or commission on every transaction done? Becoming a travel agent can be like starting your own business, once you start your business you think of earning more money and want to discern yourself from other agents. In GST Suvidha Kendra you can earn a lot being a travel agent. But first you would have to pay a small amount of Rs.24,000 to get the GST Super License but there are many benefits that come along with it.

Excited to know what would be the percentage that you would earn? Let me open the cards for you-

| # | Travel | Domestic | International |

|---|---|---|---|

| 1 | Hotel | Rs. 100 | Rs. 250 |

| 2 | Flight | Rs. 100 | Rs. 400 |

| 3 | Train | Rs. 10 | NA |

| 4 | Bus | Rs. 30 | NA |

In total, we can say that you can earn a 4%-5% commission on any travel transaction to do. The earnings completely depend on you, the more you sell the services the more you can earn. We also have a commission calculator on our website where you can easily calculate how much you would earn with the number of transactions you do. GST Suvidha Kendra has made things easy and transparent for you to understand.

Advantages of paying for GST Super License-

Just don’t think that you are paying for nothing, you would have many added benefits which you would get after paying this fee. Below mentioned are the perks that you would get-

- Get the coupons equivalent to the same amount

- Training Material

- GSTN-GST Approved License

- GST Promotional Material

- All the GST related services

- Round the clock help desk support

- GSK engagement services

- Every Tax and Company related services

- Get Rs.100 discount on all the services

- 20 clients in your local area

There are many more benefits that you can avail after paying this fee and would be really helpful for you. This is the service list which states for which service you need to pay for GST Basic License and for which you need to pay the amount for GST Super License.

Benefits of Joining GST Suvidha Kendra

This might be the next question coming to your mind that why should you join GST Suvidha Kendra or how is it different from others? We have the answer for you which would clear all the doubts in your mind about us. The advantages of being a part of GST Suvidha Kendra would be-

- First thing is that you can set up your office anywhere according to your convenience either at your house or any other place where you could meet people if required

- You would get 100% redemption on the amount you pay. For example, you would pay Rs.24,000 for the license, in return, you would get 240 coupons of Rs.100 each in your GST wallet, which you can use for any services in GSK

- You would get paid twice in a month, isn’t that great

- You would get training material such as study material, offline training, MCQ’s, etc.

- There are no hidden costs of joining us, there is only one-time charge that you would need to pay

Be a part of this now!

After reading all this don’t you think this can be the best opportunity that you can get, where just a small amount of initial investment is required and after that, you can earn an ample amount of money?

The process to apply is really simple and also you do not need any travel experience. You would get proper training here and also would advise you everything about the entire process in detail.

Thus, without any second thought, join GST Suvidha Kendra and become a part of one of the most renowned and reliable online stores.