Common Questions About Employee Group Health Insurance in India

Common Questions About Employee Group Health Insurance in India

Table of Contents

How is Group Health Insurance policy differentiated from Independent policy?

- Parties to the Contract

- Control

- Medical Tests

- Premium Payment

- Utilization as Collateral

- Customization

- Employment Dependance

- Personal Factors

- No-claims Bonus

Should you purchase some independent private insurance along with your Employee Group Insurance Policy?

Can I transfer my Group Insurance policy to Individual policy?

Should I extend my Group Health Insurance cover before coming close to retirement?

Should you include your parents in your Employee Group Insurance policy?

- Advantages

- Disadvantages

What benefits do employers get for providing health insurance to employees?

- Employee Retention

- Tax Benefits

- Motivation

- Low-Cost

What are Third Party Administrators (TPA)?

How to File a claim and what are the required documents

- Documents required for Accident Injury Claims

- Documents related to Illness or Disease Claims

What are Exclusions to Group Insurance Policy?

How to lodge a complaint against a TPA/Insurance Provider

Employee Group Insurance Policies are available by an employer to provide health insurance benefits free of cost to employees as a perk in addition to their salary. The company doesn’t have to be super big to avail of this scheme of group insurance. The IRDA has clarified in 2016 that group insurance can be available by companies having just 20 employees. And further, there are some provisions to allow for micro-companies with as low as 5 employees also. There is also a very clear incentive for employers to invest in group insurance as it is tax-deductible and inexpensive and provides a big boost of motivation for existing employees and prospective hires. In this article, we shall answer some basic questions about group insurance to give you a clear understanding of the scheme.

How is Group Health Insurance policy differentiated from Independent policy?

Group insurance is health cover provided by your employer where independent health policy is purchased by you from a third party yourself. Here are the main points of differentiation between the two.

Parties to the Contract

In the case of independent insurance, the only parties to the contract are you as the purchaser and the beneficiary and the insurance provider as the vendor. Whereas, in group insurance, your employer is the purchaser, the insurance provider the vendor and you are the beneficiary.

Control

The full control of the policy is in your hands in independent insurance. You can select the amount of coverage and the features you want. Whereas in group insurance the control is exercised by your employer and you merely play a participatory role.

Medical Tests

You and all your other family members will require to undergo medical examinations each time you purchase an independent insurance policy. However, in group insurance generally, you will not have to go additional tests than what your employer required at the time of your joining the employment.

Premium Payment

The full extent of the premium is paid by you in an independent policy as your employer is not part of the contract. However, the benefit in a group insurance policy is that generally it is totally paid for by your employer up till a certain amount, with contribution required by you only if you want additional coverage over a threshold. Further, in independent insurance, all of the annual premium is paid at one go which can cause some hardship in certain cases, whereas in group insurance a portion of the premium payable by you (if any) is deducted per month from your salary to ease the burden.

Utilization as Collateral

This is, in turn, a major benefit of independent insurance policies that they can be used as a collateral asset lien to secure a loan from a bank. However, a group insurance policy cannot be utilized in that manner.

Customization

An independent policy is fully owned by you and hence you can customize it to the maximum extent allowed by the insurer with as many add-ons as you want to maximize the policy value or choose the best plan according to your needs, social and economic conditions. But, the terms of a group insurance policy has already been negotiated by the employer with the insurance company, and it largely remains the same for all employees. The maximum you can be allowed to do is to purchase additional coverage and include parents at your own expense.

Employment Dependance

Your group insurance policy is a perk granted to you over and above your salary and thus it’s existence is conditional on your remaining as an employee. If you quit your job, your present coverage will cease and you will have to apply for porting your insurance to your new employer. If you retire your coverage will cease and you will have to port it to an independent policy. However, your independent policy has nothing to do with your employment and will continue as long as you pay your premiums on time.

Personal Factors

The amount of premiums payable by you will depend a lot on personal factors like your age, medical history, claim history, present BMI, present medical check-up outcome, etc. You may also be outright denied as an applicant if you are considered as too risky by the insurer. However, in group insurance, these factors do not matter. You will automatically be eligible once you become an employee of the company.

No-claims Bonus

In case of independent insurance, you are eligible for a no-claims bonus, which results in a reduction of annual premiums if no claims have been made by you for a continuous period of time. However, in group insurance, there are no such provisions available.

Should you purchase some independent private insurance along with your Employee Group Insurance Policy?

The short answer is yes. Group Insurance policies are a boon for both the employer and the employee. For the employer, it is a great hook to attract capable talent, whereas for the employee it gives so many advantages such as benefits in addition to salary, cover for pre-existing illnesses with no wait periods and extra medical check-ups. However, there are very compelling reasons why you should seriously consider substituting your employee health insurance with some independent cover of your own.

- Your employee plan is available as long as you continue to be in your current employment. When you retire, you are no longer covered and have to buy independent insurance at that age with higher premiums. When you change jobs, you are again no longer covered under your existing employee group policy. It is wise to invest in some independent health insurance which is independent of your employment.

- The coverage provided in employee group insurance policies is most of the time woefully inadequate for serious hospitalizations, leaving you to fork out the rest of cash out of your own pocket. With the rising costs of health care in India, especially in urban areas, this can do some serious damage to your personal finances. Better to prepare for this with some inexpensive third party private insurance.

- The features of your employee insurance have been negotiated by your employer with the insurance company to cover all employees in bulk. They are the same for all employees and there is no scope for individual customization. Whereas in private insurance, you can tweak the policy according to your preference, choose the features and add-ons you want, the coverage you need, compare policies and premiums online and get the best deal possible.

- If you are the type to not fall sick often, you can claim the benefit of no-claim bonus in private insurance. This feature is not available in group insurance.

- According to a survey reported by the Economic Times about group insurance coverage and satisfaction, of more than 3000 full-time workers in India, conduct in 2017, only 39% of employees enjoyed coverage for doctor consultations whereas 59% desired so. Only 20% were reimbursed for diagnostic services and investigations, whereas it was desired by 31%. A mere 28% of female employees were offered maternity education benefits whereas 73% desired it. It is thus statistically apparent that group insurance by itself is woefully inadequate for providing a full range of coverage desired by employees.

Can I transfer my Group Insurance policy to Individual policy?

Your employee group insurance cover is linked to your employee with your employer. Thus, the moment you leave the employer’s service, e.g., transfer jobs or retire, your insurance coverage under the group policy will most likely cease. However, fortunately under the portability guidelines issued under the Health Insurance Regulations 2016, an employee can migrate to an individual insurance policy, or family floater plan along with family members, if they are covered with the same or different insurance provider by availing the portability scheme.

Every new insurance plan when purchased has a waiting period before which the coverage will start. The main benefit of portability is that this waiting period will not be renewed when migrating, and thus the benefit of cover can be availed. The waiting period if not fully waived will certainly be reduced based on the number of years that the previous group insurance policy had been in existence.

For migrating to different plans, a policyholder shall provide an intimation of at least 30 days before the last date of employment, or at the very least, within 5 days of leaving the employment, when the benefits of the group insurance policy will cease to cover the policyholder. The details of the policy and the health card of the policyholder shall be furnished for the ascertainment of the cover. Further documents required are the new proposal form which contains the medical and family history of the policyholder, lifestyle information, income, occupation and education and a stamped copy of the superannuation certificate or registration letter from the previous employer which shall state the last day of previous employment. If the migration is due to registration, the policyholder may migrate to the new insurance before 45 days of the date of the annual renewal of the group policy.

Migrating to an independent individual or family floater plan will give you an unprecedented amount of freedom to choose the coverage and features that you want, which was not possible in your previous group insurance policy. You should take full advantage of this opportunity and choose the kind of policy you want and tailor it to your needs. Compare policies online to get the best deal.

Should I extend my Group Health Insurance cover before coming close to retirement?

Retirement is a tumultuous time for those who have not purchased an individual health insurance policy other than group insurance. Buying an individual policy at such a late age in your life means inviting hefty premiums and a barrage of exclusions, while income dwindle and medical costs rise. Under the porting scheme of health insurance Introduced by the IRDA in 2011, you can now continue your insurance coverage under a private policy. It is thus important to maximize the coverage before retire when half your cover is provided by your insurer as a benefit to your employment. Plus, abruptly raising your cover after 60 when you retire will cause premiums to inflate sharply versus if you already had a large cover when you were employed.

Should you include your parents in your Employee Group Insurance policy?

We owe our parents such a debt that it can never be truly repaid by materialistic things. The least we can do is to make sure that we can provide them with all the love and care that they deserve in their twilight years. Generally, a group insurance policy may be restricted to yourself, your spouse and kids, with a lot of employers not providing cover for your parents. However, in case your employer is generous enough to offer such inclusion, you should definitely jump at the offer and include your parents right away.

Advantages

Let us look at the main advantages gained by including parents in your group policy –

- One of the most annoying aspects of health insurance is that each time you would have to undergo a fresh medical checkup. However, your parents will not need to go for separate medical checkups if they are included in your group policy.

- The increase in premiums payable by you as a result of the addition of parents is about 30–35% cheaper than what would be required for individual senior citizen health insurance plans. So speaking from a purely monetary aspect, if you would be responsible for paying premiums for your parents in the individual policy, you will save a lot of money.

- Generally, in individual health insurance, and especially in senior citizen insurance, a lot of pre existing illnesses are not covered, or cover has to be purchased separately as expensive add-ons. However, there is no such requirement in group insurance which covers all pre-existing conditions.

- In individual policies, a lot of pre-existing illnesses have a long wait period after the purchase of policy before the coverage starts. However, in group policies, there is no such wait period and cover would start from Day 1 itself. So you can heave a sigh of relief, in case your parents are suffering from some pre-existing health conditions.

- You can extend your coverage for group insurance to match that of individual insurance through options such as top-up or super top-up so that your hospitalization expenses are covered adequately. However, it is important to remember, that in such a scheme, there may be a stipulation that coverage may be provided only when a single hospital expense breaches the entire coverage threshold at one go.

Disadvantages

There are however some disadvantages that should be planned for while including parents under the group insurance policy.

- Your employer may choose to abruptly discontinue the insurance policy or change internal policy to stop extending coverage to parents. Your parents would then be left stranded or be forced to purchase a new individual policy at old age with very high premiums. This is plausible in the case of private companies in India.

- Your policy might also be discontinued due to a job change, and your new employer might have a less liberal policy to allow your parents to be included.

It is thus important to take into account all the disadvantages, and thus we recommend that you include your parents into your group insurance plan, but definitely provide them with additional coverage under private plans such as individual policy or family floater plan. Besides, generally, the coverage under the group insurance policies is limited in nature which might not be enough to cover serious hospitalizations and your secondary private insurance plan will be a boon in these critical situations.

What benefits do employers get for providing health insurance to employees?

Group insurance provides obvious tangible benefits for employees by supplying them with health insurance. However, this is largely at the expense of the employer. So why should employers bother to provide insurance to employees?

Employee Retention

Automation, Artificial Intelligence, and Information Technology has made jobs less labor-intensive and has reduced the need for the number of employees required in the workplace. However, it has sharply increased the skill level required to operate complex technologies. There is tremendous competition amongst employers in the current marketplace to attract the best talent available, and this goes beyond just offering an attractive salary. Employers are now competing to provide the best perquisites and adequate health insurance for the family is key to employee attraction and retention.

Tax Benefits

Health insurance is tax-deductible and thus companies choose to invest in health insurance for employees which decreased the tax burden on the profits of the company. For them, it’s a win-win situation, the money which would have otherwise been eaten up in taxes can now be used to provide tangible benefits to employees.

Employee Motivation

According to Maslow’s hierarchy of needs, physiological needs among which health and safety is one, rank as one of the most basic necessities. Providing adequate health insurance to employees gives them a much-needed and boosts their morale to give their 100% to the company without worry.

Low-Cost

Purchasing group insurance policy from the same insurer provides insurance at a tremendously low value compared to individual policies, due to purchasing in bulk. Further, group insurance can afford to provide better coverage for major illnesses at lower costs, because insurers don’t care if one employee makes a big claim which will be made up by premiums due to such a large pool of participants. You can search for the best group insurance plans for your employees here.

What are Third Party Administrators (TPA)?

Third-Party Administrators (TPA) are organizations who possess a license from IRDA to process insurance claims to provide cashless treatment to policyholders on behalf of insurance providers. The concept was introduced by the IRDA in 2001 to ease the administrative burden on insurance companies.

They assistance insurance providers in many vital ways

- TPAs are essential to process claims with agility in case of discharge of patients availing cashless treatment.

- They have their own infrastructure and team of doctors and legal experts to peruse through claim documents and verify the authenticity of claims.

- They negotiate with hospitals on behalf of insurance providers on matters of empanelment.

- They connect with hospitals to book appointments for planned hospitalizations.

However, the system is also mired in some practical difficulties.

- Collusion with corporate hospitals resulting in lower rates of claim acceptance for individual clients and higher rates for corporate clients.

- Lack of effective standardizing procedures on medical bills due to a lack of a statutory authority on the subject leading to conflict between hospitals and TPAs which leads to their removal from the empaneled list of Preferred Providers Network (PPN), which in turn leads to difficulty for the policyholders in securing cashless facilities.

- Lack of any strict regulations or appraisal mechanisms for TPAs by IRDA leads to them being assessed only on financial returns rather than customer satisfaction or quality of services provided. This, in turn, incentivizes TPAs to reject policy claims on frivolous grounds to maximize profits.

An updated list of TPAs can be found on the IRDA website.

How to File a claim and what are the required documents

In case of a claimable event, you can file a claim with your insurance provider or TPA organization. If you go to a hospital affiliated to the approved network of the Insurance provider, then you can take the benefit of a cashless facility, i.e. the treatment expense up to the maximum amount under the policy will be paid by the insurer directly to the hospital. If the entire bill is less than the approved amount, then you will not have to pay a penny out of your pocket. In this case, you shall have to show your employee ID, Govt. ID and health card to the hospitalization and they will take care of the rest.

In case of diagnostic expenses and out-patient doctor fees, or if you go for hospitalization which is not affiliated with the insurance provider, you will have to pay out of your own pocket at that moment and then later apply for reimbursement with the insurer or TPA. However, you must intimate your TPA or insurance provider within 48 hours that a claimable event has occurred, or as soon as possible.

Please call up your TPA helpline and they will guide you through the claim process and email or fax you a claim form. You will have to submit all original medical documents along with the duly filled claim form.

Documents required for Accident Injury Claims

- Duly filled claim form

- Police Report and FIR if the accident required police intimation such as vehicular accidents

- Medical documents such as diagnostic reports, test reports, hospital emergency reports, X-Ray, and MRI plates, etc.

- Doctor’s prescriptions

- Full itemized bill available upon discharge

- Discharge summary

Documents related to Illness or Disease Claims

- Duly Filled in Claim Form

- Medical documents such as diagnostic reports, test reports, hospital emergency reports, X-Ray, and MRI plates, etc.

- Doctor’s prescriptions

- Full itemized bill available upon discharge

- Discharge summary

All these documents have to be submitted in original, so it is recommended that you keep photocopies of all documents with you or store them in digital form as they are valuable evidence of your medical history and will be required for reference in further medical check-ups.

What are Exclusions to Group Insurance Policy?

Group insurance may give comprehensive coverage to your entire family and parents, including cover for pre-existing illnesses and very short wait periods or none at all. However, there are certain situations and events when your claim will be denied. These are called exclusions. Here are some common exclusions found in group insurance policies in India.

- Claims such as hospitalizations or rehabilitation costs resulting from addictions to narcotics, smoking, alcohol or substances of such kind.

- Cosmetic Treatments.

- Treatments relating to aging or puberty such as testosterone therapy.

- Alternative treatments like Ayurveda, homeopathy, Reiki, Unani, Siddha, etc.

- Claims relating to injuries related to nuclear damage, war, terrorist attacks, participating in riots and such.

- Genetic disorders.

- Alternative therapy centers such as ayurvedic retreats, yoga Retreats, nature Clinics, etc.

- Treatment for Sexually transmitted diseases.

- Treatment for obesity.

- Treatment for sexual impotence, erectile dysfunction, penis enlargement, and such.

- Treatment for injuries sustained from the commission of a crime.

- Treatment for self-inflicted injuries.

- Treatment for injuries resulting from adventure sports.

- Treatment from injuries resulting from unnecessary risk-taking and gross negligence.

How to lodge a complaint against a TPA/Insurance Provider

If you are unsatisfied or feel like the claim has been unfairly rejected or underpaid, then there are a few avenues to explore for redressal.

- A grievance may be lodged with the designated grievance redressal officer of the insurance provider itself, who is usually a member of the senior management.

- A formal complaint may be lodged with the insurance ombudsman of the Executive Council of Insurers of the concerned state whose decision is binding on the insurance provider.

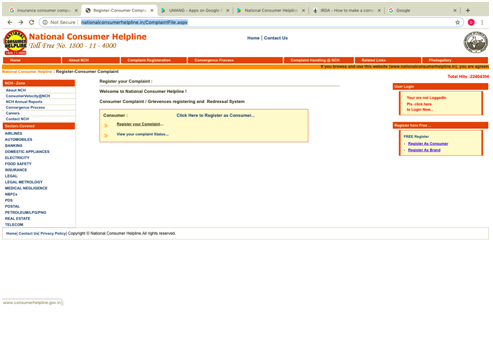

- A complaint may be lodged with the grievance redressal cell of the consumer affairs department of the Insurance Regulatory Authority of India (IRDA) by sending an email at complaints@irda.gov.in or by a phone call on 155255 (or) 1800 4254 732. The IRDA may also be contacted through the Integrated Grievance Management System (IGMS) at igms.irda.gov.in.

Know more about the GST Suvidha Kendra, their services & process.