Everything You Need To Know About Common Service Centers – CSC

Everything You Need To Know About Common Service Centers – CSC

There has been a lot of confusion surrounding the Common Service Scheme or CSC. What is it? What does it do? Will it benefit us in any way? Today we are going to discuss all these points and delve deep into what the CSC is all about.

The Common Service Scheme has been introduced as part of the “good governance” paradigm. It is stated to be a two-in-one solution that will help to revamp the front-end delivery systems of the public services and at the same time will encourage rural entrepreneurship in order to create jobs. The CSC started as part of the E-governance plans in the year 2006. At present, it is one of the 31 Mission Mode Projects under “Digital India”.

The idea behind CSC is the digitization of several government schemes so that it becomes easier to carry out the process. This process includes the issuance of certificates, licenses and so on. The job will be handed over to the ‘Village Level Entrepreneurs (VLEs)’ who will run Common Service Centers. The aim is to have at least one CSC in each of the Gram Panchayats. At present, there are 2.5 lakh gram panchayats in the country. The entire thing will be a culmination of private and public partnership at the central level.

However, at the state level, the responsibility of hiring the VLE has been given to private companies known as the ‘Service Centre Agencies’. The qualifications to become a VLE are very minimal. This has been done to encourage participation from the villages. The higher the participation the greater will be the success of this scheme.

Getting a CSC Registration in your desired location can take time and effort. There is no guarantee that you will get a CSC center and be able to sell the CSC Services.

However, you can sell some CSC Services immediately, even without obtaining a CSC Certificate. These services are related to the Utility (Called DigiPay in CSC). Some examples of such Utility services are PAN, Bill Payment,Recharges, AEPS, DMT, Bus, Train, Hotel, Flight, Loan EMI, Insurance EMI & LIC etc.

Also, you can sell services like GST Registration, GST Returns, ITR, Food License, MSME, Company Registration, Accounting, Taxation,Loans, Insurance, Mutual funds, and much more.

You will be given 55+ trainings online in English & Hindi languages.

GST Suvidha Kendra provides all of the above services.

So, you can wait for CSC Registration/Certificate, and at the same time you can start selling the above services from day 1 using GST Suvidha Kendra.

Stats to support:

As per government reports, the current figure is as such:

- 2.6 lakh VLE’s are in place, which offers services across 3,462 CSC centers in the country.

- The total transaction carried out in 2017 amounts to Rs. 1,975 lakh.

- Services include – Aadhar card and PAN card registration, booking of the train tickets, music downloads and checking one’s bank balance or information on eligibility of schemes and so on.

This is not all; the government is also planning on offline services that will make things easier and hassle-free.

What is the Common Service Scheme?

The Government of India started the Common Service Centre Scheme. This was done as part of the National E-Governance Plan Scheme. It aims to provide G2C (Government to Citizen) and B2C (Business to Citizens) services to citizens right at their home under Bharat Nirman.

As per this scheme, the budget has been allocated to 100,000 Common Service Centres in rural areas and 10000 CSC in Urban India. High quality and cost effective e-governance Services are the main cornerstones of this scheme.

Objectives of CSC-

The above-mentioned scheme is implemented in PPP (Public Private Partnership) Framework. Some of the major attributes of this scheme are:

- Emphasis on entrepreneurship in rural areas

- Offering services to the private sector as well

- Community needs are given special importance

- Playing an important role in the development of rural India and offering livelihoods

- Offers to act as an agent to numerous Government and Non Government services

- One-stop solution for various G2C and B2C Services.

One CSC will cover 6 villages, which is approximately 6,00,000 villages.

Structure of CSC-

The PPP model will be based on 3- tier structure-

- The State Designed Authority will be responsible for managing and implementing the CSC services across the state.

- The Service Center Agency (SCA) under the guidance of the owner of CSC will set up the CSC and will also decide the locations for Common Service Centre. This will play a role in promoting the CSC in rural area through numerous promotion campaigns, which will be carried out at the state or local level. The SCA is accountable for the 500-1000 CSCs operating under him.

- The Village Level Entrepreneur is the CSC Operator. 6 Villages will fall under him.

What Is The Procedure To Start a Common Service Center?

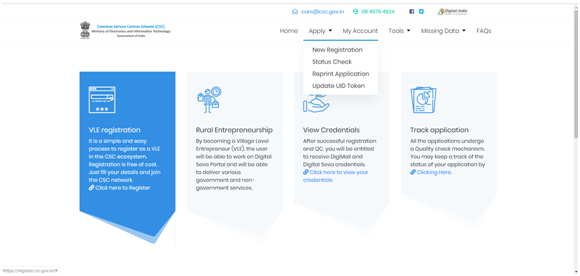

To Setup a Common Service Centre, you should be aware of the Online Process. (Mentioned Below).

Application Procedure for setting up of CSC:

- Visit the CSC Portal i.e. www.csc.gov.in

- On the left side of the page, there is a tab titled “Interested to become a CSC”. Click on it.

- Now click on Link” For CSC Registration, Click Here”

- You need to enter your Aadhar Card Number.

- Once you enter the number, you will be asked to choose any one of the authentication options (IRIS/ Finger Print/ One Time Password).

- Now click on “Proceed” to go to the next step.

- They will ask you to enter the one time generated password or OTP. Do that.

- Select the Geo-tagged Image of Center from where you wish to apply for CSC.

- Click on SUBMIT Option.

Once you submit the Application, you will receive an acknowledgment number on your registered mobile number.

What Are The Services Provided by CSC?

List of Services (In Detail)

1. Government to Consumer (G2C)

Under this, the following services are covered:

- Insurance Services

- Passport Services

- Premium Collection Services of Insurance Companies like LIC, SBI, ICICI Prudential, AVIVA DHFL and Others

- E-Nagrik & E- District Services {Birth/ Death Certificate etc.}

- Pension Services

- NIOS Registration

- Apollo Telemedicine

- NIELIT Services

- Aadhar Printing and Enrollment

- PAN Card

- Electoral Services

- E-Courts and Results Services

- State Electricity and Water Bill Collection Services

- IHHL Project of MoUD (Swachh Bharat)

- Digitize India

- CyberGram

- Services of Department of Post

2. Business to Consumer (B2C)

Under this, the following services are covered:

- Online Cricket Course

- IRCTC, Air and Bus Ticket Services

- Mobile and DTH Recharge

- English Speaking Course

- E-Commerce Sales (Book, Electronics, Households Items, etc.)

- Agriculture Services

- CSC Bazaar

- E-Learning

3. Business to Business (B2B)

Under this, the following services are covered:

- Market Research

- Rural BPO (Data Collection, Digitalization of Data)

4. Educational Services

Under this, the following services are covered:

- Adult Literacy- Through this service, reading, writing, speaking, and listening services will be offered through TARA Akshar+

- IGNOU Services- Students Admission, information about courses being offered, Examination Application Form, Results declaration, etc. services will be provided by CSC.

- Digital Literacy- Through this service, computer courses that enhance the IT skills of ASHA and Anganwadi Workers and authorized Ration Card Holder will be encouraged. There will be Investor Awareness Programmes, and NABARD Financial Literacy Programme as well.

- MKCL Services- the Maharashtra Knowledge Corporation Limited (MKCL) through online mode will offer various vocational and technical courses.

- NIELIT Services- Online Registration/ Fee Collection, Online Examination Form submission and printing of examination.

- NIOS Services- Open Schooling in Rural Areas, Registration of Students, Payment of Examination Fees, and Declaration of Results will be encouraged through the NIOS service.

5. Financial Inclusion

Under this, the following services are covered:

- Banking- Numerous banking services like Deposit, Withdrawal, Balance Enquiry, Statement of Accounts, Recurring Deposit Accounts, Overdraft, Retail Loan, General Purpose Credit Card, Kisan Credit Card, Credit Facilities to Borrower will be made available through CSC in the rural areas. It has tied up with nearly 42 public, private services sector and regional rural banks.

- Insurance- CSC will also offer insurance services through the Authorized Village Level Entrepreneur (VLE). Some special features include Life Insurance, Health Insurance, Crop Insurance, Personal Accident, and Motor Insurance.

- Pension- National Pension System in Rural and Semi-Urban Areas are promoted through the opening of Tier 1 and Tier 2 Accounts, Deposit Contribution, etc.

6. Other Services

Under this, the following services are covered:

- Agriculture- After the Farmer registration is done, they will receive expert advice on Weather Information, Soil Information.

- Recruitment- Notification for Recruitment in Indian Navy, Indian Army, and Indian Air Force is shared with the citizens in order to give them an opportunity to join the armed forces.

- Income Tax Filing- Income Tax Returns can also be filed through CSC. VLE Manual is available in both language English and Hindi.

What is the Eligibility & Other Requirements?

In order to start a CSC (Common Service Centre) in your area, it is important to match the eligibility criteria, which is mentioned below:

Eligibility to Participate in CSC Scheme-

- The applicant has to be a local person.

Age-

- He/she must be of 18 years of age.

Qualification-

- The applicant has to be class 10 qualified or equivalent.

Other Requirements-

- He/she should be well versed in the local language

- He should have a basic knowledge of English and computer skills.

Infrastructure Required for Starting a CSC Center

Required CSC Infrastructure shall be as-

- Room or the building selected should have 100-150 Sq. Ft place

- 2 PC’s with UPS with 5 hours battery back up or portable generator set. The PC should have a licensed Operating System of Windows XP-SP2 or above.

- Two Printers. (Inkjet+ Dot Matrix)

- 512 MB RAM

- 120 GB Hard Disc Drive

- Digital Camera/ Webcam

- Wired/ Wireless/V-SAT Connectivity

- Biometric/IRIS Authentication Scanner for Banking Services.

- CD/DVD Drive

Per CSC Total Estimated Cost will be 1.25 to 1.50 Lacs (Except Land & Building

Apply for PAN through CSC-

Apply for Pan Card through Common Service Center- The Indian Income Tax Department issues the PAN card under the supervision of Central Board of Direct Taxes (CBDT). It is a Unique 10 Alpha Numeric Characters. In order to pay income tax, to open a D-MAT A/c, or to pay/ refund of TDS the PAN India is required. To get the PAN Card, the interested person can apply through CSC. In order to apply for the CSC PAN Card the following supporting documents are required:

- Identity Proof

- Residence Proof

- Passport Size Photographs

Documents necessary for Identity Proof-

- Aadhar Card

- School Leaving Certificate

- Matriculation Certificate

- Degree from recognized Board or Institute

- Passport

- Ration Card

- Voter Card

- Driving License

Documents necessary for Address Proof-

- Aadhar Card

- Passport

- Electricity Bill

- Telephone Bill

- Water Bill

- Voter Card

Bill older than 6 months will not be entertained.

What's the Procedure for Village Level Entrepreneur (VLE) to Get Registered on CSC Portal-

Common Service Center portal is allocated only to the Village Level Entrepreneur (VLE). But, to become the VLE, one has to register. The procedure of registration is as follows:

- Visit the website www.apna.csc.gov.in

- On the top of the page, there is a tab called “Login”. Click on that.

- Then click on the tab “CSC Connect”

- A new tab will be open up, where VLE has to enter the CSC ID and Password.

- Once the CSC ID and Password are authenticated, a registration page will open where the VLE has to furnish the required data like Name, Address, CSC Location, etc.

- Now click on the Submit button.

- Once all the details are submitted, the VLE will receive an email and SMS asking him to verify his email id and mobile number.

- In the next step, he has to verify the same, by clicking on the link that is there in the email. Once he clicks on the link, he needs to enter the CSC ID/ Password. He will receive the activation code via message on his mobile.

- Enter all the data before clicking on the “submit” button.

The confirmation mail for successful registration will be sent to the VLE.

Search for a Common Service Center

Common Service Centers have been opened in different parts of India by the central government at the block level. You can now locate your nearest common service center easily by entering your state name, district number and block division. As long as you have these details with you, locating a CSC center is not a difficult task.

Find the CSC Center List & Different CSC Name in States of India where Common Service Centers are located.

These centres act as access points for delivery government schemes, utility payments, banking, education, healthcare, and more.

Following are the list of states & their CSC name where Common Service Centers are located.

| S. No. | State Name | CSC Name |

|---|---|---|

| 1 | Andhra Pradesh | Rajiv Citizen Service Centre |

| 2 | Andaman and Nicobar | eDweep |

| 3 | Arunachal Pradesh | Common Services Centres (CSCs) |

| 4 | Assam | Arunodoy Kendra |

| 5 | Bihar | Vasudha |

| 6 | Chandigarh | Gram Sampark Centres |

| 7 | Chhattisgarh | Grameen Choice Centres |

| 8 | Delhi | Jeevan Centres |

| 9 | Goa | Lok Seva Kendras |

| 10 | Gujarat | e‐Gram |

| 11 | Haryana | e‐Disha |

| 12 | Himachal Pradesh | Lok Mitra Kendra |

| 13 | Jammu and Kashmir | Khidmat Centre |

| 14 | Jharkhand | Pragya Kendra |

| 15 | Karnataka | Nemmadi Kendra |

| 16 | Kerala | Akshaya Centres |

| 17 | Lakshadweep | Aashraya |

| 18 | Madhya Pradesh | Nagrik Suvidha Kendra |

| 19 | Maharashtra | Maha e Seva Kendra |

| 20 | Manipur | Common Service Centres |

| 21 | Meghalaya | Rainbow Centres |

| 22 | Mizoram | Mizoram Online Centres (MOC) |

| 23 | Nagaland | Nagaland One, Common Service Centre |

| 24 | Odisha | Common Services Centre |

| 25 | Puducherry | Common Services Centre |

| 26 | Punjab | Gram Suvidha |

| 27 | Rajasthan | e‐Mitra |

| 28 | Sikkim | Common Services Centre |

| 29 | Tamil Nadu | People’s Computer Centre |

| 30 | Tripura | e‐Pariseva Kendra |

| 31 | Uttar Pradesh | Jan Seva Kendra |

| 32 | Uttarakhand | e‐Uttara |

| 33 | West Bengal | Tathya Mitra Kendra |

| 34 | Daman and Diu | Saral Seva Kendra |

| 35 | Darda And Nagar Haveli | Saral Seva Kendra |

| 36 | Telangana | MeeSeva Center |

Why was the Common Service Centre set up?

The main intention behind setting up the Common Service Centre, which is popularly known as CSC, is to do away with the middleman. The middleman will completely vanish. Now that everyone has access to the basic necessities and are aware of how to carry out the transaction, they don’t have to depend on the middleman. This is really good news because there are many incidents where the middleman has duped the common people out of their hard-earned money and left them to look after themselves. Since the CSC Scheme provides the G2C services or government to citizen benefits, the middleman will not be able to make any kind of benefits whatsoever. All the services that will be launched by the Government will be introduced directly to the citizen with full transparency. As such one can expect a fair flow of policies and ideas.

Because of the CSC, the rates of government services will be well publicized. This, in turn, will reduce the avenues of taking bribes. As and when the number of transactions increases the responsibility of the VLE’S will also increase which means that there will be an increased effort to maintain the customer base and improve customer relations. When one has access to an alternative avenue to apply for a service without depending on any third party, it automatically improves the accountability aspect as well. This is felt more in areas of social welfare programs like the old-age pensions and ration cards. This is really very commendable.

You will be happy to know that as part of the CSC scheme, a Special Purpose Vehicle or SPV has been created so that the Government can operate through e-Governance in a progressive and effective manner. This platform is connected with the CSC network. Under the Companies Act 1956 on 16th July 2009, the CSC SPV has been incorporated. It is named as ‘CSC e-Governance Services India Ltd’. The main objective of the SPV is to monitor the CSC scheme and to make sure that all the activities are carried out as per the guidelines and to monitor the outcome on behalf of the State and Central Government.

What are the major roles of SPV?

The major roles include the following:

- To make sure that the systemic viability and sustainability of the CSC Scheme is in order

- To monitor the goals and the outcomes achieved by the CSCs

- To enable proper delivery and implementation of G2C and B2C services through the Common Service center

- Maintaining a standard framework for decision making in a collaborative manner

- To ensure content aggregation and to act as a catalyst on a daily basis

- Improving the stakeholder capacity and ensuring best practices for sharing and overall development and progress of the society.

This is custom heading element

GST or Goods and Service Tax is charged on goods and services at the end stage of the distribution of goods. The government has set up the GST Suvidha Kendras to make the filing of tax easier and simple.

On the other hand, CST or Central Sales Tax is one of the components of VAT (Value Added Tax). This tax is imposed when the sale of goods takes place between the two states. This tax is levied when the invoice is raised or when the goods are transferred, whichever is earlier.

GST Suvidha Kendra is a one-stop solution for all SME (small and medium entrepreneurs), shopkeepers, an individual whose turnover is above 20 lakhs. The GST Suvidha Kendra will help them to file their GST returns on time at a much lower fee compared to the tax professional in India.

Conclusion

When one has access to free and correct information from the government schemes, the eligibility and application procedures that are there for so long, it actually opens a way to take forward the mandate of Section 4 of the Right to Information Act.

As well known that as per RTI every citizen of India has the right to ask questions to the government and the government is bound to answer them. However, the questions have to be related to the duties that have a direct impact on the citizen. There has been a lot of debate on RTI and how effective it is. But slowly, we can safely say that people will have real power. They will determine the course and future of this country. The question is – are you prepared to take on the challenge?

If what has been stated above is really implemented and all the objectives of Common Service Scheme are really followed than we can safely say that India will become a Digital Platform in the truest sense of the term. No one will be able to stop us from becoming a force to be reckoned with. What do you think of the Common Service Center? Share your feedback in the comments section.