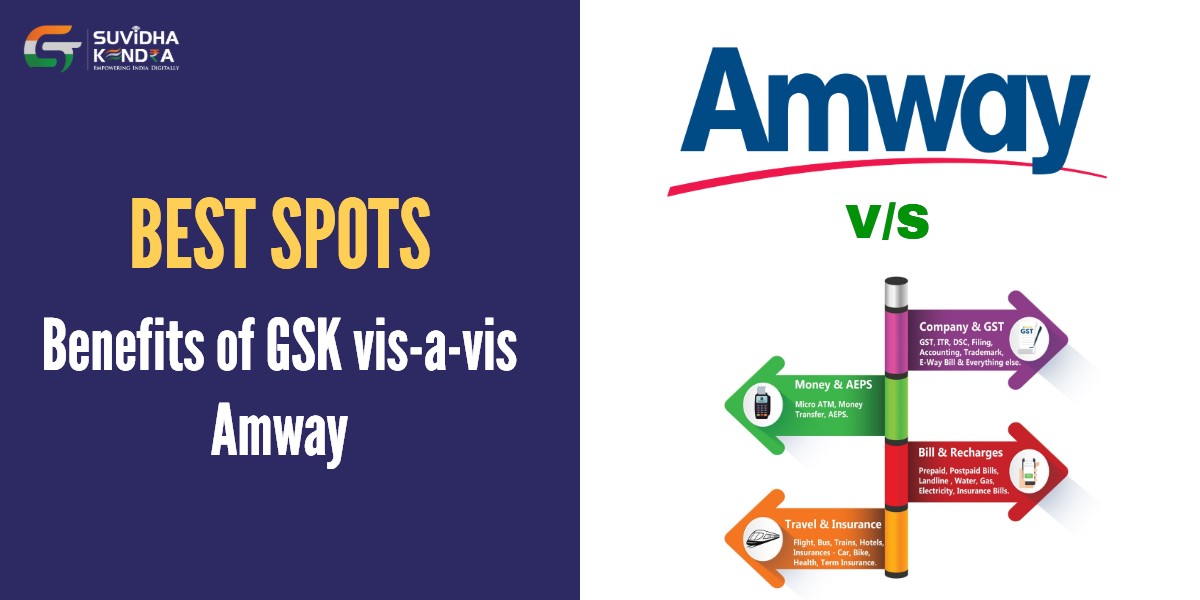

Benefits of GSK vis-a-vis Amway

Benefits of GSK vis-a-vis Amway

Amway Franchise: What should you know before getting one?

If you have a knack for sales and are looking to start out as an independent businessman you must have enquired about the opportunities for Direct Selling, Network Marketing or Multi-Level Marketing.

Direct Selling or direct marketing is basically when a Company skips all the middlemen, directly engages with the end-customer to sell its product. Products are not offered in a retail environment. Instead, personal arrangements are made to sell such as the seller visiting the home of the customer.

Though the terms differ from company to company, network marketing or multi-level marketing (MLM) places the responsibility of growing the distribution network on the shoulders of existing distributors by incentivizing them to in-turn hire others like them. When someone is hired this way, the distributor who made the hire also gets a small percentage of the sales generated by his new hire.

Thus, the more the number of people you can add to your network, the more money that you will get a small percentage of their earnings – and this continues through several levels, i.e. if they hire someone else independent, you will also get a commission on that sale as well.

Amway is probably the most famous company whose business model operates on a network marketing model. It sells cosmetics, health supplements, lotions and cream, household items, etc. Its products are not available in retail stores and only sold through licensed agents who are private persons such as housewives and independent businessmen and women. However, one of the major criticisms of network marketing companies is that eventually to make a profit you have to keep hiring more and more people. This is why even while the company is regularly earning more than 8.5 billion dollars every year, and some distributors reported earning in six figures, social media is full is reports of Amway distributors suffering huge losses and warning potential hopefuls to stay away.

Legal Troubles For Amway

Amway India Enterprises v. Union of India, 2007 SCC OnLine AP 494

The case in hand deals with, whether “Multi-Level-Marketing” comes under the ambit of “money circulation scheme,” under section 2(c) of the Prize Chits and Money Circulation Schemes (Banning) Act 1978 or not.

So if you are a person who wants is a self-starter and wants to start your own business but does not want to risk money in a pyramid scheme like Amway, read on to find out how becoming a partner with GST Suvidha Kendra (GSK) can be a risk-free and more profitable choice for you.

https://blog.ipleaders.in/multi-level-marketing/

GO TO WIKIPEDIA AMWAY

Why you should choose to partner with GST Suvidha Kendra instead of Amway.

GSK provides potential for regular long-term customers

One of the biggest concerns for any new business owner is how to get clients or customers. But a seasoned businessman promptly tells you that it is easy to get clients but rather difficult to retain them. Take it to heart because retaining a client requires excellence on multiple fronts. You need to provide a competitive price on the market, have the best quality of product, gauge customer needs and approach at the right opportunity, and actively push your product to sometimes create a demand where there is none.

In businesses like Amway, clients are not always regular. Many people hear about it from their friends, try it out once or two, but often switch over to cheaper alternatives.

After all, Amway’s quality is good, but their products are extremely expensive. Also, it is difficult to get a hold of their products on short notice. You have to contact a seller you know, who will visit your home themselves. All these drawbacks lead customers away from Amway and towards other cheaper and more readily available alternatives on the market.

But this is where GST Suvidha Kendra especially shines! GST Suvidha Kendra customers are by default repeat customers because GST has to be filed monthly. So automatically the next month you will get business from the same client. Only thing is that you must provide good service which will be a piece of cake for you because you will be provided with excellent sales and technical training. Also, your clients will need other services also like Accounting, Income Tax Returns, TDS, Audit by Chartered Accountant, registration of company or partnership, money transferred Flight books, utility bill payments, telecommunications recharge, etc. All these services and more will be available in your repertoire with GST Suvidha Kendra. Just imagine your clients required so many services – every single month.

GSK has a transparent commission system

We treat our partners with the sacrosanct level of respect they deserve. We understand that for the company to progress, what is most important is that you as an independent business owner must grow. That is why we strive to provide better services to you -our partners – so that you continue to remain with us in a mutually beneficial organization.

One of the first steps to foster cooperation is transparency and for that, we have taken care to keep our commission system as simple and easy to understand as possible. There is no fine print, hidden charges, or complicated points system. The commission percentage and amount is clearly stated. We even have an online commission calculator at our website to give you an idea about the earning potential before you jump into business.

Amway, however, has a complicated point value system which has to be converted into corresponding money amount as per information provided by the company. Different items have different commission percentages, and different classes of items have varying calculations of how many rupees the selling price of the items has to be to get a point (PV).

Also, there is a minimum amount of sale of 100 points that has to be conducted to receive the commission percentage. GSK has no such minimum percentage requirements. What you have earned is yours, unqualifiedly.

GSK provides ubiquitous and in-demand products

The products you sell at Amway are all limited to domestic and personal use such as cosmetics and health supplements. Who will you approach to sell them? Maybe your friends and family for the start, people who may have met from other people. Then what? Amway distributors generally get limited to their friends, family, and acquaintances. But that is nowhere near the number of clients required to make a decent income from this business. There will come a time when you will run out of people to sell to.

However, GSK insulates you from all these problems. See, the Goods and Services Tax has replaced all of the indirect taxes in India. So, every small trader, employer, or freelance service provider, whether they are big or small, it doesn’t matter, will have to pay GST and file GST returns. As the implementation of GST is still at a nascent stage in our country, the majority of small business owners are still not very educated about it and will welcome any help you can provide in filing tax returns for them. You will not have to awkwardly solicit people to buy cosmetics. Rather, you will be helping them out to grow and flourish their business, which makes approaching people for business a lot more attractive.

You will be directly involved in Nation-building

The Goods and Service Tax Network (GSTN) is a non-profit, NGO which manages the entire electronic infrastructure system of the GST web portal. Since the collection of GST is to be done very frequently, once a month, the GSTN has decided to utilize software systems with graphical interfaces to be used by customers to file GST returns. This solves the issue of complicated procedures and tax regulations and a complete solution is provided with a single software. The GSTN has chosen to delegate the manufacture and operation of these software systems to a GST Suvidha Provider (GSP). You will get an opportunity to work with us, a GSP, in the capacity of a GSK – Gst Suvidha Kendra. Taxation is the lifeblood of a nation. Except for directly selling goods and services directly, taxation is one of the only sources of income by the govt. to pay for the massive amount of public infrastructure development and subsidized schemes that is essential for the lifeblood of an adolescent economy like ours.

GST provides a nascent Market with tremendous growth opportunity

The introduction of GST was a complete paradigm shift in the scheme of indirect taxation in India. GST completely abolished all the Central and State indirect taxes such as VAT, excise duty and service tax, at one go. Since it was implemented, the law has been fraught with amendments and complicated notifications. As a result, there was considerable chaos and a downturn in the market. However, the storm has calmed but the ignorance is there. People are still not clear about the tax scheme and are ignoring their right to claim important rebates like input tax credit which is leading to significant losses in their business. People are desperately looking for a reliable GST professional but professional accountants and lawyers worth their salt charge enormous fees which small businessmen cannot afford. It is this gap in the market that you as a GST Suvidha Kendra (GSK) will provide. Our software has the capability to do everything an expensive account can do at a fraction of the cost. Once your customer sees how excellent and cost-effective it is, he wouldn’t have a reason to go anywhere else.

Anyone can join and all assistance will be provided to you

To become a part of a GSK, you do not need to have expert knowledge of taxation, you just need to learn how to operate the software, which will do all required calculations in the back-end at our office. All the required technical training about the software, basic concepts about GST, and sales assistance along with promotional materials and other costs will be provided from the Company to get you started. Further, we offer a 100% Cash-Back Guarantee – all the money you spend to acquire your license will be refunded in full in your wallet to spend on any of the GSK services free of cost. Further, if you are unable to get your business going and decide that this is not your cup of tea, we also provide a full money back guarantee within 90 days of purchase.