Common Questions About Car Insurance In India

Common Questions About Car Insurance In India

Is Car Insurance Compulsory?

What are the types of Car Insurance Plans available in India?

- Third-party car insurance

- Comprehensive Cover Insurance

- Uninsured Motorist Protection Cover

Liability Cover

Collision Cover

Personal Injury Cover

Theft and Vandalism Cover

Natural and Man-made Calamities Cover

What are Some Add-ons for car insurance policy available in India?

- Roadside Assistance Add-on

- Depreciation Reimbursement Add-on

- Return to Invoice Add-on

- Consumables Cover Add-on

- Daily Allowance Add-on

- Courtesy Car Add-on

- Engine Protection Cover Add-on

- Tire Protection Cover Add-on

- Loss of Personal Belongings Add-on

- No Claim Bonus Ad-on

- No Claim Bonus Protection cover Add-on

- Key Replacement Add-on

Should you venture out of your dealership to buy car insurance?

- Advantages

- Disadvantages

What are some Myths and Misconceptions regarding Car Insurance in India?

- Buying car insurance is a cumbersome process

- Insurance is not needed if you are driving an older vehicle

- Insurance will not cover incidents where you are at fault

- You can’t change your insurance provider once you purchase one

- You will lose your No Claim Bonus if you transfer insurance policy to another provider

- Your No Claim Bonus will be transferred to the new owner if you sell your car

- You have to pay first from your own pocket in case of an accident and then claim reimbursement from your insurer

- You can claim the cost of your new car from your insurer in case your current car gets destroyed beyond repair

What Factors decide your Car Insurance Premiums?

- Car insurance premiums are variable due to a variety of factors, and you should thus take the help of an up-to-date premium calculator online.

- Demographic Factors

Credit Score

Age

Residential Area

Profession

Marital Status

Gender

- Vehicle Related and Personal Factors

Car Make and Model

Engine Capacity (Cubic Capacity)

- Vehicle Age

Safety Features

Your own Driving Record

- Insurance Related Factors

Deductibles

- No Claim Bonus

Type of Insurance Policy

Add-ons

What are some exclusions applicable to car insurance in India?

How to File an Insurance Claim in case your car gets stolen?

- Submit FIR copy

- Intimation to the RTO

- Stolen endorsement on Registration certificate

- Original Vehicle Documents

- Dump Yard Certificate

- Transfer ownership of the Car

- Acknowledgment from Loan Provider

- No Trace Certificate

- NOC and Indemnity Letter

How to File a complaint against an Insurance Provider?

Indian roads are notorious for being one of the most unsafe in the world. We ranked as the global leader in accident-related fatalities and single-handedly contribute over 12% of the global fatalities every year. In our country, over 53 accidents take place every hour leaving 17 people dead on average. In 2017 over 500,000 accidents occurred which left over 150,000 dead. Further, car thefts are on an incredibly sharp rise in India and is one of the fastest-growing and most prevalent crimes. It is reported that some urban areas witness more than 100 car thefts per day on average, with the leading city being Delhi where the number staggers to more than 125 per day. Nowhere on earth is it more important to purchase car insurance. A comprehensive cover will protect you from vehicle damage, reimburse you for theft and also provide funds for hospitalization and other injuries – not only for yourself but other passengers and the other car that you hit in an accident. You can very conveniently compare policies and purchase car insurance online. Here are some frequently asked important questions about car insurance relevant to the Indian Context.

Is Car Insurance Compulsory?

It is compulsory to have insurance for a car to be driven on public roads in India. Without insurance, a car can even be taken out of the showroom. However, not all types of insurance are mandatory. It is not absolutely mandatory to insure your car in regards to monetary damages sustained by you for the value of the car purchased. This is called First Party Insurance. However, Section 146 of the Motor Vehicles Act, 1988 makes it mandatory for you to purchase insurance against Third-Party Liabilities, or Third Party Insurance. What this means is that the insurance company agrees to indemnify you in case you are sued by third parties for injuries caused by your vehicle. This type of insurance is absolutely non-negotiable, and it was held by the Supreme Court in G. Govindan v. New India Assurance Co. Ltd. that the requirement of third party insurance cannot be overridden by any clause in the insurance policy. Also, please note that third party insurance does not cover the injury caused to the policyholder himself, as held in National Insurance Co. Ltd. v. Fakir Chand. There are however, some circumstances in which liability can be refused by the insurer – if vehicle was used for racing and speed testing purposes; used as transport vehicle without valid permit; driving without a valid driver’s license; commercial use of private vehicle; and concealment of a material fact at the time of taking insurance.

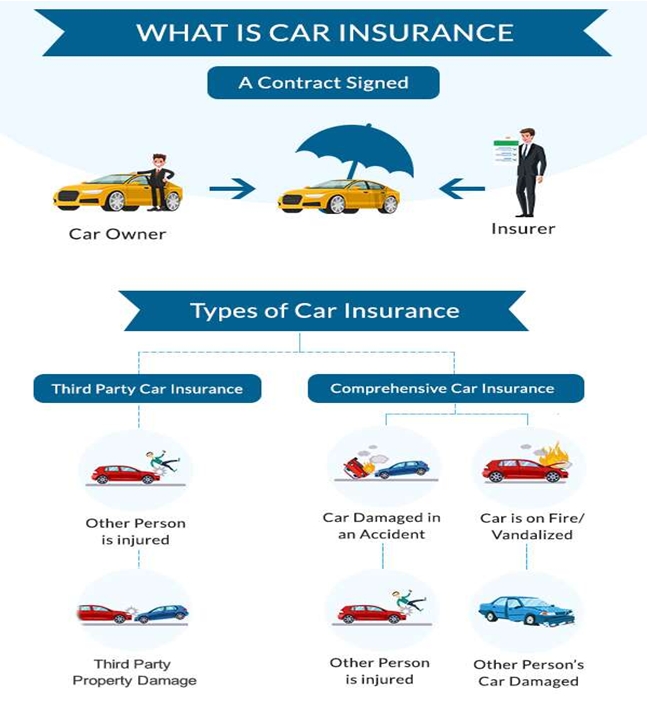

What are the types of Car Insurance Plans available in India?

Broadly speaking there are two types of car insurance plans in India.

Third-party car insurance

This is the most basic type of insurance which provides you with cover against any legal liability incurred against a third party for injury or damage caused in case of accidents where you are at fault. Third-Party insurance is mandatory as per the law under the Motor Vehicles Act, 1988. There are no specific limits prescribed for injuries against third parties, but the liability for property damage is capped at Rs. 7.5 lakhs. A third party insurance offers you no cover for the injury or property damages sustained by yourself, and this is a good option for low-cost vehicles whose repair costs are not very high.

Comprehensive Cover Insurance

A comprehensive policy offers you complete protection for all types of vehicle-related injuries and damages suffered by you. On top of third party liability, it reimburses you for damages suffered by yourself. It is not mandatory by law to opt for comprehensive cover but is practically essential for higher-end vehicles. It provides for damages in case of accidents even when it’s your fault, damages caused by natural disasters and add-ons like zero depreciation and engine protect. Here are some of the different types of enhanced coverage available under comprehensive cover insurance plans.

Uninsured Motorist Protection Cover

If you are hit by another vehicle that is uninsured or has inadequate insurance cover, then you will have to pay the rest of the cost incurred for out of your own pocket. Further, third party insurance more often than not falls short to provide cover for the whole extent of the damage incurred. The uninsured motorist protection cover protects you in this care, by providing the rest of the amount in excess of the third party insurance coverage so that you don’t have to pay out of your own pocket.

Liability Cover

When an accident has been caused due to your fault, you are liable to pay the hospital bills of the injured party and for damages caused to the property of a third party such as for repair of the damaged car. Liability cover reimburses you for these expenses up to a certain amount as per your policy. This is similar to third-party cover is mandatory under the Motor Vehicles Act.

Collision Cover

The collision coverage insurance reimburses you for accidents suffered due to collision with another vehicle or an object like a wall or a tree. In some older vehicles, repair costs can exceed the current value of the vehicle, and with collision coverage, the insurance will pay only up to current market value. Thus collision cover is especially important for newer vehicles and vehicles with third-party liens. It is important to note that collision coverage will not be activated if the vehicle is stolen, or for hospital bills of the injured third party.

Personal Injury Cover

The personal injury cover reimburses you for the medical bills of the driver and the other persons for injuries caused by an accident regardless of whose fault it was.

Theft and Vandalism Cover

As the name suggests, this cover protects you in case your car is stolen or vandalized by reimbursing you up to a limit according to your policy. A higher chosen limit will warrant higher premiums.

Natural and Man-made Calamities Cover

The natural calamities cover protects you against vehicle damage caused due to natural calamities like fire, flood and other types of weather damage.

What are Some Add-ons for car insurance policy available in India?

Add ons are optional features that provide extra coverage, facilities, and bonuses which may be useful in certain tricky situations. They enhance the value of your car insurance but understandably raise your premiums payable. However, depending upon your car model, geographical factors and conditions of use add-ons can be well worth the little extra cost that you have to pay. Here are some of the typical car insurance add-ons available in India. Please note that not all of them may be available with a single insurance provider.

Roadside Assistance Add-on

When you are in the middle of a journey and your car suffers some malfunction or an accident, it is a harrowing experience to locate a nearby garage and secure the services of a mechanic. The roadside assistance add on come to your rescue in these situations, wherein you can call up your insurer to send on-the-spot bespoke mechanic services to your location so that you don’t have to go look for a garage yourself. Some of these services are dispatching a mechanic for on-the-spot type repair, jump start of flat batteries, emergency fuel delivery, spare-key retrieval service, and towing service if the repair is not immediately possible. This is a very essential cover for people living in or traveling to remote places where there isn’t too much of a garage support infrastructure.

Depreciation Reimbursement Add-on

Without this add-on, a standard insurance will deduct the depreciation value of parts made of plastic, rubber, fiberglass (not glass), tires, tubes, batteries, airbags, etc. during an insurance claim for vehicle repair. The depreciation reimbursement or zero depreciation add-on compensates the depreciation amount so calculated either partly or in full. However, it is important to note that there may be a maximum vehicle age limit for this to be applicable and also a restriction on the number of times it may be claimed during the life of the policy. Further, it may only be claimed if repair is done in workshops authorized or affiliated with the insurance provider.

Return to Invoice Add-on

Without this add on, if your car is stolen, totaled or completely damaged in an accident beyond repair, the insurance company is normally only liable to pay you an amount equal to the current market value of the car. This value will be less than the price you paid when you bought it at the showroom as it will take into account depreciation. The return to invoice add-on disregards this depreciation and pays you exactly equal to the showroom price you paid for your car, or your “invoice price”. Moreover, the insurer will also pay the registration charges, road tax and insurance charges you had incurred when you first purchased the insured car. However, it is important to remember that the return to invoice add on is usually only available for newly purchased cars.

Consumables Cover Add-on

Normally the insurance company does not pay for consumables like nuts and bolts, lubricants, oil change, etc. While these may seem minor, they can cause a significant dent to the monthly budget as these types of expenses may crop up unannounced during routine services or even at petrol pumps. Further, during accidents also consumable refills have to be mandatorily done. The consumables cover add on provide reimburses you for all these types of consumables except fuel and can be a valuable add on for those who travel large distances in their car regularly and require frequent consumables refills.

Daily Allowance Add-on

This is an add-on provided by some insurance companies which provides you a daily travel allowance to avail hired transport while your vehicle is getting serviced for an extended period of time. It is, however, important to remember that there are various applicable thresholds to this cover. There is a minimum period for which your vehicle must have been engaged in the service center – usually around 3 days. And there is a maximum no. of days for which you can continuously avail this add-on – usually around 10 days for accidents, which may be extended to 15 days in case of theft.

Courtesy Car Add-on

Some insurance companies, if a higher premium is availed, may provide a facility for a temporary replacement car, in circumstances similar to that of daily allowances, i.e. if your car is at the service center for an extended period of time. The car is advertised to be of a similar kind, cost, and status as your original vehicle but usually maybe a step below that. The facility is usually provided within 24 hours of the original car reaching the garage, or the claim being intimated to the insurance company, whichever is later. The add-on usually contains a caveat that if a suitable car cannot be arranged, then expenses such as daily allowance would be provided in lieu. There is, however, a maximum no. of days for which the courtesy car can be used by the policyholder.

Engine Protection Cover Add-on

The engine is most often the most expensive part of the car and its repair costs quite a substantial amount. However, normally engine repair is one of the exclusions in a car insurance policy, which means that the insurance company will not pay the cost of engine repair. An engine protection cover add-on provides for the cost of engine repair if damaged in accidents or due to natural calamities like floods.

Tire Protection Cover Add-on

Similar to engines, expenses for tire repairs are often generally excluded from car insurance covers. Purchasing tire protection cover provides for tire repair/replacement expenses.

Loss of Personal Belongings Add-on

Usually, if a car is stolen or involved in a major accident, the belongings of the policyholder inside the car may be lost or destroyed. Nowadays, considering the skyrocketing price of electronic gadgets like laptops and smartphones this may be a significant blow to the policyholder. While basic car insurance does not cover reimbursement for personal belongings, such cover can be separately purchased by add-on. However, it is important to note, that there will always be a maximum limit to which the reimbursement will be provided.

No Claim Bonus Ad-on

A no claim bonus add-on gives you a lump sum bonus along with the sum assured at maturity if no claims are made within the period of the term of the insurance. It is a great-on for people who don’t use their cars often or in rough conditions and anticipate that they would most likely not need to claim their car insurance. However, it is important to remember that the no-claim bonus is attached to damages suffered by you and not third party damages.

No Claim Bonus Protection cover Add-on

Usually, if you do not make a single claim for insurance during the term and your policy matures untouched without a claim, you are eligible for a no-claim bonus lump sum amount in addition to the regular maturity benefit – provided that you have selected the no-claim bonus add-on in the first place. However, if you purchase the no claim bonus protection cover add-on, then you can protect your no claims bonus even after making certain types of claims under the policy. Such claims may be restricted to breakage of windshield, rear glass, door glass, sunroof glass and the like. Also, if you’re making a claim for your car getting totaled or stolen, you may still keep your bonus cover if you purchase a new car and get that insured with the same insurance provider within a certain time, such as 90 days.

Key Replacement Add-on

Replacing a lost key for your car is obviously a hassle, however, it can be quite expensive as well since most car keys now in-built radio signal electronics matched to your car, battery system and other high-end advanced features such as remote control and camera. This expense is not covered by ordinary insurance and must be purchased as an add-on. The insurer may even spare you the burden and get in touch with the manufacturer or the dealership on your behalf.

Should you venture out of your dealership to buy car insurance?

Buying car insurance from the dealership itself is almost ubiquitous in India as a car cannot be driven out of the dealership without valid insurance. These dealerships have tie-ups with insurance companies, so much so that it is estimated that for some insurance companies 80 – 90% of the business comes from the dealerships itself. But despite the ubiquitous nature of the trend, buying insurance from the dealerships is far from mandatory. It can be a tempting affair as it saves you the hassle and extra time. But is it worth it? Or should you venture out and look for third-party insurance on your own? Here are some pros and cons of purchasing insurance directly from the car dealership.

Advantages

- It saves you some time and hassle. The entire process is streamlined. The car dealership guides you through the steps and available features of the available policies. It is definitely much more convenient than venturing out on your own.

- You may be offered some bundling discounts when purchasing the car and insurance from the same dealership. Some go as far waiving the premium for the first year, to sweeten the pot.

- You have the option of calling up the dealership and get assistance from them at the time of submitting a claim for insurance. This is more convenient than calling up a third party insurance company directly as you already have a relationship with the dealership.

Disadvantages

- The options available to you will be limited to the insurance companies that the dealership has a tie-up with. Purchasing car insurance after comparing online will give you a wide variety of options and much more flexibility to choose the features you want.

- Dealerships often offer higher premiums than what you would have been able to get after comparing online as they know that customers are too focussed on convenience to care.

- Dealerships also often bundle unnecessary add-ons with your insurance policy in the fine print without specifically highlighting it to maximize their commissions As a result, your premium rates go up, and moreover, you may not ever claim such add-ons are you aren’t really aware that they were included with your policy in the first place.

- Lastly, you may be charged extra for the paperwork and administration fees for the convenience which can very well cancel out discounts that you may have received.

Comparing the pros and cons, we can see that the only major advantage of purchasing insurance directly from the car dealer is convenience. The flipside is that your options get restricted and you are charged much more. If you take a little effort to compare insurance online, as you can save as much as 30-40% on your premium prices. Moreover, taking note of the significant amount of collusion between car dealerships and car companies, the Insurance Regulatory Development Authority of Indian (IRDAI) in January 2018 issued some guidelines and clarifications to its 2017 “Guidelines on Motor Insurance Service Provider”. The clarification stated that “It is reported that the Original Equipment Manufacturers – OEMs are exercising undue influence both on the insurance intermediary and the automobile dealer who have become MISP without having corresponding accountability for their actions. In order to ensure that MISP guidelines work in the interest of the customers, it is advised that no MISP or the insurance intermediary can enter into an agreement with the OEM which has an influence or bear.”. It is thus highly recommended that you explore third party options for car insurance out of the car dealerships.

What are some Myths and Misconceptions regarding Car Insurance in India?

There are a lot of myths surrounding car insurance just like any other type of insurance in India. These myths put you off buying insurance (not buying car insurance specifically since it is mandatory as per the Motor Vehicles Act, 1988) but can deter you freely lodging a claim or claiming an add-on to which you are entitled. Here are some of the biggest myths regarding car insurance in India.

Buying car insurance is a cumbersome process

This couldn’t be further from the truth. You can now purchase a car insurance policy online and the process couldn’t be simpler. You just need to enter your car number, and your car make and model along with previous insurance details are detected automatically so provide you with a list of available companies and price quotes. The entire process is free, streamlined and automated to provide you with the most hassle-free experience possible.

Insurance is not needed if you are driving an older vehicle

The Motor Vehicles Act does not distinguish between old and new cars for the requirement of mandatory third party insurance. So if you think that your old car doesn’t warrant a comprehensive cover with all available add-ons, you must still take a basic third-party insurance if not first party cover.

Insurance will not cover incidents where you are at fault

Well this is partially true but it depends. For e.g., your insurance provider will cover all vehicular damage due to mechanical faults or damages, theft, flood, terrorism, riots, etc., but you must have been using the vehicle in compliance with the policy stipulations and for proper purpose. But let’s say that you are improperly using your private vehicle, damage will not be covered under the policy. Also, if you were driving under the influence of drugs and alcohol that will automatically void the insurance, as these are one of the most basic exclusions of all vehicle insurance.

You can’t change your insurance provider once you purchase one

There are no such restrictions on changing your insurance provider. You can switch at the time of the annual insurance revival. In fact, by comparing insurance providers online, you can get better rates and benefits than your previous provider, especially if you had purchased your insurance through the car dealership.

You will lose your No Claim Bonus if you transfer insurance policy to another provider

A no claim bonus (NBC) is a lump sum reward amount or which is paid to the policyholder at maturity if no claims have been made for the entire duration of the insurance, or a yearly reduction in premium if no claims have been made till that year. It is important to note that the NCB is linked to you, and not the car. That means that you can transfer the NCB on insurance for a new car as well as switching to a new insurer for the existing car. To transfer, you just need to submit a letter requesting the transfer of NCB to your old insurer at the time of renewal within 90 days. Your old insurer will provide you with an NCB certificate.

Your No Claim Bonus will be transferred to the new owner if you sell your car

As mentioned above, your NCB is linked to you and not your car. So if you sell your car to a new owner, your existing NCB still remains with you and you can transfer the benefit of continuous coverage one you purchase a new vehicle and save premium on that. To transfer to the new vehicle, you need to provide the buyer-seller agreement in Forms 29 and 30 to the old insurer along with a letter requesting transfer of NCB, and you will receive an NCB certificate valid for 3 years.

You have to pay first from your own pocket in case of an accident and then claim reimbursement from your insurer

Repairs in case of accidents are expensive. Paying from your own pocket and then going through the hassle of claiming reimbursement from the insurer is not a viable option for many and defeats the whole purpose of insurance in the first place. They may have to tap into long term investments like fixed deposits to cover the costs. However, if you take your vehicle to a garage authorised and affiliated with the insurance provider then you can take the benefit of a cashless claim, where the garage will automatically coordinate with the insurer on your behalf, and the insurer directly transfers payment to the garage without any hassle caused to you.

You can claim the cost of your new car from your insurer in case your current car gets destroyed beyond repair

At the time of initiating the insurance, every policy has something called the Insured Declared Value (IDV). In case of an accident, your insurance provider will pay you an amount up to the IDV limit, not more than that.

What Factors decide your Car Insurance Premiums?

Car insurance premiums are variable due to a variety of factors, and you should thus take the help of an up-to-date premium calculator online.

Demographic Factors

Credit Score

Your credit score has a significant weightage in deciding your car insurance premiums. The lower your credit score, the higher the premiums that you’re likely to be charged. It is thus recommended that you keep a regular check on your credit score. You can check your credit score online.

Age

Insurance providers co-relate your age with your experience with driving a car and thus your risk of being involved in an accident. People of 18-25 years are generally charged a higher premium than people belonging to the 26-55 age group. This is assuming that people who are 26-55 years of age had taken their driver’s license when they were younger, around 18 years.

Residential Area

Geographical locations have a correlation with the rate of accidents and insurance companies have mapped out areas according to the degree of accidents caused. Generally, if you live in a crowded metropolitan area you will be charged a higher premium, especially for third party cover, than if you live in a sparsely populated area.

Profession

Some professions require a lot more travel than others. For eg., a doctor or office executive may be charged less premium than a delivery professional or lawyer because it is presumed that they will be required to commute less.

Marital Status

People who are married may be charged less premium than bachelors or bachelorettes as married people are considered to be more responsible and travel less.

Gender

Generally, females, especially in teenage years and early twenties, are charged less premium than their male counterparts because it has been statistically shown that younger men get into more accidents than younger women.

Vehicle Related and Personal Factors

Car Make and Model

Insurers collect statistics on the number of accidents each car model is involved in. Models which have been involved in many accidents over the years according to statistical data gets charged a higher premium than models which are considered safer. The context, i.e. the roads which the car plies on also plays a factor, so for e.g. a sports car with a higher rate of acceleration would be charged a higher premium.

Engine Capacity (Cubic Capacity)

Cars with higher engine power, like sports cars get charged a higher premium, because the owner might decide to speed in them which increases the risk of an accident.

Vehicle Age

Older cars have a lot of miles and wear and tear on them and are thus deemed to be at a higher risk of malfunction. They are thus charged higher premiums than newer vehicles.

Safety Features

Cars with safety features approved by the Automotive Research Association of India (ARAI), such as GPS tracking, car alarms, etc. are generally provided with discount on premiums by insurers as they increase the likelihood of them being found in case of theft.

Your own Driving Record

If you have an unblemished driving record with no previous accident claims then you will be charged less premiums than someone who has been involved in accidents before, as they are considered to be risky by insurance companies.

Insurance Related Factors

Deductibles

Deductibles are part of the amount that is paid by you in case a claim is lodged. They are of two types – fixed and voluntary. Fixed deductibles are decided by the insurance provider and cannot be altered by you. Voluntary deductibles are decided by you to be applicable on top of fixed deductibles. The larger the amount of voluntary deductible, the lesser the premium that you have to pay.

No Claim Bonus

A no claim bonus is an add-on to your insurance policy which gives you a reduction is premiums or a lump sum amount at maturity, or more generally a percentage discount (up to a limit) on the yearly premiums payable if no claims has been raised by you in the years preceding. This is quite a useful add-on to have, but would result in a rise in the rate of premiums.

Type of Insurance Policy

Comprehensive policy with add-ons will attract more premiums than a bare-bones third party cover.

Add-ons

Add-ons are extra features that provide very useful services in critical situations, such as sending over a mechanic to your location for repair in the middle of a journey, on-call towing facility, travel allowance or replacement car allowance in case of long-term car repair at the garage, etc. While add-ons increase the value of your policy, they contribute to the increase in prices of premiums. You are thus advised to not spend frivolously on add-ons and only select those which are crucial for your needs.

What are some exclusions applicable to car insurance in India?

There are certain types of exclusions such as – tire damage, engine damage, depreciation, etc. which while may not automatically covered under the policy, can be covered by purchasing an appropriate add-on. However, there are certain types of exclusions that are permanent or non-negotiable and are not generally not covered under any circumstances. Here is a list of these permanent exclusions.

- Damages incurred during the time the policy was not in force, i.e. when there was a break in the policy due to non-payment of premium even after the grace period.

- Damages incurred while driving under the influence of alcohol.

- Damages incurred while the vehicle was being driven by a person without a valid driver’s license.

- Damages incurred by an accident which was caused deliberately.

- Consequential damages, or losses which are the consequences of some actions by the policyholder, whether deliberate or unintentional- such as hydrostatic loss during monsoons because of cranking up the car in a water-logged area.

- Damages caused due to war, invasion, terrorist attacks, nuclear radiation, etc.

- Damages incurred due to collateral contracts such as pledging the car to secure a loan.

How to File an Insurance Claim in case your car gets stolen?

Filing a claim because of theft is extraordinary as it leads to the total loss of value of the car. Here are the documents which need to be submitted along with your claim form for theft.

Submit FIR copy

Before a claim can be filed for a stolen car, the insurer requires the owner to execute a diligent attempt at recovery. An FIR is an indispensable proof in this regard and must be submitted while filing a claim.

Intimation to the RTO

A written intimation has to be submitted to the Regional Transport Officer (RTO) for your jurisdiction to prevent the thief from transferring the vehicle to his own name. A copy of this letter along with acknowledgment from the RTO has to be submitted along with the claim.

Stolen endorsement on Registration certificate

A stolen endorsement request has to be submitted against the registration certificate of the car held with the RTO in the appropriate register. Such a request along with the corresponding acknowledgment must be submitted with the claim. If such a certificate is held in a smart card, that card has to be surrendered with the insurer.

Original Vehicle Documents

All original car documents such as latest tax receipts, the first two pages of the insurance policy, dealership invoice, registration certificate, emission testing certificate, etc. that would have been demanded by a legitimate buyer has to be turned over to the insurer along with the claim so that it is proved that you fraudulently sold your vehicle to someone else and defrauding the insurance company.

Dump Yard Certificate

Often times when a car is stolen, it is stripped of its parts and the chassis is then dumped in a scrap yard to be crushed. Your insurer may require you to get a certificate from local scrap yards in the area of theft that such a vehicle has not been sent to the scrap yard.

Transfer ownership of the Car

Acknowledgment from Loan Provider

You have to inform the lender about the theft if you had taken a loan for purchasing the car and submit an acknowledgment of such intimation to the insurance company, along with the latest loan documents to show how much of the loan amount is left to be repaid. This will be deducted from the final amount paid to you. In practice, the lender may require you to pay off the remaining loan amount before handing over the acknowledgment or clearance certificate so you might need to negotiate with the lender bank.

No Trace Certificate

The insurance company will only pay you the amount after two to six months after the court issues a No-Trace certificate certifying that the police have failed to locate your stolen vehicle. This No-Trace certificate has to be submitted with the insurer to claim the final pay-out.

NOC and Indemnity Letter

You also need to submit an NOC for transferring vehicle ownership and also an indemnity to the Insurance company to compensate them for any contributory actions on your part which unknowingly facilitated the theft.

How to File a complaint against an Insurance Provider?

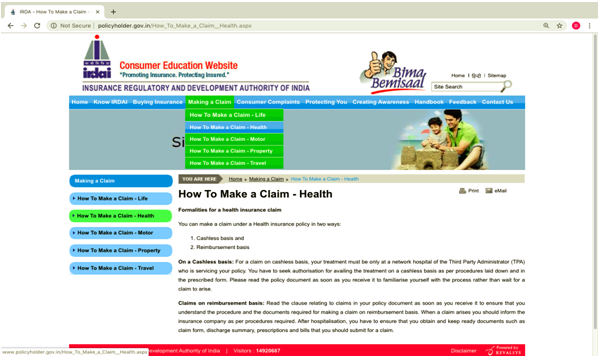

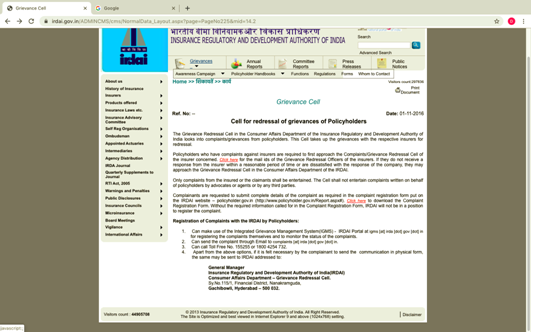

If you are unsatisfied or feel like the claim has been unfairly rejected, or deliberately delayed, then there are a few avenues to explore for redressal.

- A grievance may be lodged with the designated grievance redressal officer of the insurance provider itself, who is usually a member of the senior management.

- A formal complaint may be lodged with the insurance ombudsman of the Executive Council of Insurers of the concerned state whose decision is binding on the insurance provider.

- A complaint may be lodged with the grievance redressal cell of the consumer affairs department of the Insurance Regulatory Authority of India (IRDA) by sending an email at complaints@irda.gov.in or by a phone call on 155255 (or) 1800 4254 732. The IRDA may also be contacted through the Integrated Grievance Management System (IGMS) at igms.irda.gov.in.

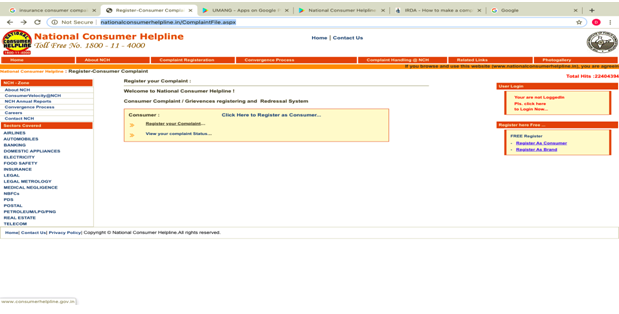

- Finally, you can also complain to the National Consumer Helpline by signing up online, giving a call on 1800-11-4000 or 14404 or SMS to 8130009809 or signing up on the app, litigation may be lodged at a consumer court of the judiciary. Off late there has been an increase in private complaints against insurance companies.

Know more about GST Suvidha Kendra services & their process.