Common Questions About Income Tax In India

Common Questions About Income Tax In India

What are Direct and Indirect Taxes?

- Direct Tax

- Advantages of Direct Taxation

- Indirect Tax

Who has the power to levy Income Tax – The Central or State Govt.? Under what law?

Who is liable to be charged Income Tax?

What are Income Tax Slabs?

- For Individuals below 60 years and HUF

- For Senior Citizens above 60 years of age

- For Super-senior Citizens above 8 years of age

- For Domestic Companies and Firms

What is Income Tax Return (ITR)? How is ITR filed?

- Who has to mandatorily file Income Tax Returns?

- What are the benefits of filing regular Income Tax Returns?

How does the E-Filing of Income Tax Return work?

- STEP 1

Log in to the Income Tax E-filing Portal - STEP 2

- STEP 3

- STEP 4

- STEP 5

Documents Required for filing Income Tax Returns

What are the consequences of missing the deadline for filing Income Tax Returns?

- Penalties

- If ITR not filed at all during the financial year

What are the different types of taxable income and how is the Total Taxable Income Calculated?

- Different types of taxable income

- How the Net Taxable Income is calculated

Income from salary

Income from House Property

Income from Capital Gains

Income from Business or Profession

Income from other Sources

Deductions under Chapter VI-A

What are deductions and exemptions and rebates?

- Deductions

- Exemptions

- Rebates

- Difference between Deduction and Exemption

What is Tax Deducted at Source (TDS) and how does it work?

Income Tax is a direct tax imposed by the Govt. on any income generated from any source (not exempt) by an individual, corporation or association. In this article, we answer the most important questions about income tax to arm you with a thorough understanding of a concept as a tax-payer or future tax-payer.

What are Direct and Indirect Taxes?

Direct Tax

A direct tax is one that is implemented on the taxpayer directly by the Govt. and the burden cannot be transferred to someone else. Examples of direct taxes are income tax imposed on earnings of the individual during a financial year, estate tax imposed on the value of the property or estate that is inherited by someone when the erstwhile owner passes away, and wealth tax which is imposed on the value of the property possessed by someone. It is important to note that both estate and wealth tax has now been abolished in India.

Advantages of Direct Taxation

- Inflation control – The Govt. increases the income tax rate when inflation gets out of control to decrease spending power and thus bring up the value of money.

- Economic Balance in Society- The Govt. can adjust the economic balance between different social strata by adjusting the tax brackets and exemptions to control income equality.

Indirect Tax

Whereas indirect taxes are imposed by the Govt. on the value of goods and services manufactured, sold and transacted in the economy. The burden of the tax is shifted to the ultimate consumer by increasing including such taxes paid by the manufacturer and retailer in the final price of the goods. Examples of Indirect Taxes are the erstwhile excise duty, service tax, sales tax and value-added tax (VAT) which have now been replaced by the Goods and Services Tax (GST).

Who has the power to levy Income Tax - The Central or State Govt.? Under what law?

The Constitution of India under Schedule VII, Union List, Entry 82 has bestowed the Central Govt. with the power to levy income tax on any income generated in the country, except ‘agricultural income’.

The law of income tax consists of the Income Tax Act of 1961 (as amended), Income Tax Rules 1962 (as amended), the circulars and notifications issued by the Income Tax Dept. of the Central Board of Direct Tax (CBDT), the Annual Finance Acts issued by the Central Govt. and the judicial pronouncements by High Court, Supreme Court and Income Tax Tribunal and Income Tax Appellate Tribunal.

The responsibility of the administration of Income Tax is discharged by the Income Tax Dept. of the Central Board of Direct Tax (CBDT), which functions under the Dept. of Revenue under the Ministry of Finance in India.

Who is liable to be charged Income Tax?

Any entity who is earning an income high than the minimum taxable slab is liable to be taxed under income tax. The list of such entities are –

- Individuals (whether self-employed, professionals, salaried persons or otherwise),

- Hindu Undivided Families (HUF) operating as a business unit,

- Any legally recognized artificial persons,

- Association of Persons (AOP),

- Local Authorities,

- Body of Individuals (BOI),

- Companies and Corporate firms/entities.

What are Income Tax Slabs?

The whole of your income is not taxed at the same rate. The whole of your net annual assessable income is divided into different parts called slabs which increase progressively higher in quantity of income, and higher slabs of income are taxed at higher rates. The Central Govt. has the power to change the rates at which different slabs of income is taxed in the Annual Union Budget to control the economy and inflation rate.

The current Income Tax slabs for the financial year 2019 -20 are as follows:

For Individuals below 60 years and HUF

Additionally there is a 10% surcharge applicable on income exceeding Rs. 50 lakh to 1 crore. And there is a 15% surcharge applicable on income exceeding Rs. 1 crore. 4% education cess is also chargeable.

For Senior Citizens above 60 years of age

For Super-senior Citizens above 8 years of age

Additionally, there is a 10% surcharge applicable on income exceeding Rs. 50 lakh to 1 crore. And there is a 15% surcharge applicable on income exceeding Rs. 1 crore. 4% of education cess is also chargeable.

For Domestic Companies and Firms

Additionally, 4% cess is applicable as corporate tax and 3% education cess. And a 7 % surcharge is applicable for taxable income more than Rs. 1 Crore but less than Rs. 10 Crores, and 12% surcharge for taxable income more than Rs.10 Crores.

What is Income Tax Return (ITR)? How is ITR filed?

Simply stated, Income Tax Returns (ITR) are the forms which come in a pre-determined worksheet format that have been filled by any person earning taxable income, every year with the Income Tax office. ITR calculates the amount of income owed by the individual in a financial year. They must be filed with the Income Tax Office (ITO) within a certain deadline date as publicly announced by the ITO.

Who has to mandatorily file Income Tax Returns?

Filing of ITR is mandatory for the following category of persons –

- Every individual, below the age of 60, earning more than 2,50,000 in a financial year must compulsorily file an Income Tax Return. For Senior citizens, the minimum threshold is Rs. 3,00,000 and for super-senior citizens above 80 years of age, the limit is Rs. 5,00,00.

- A corporate entity must submit an ITR irrespective of a loss or taxable profit.

- For those are looking for claim a tax refund, for TDS deducted by the employer, even if their net accessible income comes to below the taxable threshold.

- For any income earned by residents in India, from any property situated outside the country, irrespective of the amount of money earned.

- If income is received from any property held un a religious or charitable trust, political party, research organization, educational institute, medical organization or a news agency, regardless of the amount.

- For any income earned in India by NRIs, regardless of the amount.

What are the benefits of filing regular Income Tax Returns?

Even if you earn below the taxable income limit, it is recommended that you file regular ITR, declaring tax liability as nil, to avail the following benefits –

- It facilitates easy processing of loans – home loans, car loans, personal loans, etc. It is proof that you have a regular source of income.

- ITR filing is mandatory for the processing of VISA for traveling abroad.

- Regular ITR expedites the process of registration of immovable property.

- The issue of credit cards is not possible without ITR filing.

- ITR filing sets up a record of the individual with the Income Tax Office.

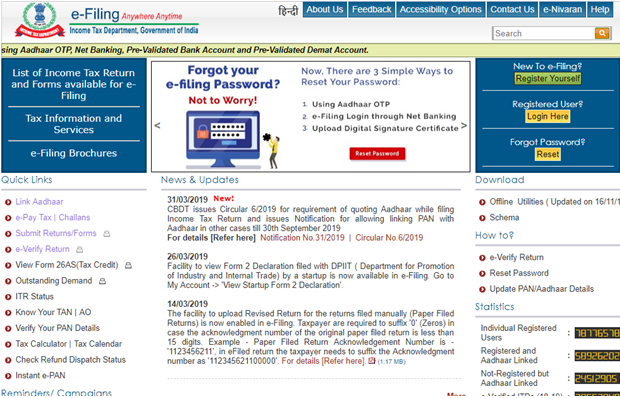

How does the E-Filing of Income Tax Return work?

Making and filing your Income Tax Returns can be complicated and cumbersome. To avail the help of online portals to assist you in filing your ITR, click here. Here is a step by step guide to e-filing of income tax returns in the official Govt. Portal of the Income Tax Office.

STEP 1

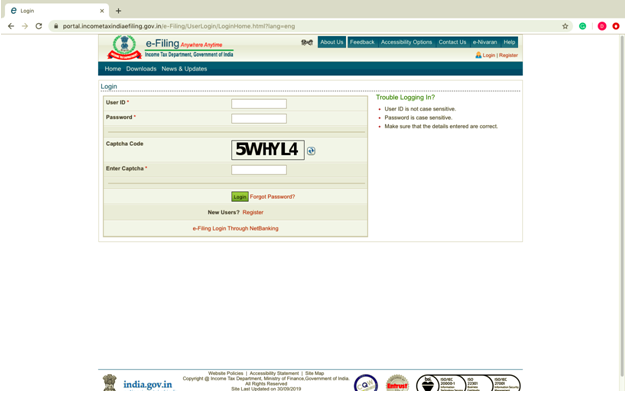

Log in to the Income Tax E-filing Portal

You need to visit the e-filing portal at http://www.incometaxindiaefiling.gov.in/

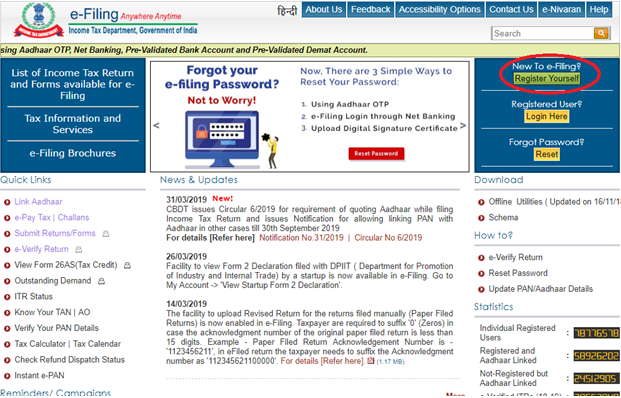

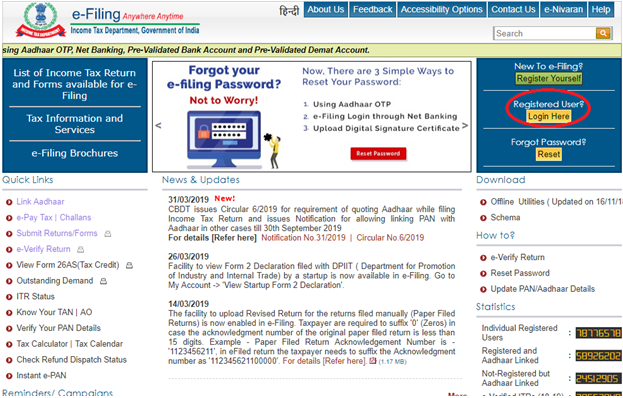

STEP 2

Register yourself as a new user

or log in by clicking “registered user” if you already have an account.

Provide your user ID and Password. Type in the CAPTCHA and click “login”.

STEP 3

You will now get directed to the online ITR returns Form. However, make sure to read the “General Instructions” given at the beginning to that you can avoid an error. Once you have completed reading the instructions, you can now begin filing up the information provided under appropriated spaces such as “Income Details”, “Tax Details”, “General Information”, “taxes paid and verification” and “80G”, etc. If you are unsure of what these terms mean, take the help of a professional as this will affect your final tax liability.

STEP 4

Once you have verified all the information provided under the ITR to be correct, click on “Preview and Submit”. This preview is your final chance to verify the information before it is submitted. Finally, click the “Submit” button when you are satisfied.

STEP 5

For verifying the information you can use view your return using ADHAAR OTP or by the Electronic Verification Code (EVC) sent to your registered mobile phone. Offline verification is also available by sending a request in a duly filled in Form ITR V to the Central Processing Centre (CPC) at Bangalore.

Documents Required for filing Income Tax Returns

Here are the required documents for filing the income tax returns for various categories of assessees –

- PAN card

- Bank statement

- Interest certificates from banks or post offices

- Proof of tax-saving investments

- Form 16 (for salaried individuals)

- Salary Slips

- TDS certificate

- Form 16A/16B/16C

- Form 26AS

What are the consequences of missing the deadline for filing Income Tax Returns?

You can file a belated Income Tax Return after missing the original deadline by paying the appropriate penalties applicable.

Penalties

For the financial year, 2019 -20, the various penalties applicable are followed –

- Annual income less than Rs. 5 lakhs – Rs. 1000, irrespective of when the late returns are filed.

- Annual income more than Rs. 5 lakhs – Rs. 5000, if returns are filed after 31st Dec. 2019, and Rs. 10,000 if filed between 1st January – 31st March 2020.

If ITR not filed at all during the financial year

Suppose you have not filed any returns all together during the applicable fiscal year, you will not be eligible to file the return even with payment of late fees in the subsequent fiscal year. For e.g., if you haven’t filed ITR for 2018-19, you cannot file it in 2019-20, despite payment of late penalty. In that case, all you can do is wait to receive a notice from the Income Tax Office (ITO) and attach the return along with the reply to such notice, along with penalty amount, if specified.

What are the different types of taxable income and how is the Total Taxable Income Calculated?

Different types of taxable income

There different sources of taxable income are as follows –

- Income from Salary

- Income from Capital Gains

- Income from House Property

- Income from Business

- Other income such as lottery and other legal gambling, dividend income, etc

How the Net Taxable Income is calculated

In order to file an Income Tax Return, we must first calculate the Net Taxable Income from the five sources mentioned above, and then deduct taxes already paid by way of TDS/TCS. Here is a detailed guide on how to calculate your net taxable income.

Income from salary

- Collect all your salary slips and Form 16 TDS certificates issued by your employer.

- Add all emoluments receivable by you which includes basic salary, dearness allowance, travel allowance, house rent allowance, and any other allowance and reimbursements – a comprehensive list is mentioned in your salary slip and Form 16 part B of TDS certificate.

- This is your gross salary.

- Now deduct the exempted portion of your house rent allowance and Travel allowance, up to Rs. 19,200 p.a., medical reimbursements up to Rs. 15,000, a standard deduction up to Rs. 50,000 (for the fiscal year 2019 – 20) and all reimbursements applicable.

- This is your net taxable income from your salary.

Income from House Property

Income from house property is mainly consisted of rent from properties let out. In case of a single property that the assessee resides in, this income will be nil. Here are the steps required to compute net taxable income from house property –

- Compute the Gross Annual Value (GAV) of the property that you have rented out. This is done by computing the Fair Market Value (FMV) which is market-rate of rent expected from a similar property in the market, taking into account size and location. Compute the Municipal Valuation (as obtained from the Municipality). The higher of these two values have to be considered which called the Expected Rent. the Expect Rent is compared with the actual rent received, and whichever is higher is considered the Gross Annual Value (GAV).

- Then, deduct the GAV from the municipal taxes paid during the fiscal year to arrive at the Net Annual Value (NAV). If any loan is taken to purchase the property, deduct 30% of the NAV. Now the final amount is your net taxable income from house property.

Income from Capital Gains

Income from capital gains is any income that is obtained from the sale of a capital asset like a house, flat or land or shares. Calculating the income from capital gains is a complicated affair, and you may need the help of an expert. However, this is the broad method –

- Calculate Long-term Capital Gains (LTCG) by deducting the indexed cost of improvement, and indexed cost of acquisition from the full value of the sale consideration (indexed cost is found out by adjusting for inflation as per the cost inflation index). Then deduct exemptions provided under sections 54, 54EC, 54F, and 54B of the Income Tax Act.

- Calculate Short-term Capital Gains (STCG) by deducting the cost of improvement, and acquisition from the full value of the sale consideration.

- Deduct the cost of brokerage, stamp papers, travel costs, costs of inheritance procedures, and legal costs like cost of obtaining succession certification, probate, executor certificate, etc. – Allowed in some cases.

- The final amount after all deductions from the sale consideration price received is the taxable income under capital gains.

Income from Business or Profession

If the business set up is very large involving complex transactions, it is better to take the help of a professional. For a simple set up, the calculation can be made by the assessee himself. However, beware that several provisions of the Income Tax Act which deal with allowances and disallowances will be applicable and concepts like book profits, presumptive incomes, AMT are also at play.

- Take the Net Profit mentioned in the Books of Accounts as the base value.

- Add all deductions disallowed under the IT Act under Sections 37 and 14 which have already been availed in the Profit and Loss Account.

- Subtract the expenditures allowed under Sections 32, 35 and 36 of the IT Act.

- This value is the net assessable income under business or profession.

Income from other Sources

- Dividends from cooperative societies and foreign companies are fully taxable, as s ‘deemed dividends’ under Section 2(22)(e) of the Income Tax Act. Dividents under section 10(34) of the IT Act have been fully excluded from income tax, these include the income of mutual funds, dividend liable to corporate dividend tax, and dividend from Indian Companies.

- Winnings over Rs. 10,000 from lotteries and games like horse racing are taxable at the rate of 30%.

- Deduct 50% of all incomes received in the previous year.

- Include incomes not declared under profit and gain of business or profession, like interest earned on securities except shares, furniture rental, rents on plant and machinery, insurance policies, etc.

- Include taxable gifts, monetary or non-monetary.

- The total amount is income taxable from other sources.

Deductions under Chapter VI-A

Finally, apply all relevant deductions under Section 80C to 80U of the Income Tax Act. If the deducts exceed the Gross Total Income (GTI), then deducts shall be limited up to the GTI.

The final amount arrived at is the Net Taxable Income.

What are deductions and exemptions and rebates?

Deductions

Various deductions can be claimed by the taxpayer which are as follows –

- Section 80C – Contributions to annuity Insurance plans, provident funds, kid’s tuition fees. Section 80 CCC – Contribution to annuity plan up to Rs. 1,50,000 per year. Section 80 CCD – Contribution to Government notified Pension Schemes such as the National Pension Scheme. The total deduction under 80C, 80 CCC, and 80 CCD shall not exceed more than Rs. 1,50,000 per year.

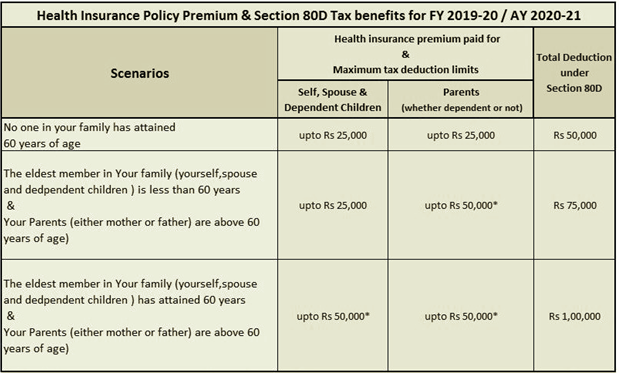

- Section 80D – Deductions for payment of health insurance premiums for yourself or your family, up to a total of Rs. 2,25,000 every year. This is subject to many sub-factors, like parents, age, disability, etc. and the amount is not a lump sum umbrella deduction.

- Section 80DD – You can claim up to Rs. 75,000 per year as deductions for spending on medical treatment of family members who have a disability. In case of severe disability, the limit is raised to Rs. 1.25 lakhs. This amount is in addition to the amount claimed under insurance.

- Section 80DDB – You can claim Rs. 40,000 for treatments for specified crucial illnesses.

- Section 24(B) – You claim a deduction of up to Rs. 2 lakh per annum on income from house property.

- Section 80E – You can claim deduction on interest paid for loan taken for higher studies. There is no limit to this, and the full interest can be claimed as deduction.

- Section 80EE – If you are a first time home buyer, you can claim up to Rs. 50,000 as an additional deduction on home interest payments.

- Section 80 G – You can claim refunds for contributions made to charitable organizations. However, this is limited to cash contributions only.

Exemptions

Exemptions are those items that are totally excluded from calculations of the tax payable.

- Section 80GG – If you own a house but receive no house rent, then you can claim a deduction, subject to rent paid for 10 months, Rs. 5,000 per month, or 25% of the total income, whichever is lower.

- Section 80TTA and 80 TTB – For senior citizens, interest earned on fixed deposits and recurrent deposits is exempt from Tax till Rs. 50,000.

Rebates

Rebates are those items that are discounted after calculation of total tax payable, but not disregarded before. Thus, whereas deductions and exemptions are claimed from income, rebates are claimed from payable tax.

- Section 87A – Individuals drawing a salary up tp Rs. 5 lakhs have been granted a tax rebate up to Rs. 12,500. This has effectively brought the taxable liability from salary to nil for up to Rs. 5 lakhs.

Difference between Deduction and Exemption

In the case of exemption, the particular income will not be included when calculating the tax liability. Whereas in the case of deductions, the income is calculated at first and later excluded. The practical difference is that there is no maximum ceiling incase of exemptions and the total head is excluded regardless of the amount earned under that head. Whereas in deductions, there is a maximum ceiling up to which a deduction can be claimed. Further, deductions can sometimes only be claimed if the money has been invested in a particular avenue, whereas in exemptions there is no such stipulation.

What is Tax Deducted at Source (TDS) and how does it work?

The Tax Deducted at Source (TDS) scheme has been initiated by the Govt. wherein the employer deducts the tax from the salary of the employee ‘at the source’ before crediting salary every month.

The collected tax is deposited with the Govt. every quarter and the employer is liable to provide the employee with a TDS certificate in lieu under Section 203 of the Income Tax Act. The employee can claim a rebate in income tax against the issued TDS certificate. The minimum salary for the deduction of TDS is Rs. 2.5 lakhs.

For TDS deducted from salary, Form 16 will be issued by the employer. For TDS deducted for income from other sources such as mutual funds, recurring deposits, capital gains, gold bonds, etc., Form 16A will be issued by the deductor. For TDS deducted for income from the sale of the property, Form 16B will be issued by the buyer deductor.

Apart from salary TDS is also deducted in case of interest received from FDs, savings account, deemed dividends, insurance payouts, mutual funds, etc. as given in Sections 192 to 194L of the Income Tax Act.

If the employer fails to deduct TDS, he will liable to pay the interest on the amount due at the rate of 1 -1.5% for every month due under Section 201 of the Income Tax Act.

Benefits of TDS Scheme -

- Prevents tax evasion

- Source of regular tax collection as TDS is deposited every quarter.

- Tax Collection base is widened.

- The burden of collection is shared by the deductor employees with Tax Collection Agencies, which provides much-needed support to the already stressed Govt. infrastructure.

- Automatic deduction is also convenient for the deductee employee.

Know more about GST Suvidha Kendra services & processes.