e-Way Bills – What is it and How to Generate?

e-Way Bills – What is it and How to Generate?

What is the e-Way Bill?

An e-Way Bill is a new system under the Goods and Services Tax (GST) that is mandatorily required to transport goods exceeding more than Rs. 50,000 across State Lines by a vehicle. It has been implemented because GST is a destination-based tax (meaning if goods manufactured in Rajasthan are sold in Madhya Pradesh, the tax will be paid in M.P.), and Intra-State sales of goods attract Integrated GST (IGST), instead of SGST and CGST.

An e-Way bill is issued during the “supply”, exchange or transport of goods for reasons other than supply, with or without consideration (payment), in or outside the usual course of business.

The documents required are an invoice, challan or a bill or supply, Transporter ID of the vehicle, along with Transporter document number if the means of transport is by rail, air, or ship.

Generally, the e-Way Bill is generated by the supplier. Otherwise, a Transporter can complete the formalities via PART A of FORM GST EWB-01. This is based on the bill of supply/ challan or invoice given to the Transporter by a Supplier.

The Bill is compulsory for all parties – registered or unregistered. However, in a transaction between a registered and an unregistered party, where the bill has not been generated by an unregistered supplier, the registered receiver shall have to ensure that all formalities have been complied with. Unregistered transporters can first generate a Transporter ID by logging on to the online e-Way Portal.

If multiple consignments are transported in a single conveyance, a consolidated e-way bill for all consignments can be generated through Form GST EWB-02.

The validity of an e-Way Bill is based on its dimensions. If the cargo dimensions exceed that prescribed in Rule 93 of the Central Motor Vehicle Rules, 1989, it is called an “over-dimensional cargo”. An e-Way Bill for an over-dimensional cargo is valid for 1 day for less than 20 km, with an increase of an additional day for every 20 km thereafter. If however, the cargo is within the dimensions under Rule 93, the validity is 1 day for less than 100 Kms with an additional day every 20kms thereafter.

What are the advantages of an e-Way Bill?

- The e-Bill system has improved the speed of movement of goods.

- The system does away with the checkpoint system, which increases the turnaround time for trucks and distance traveled for trucks while decreasing the costs for the transport industry.

- The entire e-Way Bill generation system is online, which increases the convenience of transporters, by eliminating the need to physically visit an office and stand in a queue to generate an e-Way Bill.

- Tax evasion and delinquency can also be tracked by virtue of online infrastructure.

When is e-Way Bill not necessary?

An e-Way Bill is not needed in the following circumstances –

- When a non-motor vehicular transport is used.

- When the goods being transported have been approved by customs supervision or seal. Or the goods are being transported from for customs clearance from an airport, harbor, or cargo hold to the Inland Container Depot (ICD) or Container Freight Station (CFS).

- Goods being transported to and from certain countries like Nepal or Bhutan.

- Consignments under the Ministry of Defense.

- Empty containers.

- Internal transportation of goods by business between its production office and the weighing station within 20 km, provided that there is a valid delivery challan.

- Goods exempted under State/UT GST Rules.

- Goods exempted under Annexure to Rule 138 (14) of the GST Rules.

When are the provision regarding inspection and verification of transported goods in the e-Way Bill system?

- A summary inspect report by the proper authority is to be recorded online in Form GST EWB 03 Part A within 24 hours of conducting the inspection and a final report is updated within 3 days in Form GST EWB 03 Part B.

- Once verification has conducted during transit at one point in the State, further inspect is not to be done, unless there is a specific complaint or suspicion of tax delinquency in respect to the consignment.

What is the process of the generation of e-Way Bills?

Below we discuss a step-by-step procedure to generate e-Way Bills online.

- First, log on to the e-Way Bill Generation Portal at https://ewaybill.nic.in and log in by entering your username, password, and captcha.

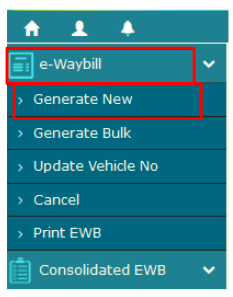

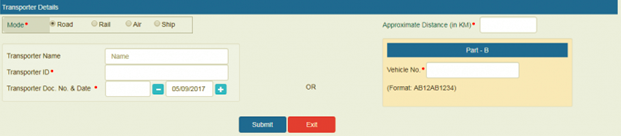

- Next, find the “e-Waybill” tab on the left-hand side and select “Generate New”.

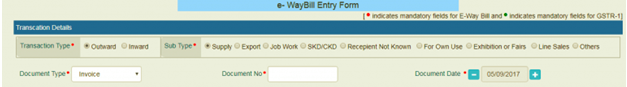

- The following parameters will appear. Select the appropriate options based on our guidelines below.

Transaction type: Section “Inward” if you are a recipient of goods and “Outward” if you are a supplier.

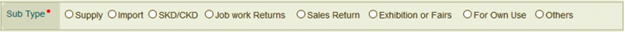

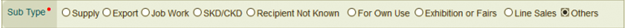

Sub-type: This appears based on whether you have selected transaction type as inward or outward. Select the appropriate type, there are quite self-explanatory.

Inward

Outward

Document type : Select whether Bill/Challan/Invoice/Bill of entry/Credit Note or “others”.

Document No. : This is the invoice or challan number.

Document Date: Enter the date on the invoice or challan.

- Next, enter the To/From details based on if you are a recipient or supplier. For an unregistered entity, “URP” can be entered in place of “GSTN”.

- Next, fill in the details of the items being transported such as the product name, its description. Quantity, HSN Code, total value, taxable value, tax rates, cess rates.

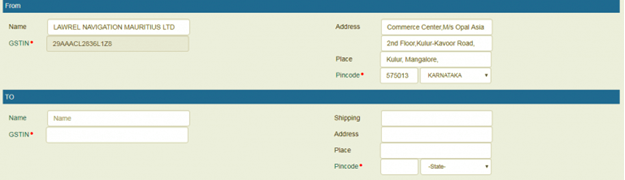

- Enter the details of the transported such as ID, Doc. No. Or you can enter the transport vehicle number instead.

- Lastly, click on “Submit. This will generate your e-Way bill in Form of EWB-01. A unique 12 digit code will be provided for each EWB-01. Below is an example.

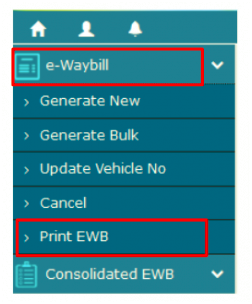

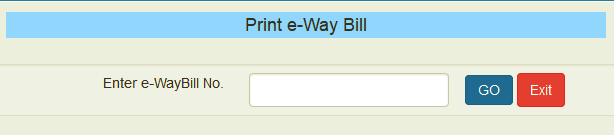

How to print e-Way Bills?

You can print your e-Way Bill after generation as shown in the above steps.

- First, log on to the e-Way Bill Generation Portal at https://ewaybill.nic.in.

- Next, navigate to the “e-Waybill” tab on the left side and select “Print EWB” from the drop-down menu.

- Enter the unique 12 digit number of the e-Way you have already generated in the previous step.

- Now, a digital copy of your e-Way Bill will appear and your will find the print option at the bottom.

e-Way Bills have become a mandatory step in basically any inter-state trading and transportation of goods. Unfortunately, they can be quite a hassle for businesses, who often find it difficult and time-consuming to generate e-Way Bills themselves. This has created a huge demand in the market for services that can help these businesses and transportation agencies generate e-Way Bills quickly and easily.

You can take advantage of this lucrative business opportunity by registering yourself as a GST Suvidha Kendra partner today, and launch your own independent business approved by Govt. of India.