Everything You Need to Know About ‘Mudra Loan’

Everything You Need to Know About ‘Mudra Loan’

The Pradhan Mantri Mudra Yojana or PMMY is a lead plan of the Government of India to provide reasonable credit to the small scale and little ventures.

Mudra loans are intended to carry undertakings into the formal financial framework, or to “support the unfunded”. Credits under the PMMY plan are accessible to non-agriculture, minor or little ventures occupied with salary generation through manufacturing, trading and important services. Undertakings engaged with partnered agricultural activities can also apply for Mudra loans

Advantages

- The Mudra loan plan offers credit to minor and little endeavors occupied with salary generation.

- One of the key advantages of a Mudra credit is that borrowers are not required to give security or insurance. Moreover, there are no preparing charges for Mudra loans.

- The credit reached out under the PMMY can be for a store or non-subsidize based necessities. Henceforth, borrowers can utilize the Mudra loan plan for multiple purposes. The credit from Mudra loans can be utilized for term loans and overdraft facilities, or to apply for letters of credit and bank ensures.

- There is no base credit sum for Mudra loans.

There are 3 items under the Pradhan Mantri MUDRA credit:

1. Shishu

Shishu under the MUDRA credit plan gives up to Rs.50,000 to those business people who are either in their underlying phases of business or hoping to begin one.

Necessary details required:

- Machinery citation and different things to be obtained.

- Details of the hardware to be bought.

Borrowers also need to give details of the machinery provider.

2. Kishor

Kishor under the MUDRA credit offers up to Rs.5 Lakh to those businesspersons who are searching for extra assets to extend their activities.

Necessary details required:

- Last 6 months of record statement from a current banker

- Balance sheet for the most recent 2 years

- Income/sales tax returns.

- Estimated accounting report for 1 year or for the span of the loan.

- Memorandum and articles of association

- Sales made before documenting the loan application and in the current FY.

Borrowers additionally need to give a report containing the financial and specialized suitability of the business.

3. Tarun

Under the Pradhan Mantri MUDRA loan course of action, Tarun endorses up to Rs.10 Lakh if the entrepreneur meets certain qualification foundations.

Necessary details required:

• Same as Kishor.

Mudra Credits

With a goal to loan enterprises among the new age yearning youth, it is guaranteed that more attention is given to Shishu Category Units than Kishore and Tarun category loans.

Inside the structure and generally, the target of advancement and development of minor undertakings division under Shishu, Kishore, and Tarun, the items being offered by MUDRA are so planned, to meet prerequisites of various areas/business activities just as business/business person portions.

While there is no base credit sum under the Mudra loan plan, the most extreme loan sum that can be taken under the PMMY is Rs.10 lakh.

Borrowers don’t have to pay handling charges or offer a guarantee on the off chance that they get the benefit of a Mudra loan.

According to the PMMY conspire, the Mudra credit cannot exclusively be offered to ventures in the non-agricultural division yet in addition can incorporate those occupied with partnership rural activities, for example, cultivation and fisheries.

The financing cost on Mudra credits is dictated by the Marginal Cost of Lending Rate or MCLR, which is determined by the RBI rules.

The financing support from MUDRA is of two kinds:

- Small scale Credit Scheme (MCS) for loans up to 1 lakh fund through MFIs.

- Refinance Scheme for Commercial Banks/Regional Rural Banks (RRBs)/Small Finance Banks/Non-Banking Financial Companies (NBFCs).

Micro Credit Scheme:

Micro Credit Scheme is offered essentially through Micro Finance Institutions (MFIs), who convey the credit up to 1 lakh, for different small scale endeavor/independent venture activities.

Despite the fact that the model of conveyance might be through SHGs/JLGs/Individuals, the credits are given by the MFIs to singular business people for a specific amount of income generated by micro-businesses or enterprises.

Refinance Scheme for Banks/NBFCs

Various banks like Commercial Banks, Regional Rural Banks, Small Finance Banks, and NBFCs are qualified to avail of refinancing support from MUDRA for financing minor business activities. The refinance is accessible for term credit and stirring capital loan up to a measure of 10 lakh for every unit. The qualified banks/NBFC, which go along to the prerequisites as advised, can avail of refinancing from MUDRA for the loans given by them for qualified MUDRA consistent activities under Shishu, Kishore and Tarun classes. So as to energize women entrepreneurs, the financing banks/MFIs may consider expanding extra facilities, including premium decrease on their credit.

The Motivation Behind MUDRA Loan

Mudra loan is stretched out for an assortment of purposes which result in business creation. The credits are expanded fundamentally for:

- Business loan for other Service Sector activities

- A working capital loan through MUDRA Cards

- Gear Finance for Micro Units

- Transport Vehicle loans – for business utilize as it were

- Loans for agri-united non-agricultural salary producing activities, for example, pisciculture, honey beekeeping, poultry cultivating, and so forth.

- Tractors, tillers just as bikes utilized for business purposes as it were.

Following is an illustrative rundown of the activities that can be secured under MUDRA credits:

1) Transport Vehicle

Purchase of vehicles/vehicles for transportation of products and travelers, for example, auto-rickshaws, little merchandise transport vehicles, 3 wheelers, e-rickshaws, taxis, and so forth. Tractors/Tractor Trolleys/Power Tillers utilized distinctly for business objects are additionally qualified for help under PMMY. Bikes utilized for business objects are additionally qualified for inclusion under PMMY as well.

2) Community, Social and Personal Service Activities

Salons, magnificence parlors, recreation center, boutiques, fitting shops, cleaning, cycle, and cruiser fix shops, DTP and Photocopying Facilities, Medicine Shops, Courier Agents, and so forth are included.

3) Food Products Sector

Activities, for example, papad making, achaar making, jam/jam making, farming produce conservation at provincial level, sweet shops, little administration sustenance slows down and everyday providing food/bottle administrations, cold chain vehicles, cold stockpiles, ice-making units, frozen yogurt making units, scones, bread and bun making, and so forth.

4) Textile Products Sector/Activity

Handloom, power loom, khadi action, chikan work, zari and zardozi work, customary weaving and handwork, conventional coloring and printing, attire configuration, sewing, cotton ginning, electronic weaving, sewing and other material non piece of clothing items, for example, sacks, vehicle frill, outfitting extras, and so on.

5) Business Credits for Traders and Shopkeepers

Financial help loaning to people for running their shops/exchanging and business activities/administration undertakings and non-agricultural salary producing activities with a recipient loan size of up to 10 lakh for every venture/borrower.

6) Equipment Finance Scheme for Micro Units

Help for setting up minor undertakings by purchasing important machinery/types of gear with per recipient loan size of up to 10 lakh.

7) Activities United to Agribusiness

‘Activities united to agribusiness’, for example pisciculture, honey beekeeping, poultry, domesticated animals raising, evaluating, arranging, conglomeration agro ventures, journal, fishery, agri-facilities and agribusiness focuses, sustenance and agro-preparing, etc.(excluding yield loans, land improvement, for example, waterway, water system, and wells) and administrations supporting these, which loan occupation or are pay creating will be qualified for inclusion under PMMY in 2016-17.

Formation of Framework for "Private Venture Finance Entities"

An empowering system for help to “Private venture Finance Entities” would be made prompting formalization of the economy which is by and by incorporated into the casual part.

Cooperative Energies with National Rural Livelihoods Mission/National Urban Livelihood Mission

The National Rural Livelihoods Mission [NRLM] is set up “To decrease neediness by empowering the poor families to get to productive independent work and talented compensation business openings, bringing about calculable improvement in their jobs on a manageable premise, through structure solid grassroots establishments of poor people.” To accomplish the above mentioned, NRLM Mission inter alia pursues an interest-driven procedure for consistent limit building, granting essential abilities and making linkages with occupation open doors for poor people, incorporating those rising in the sorted out segment.

Correspondingly, the Deendayal Antodaya Yojana [DAY] National Urban Livelihood Mission is another program that is planned for diminishing Urban neediness through the production of smaller-scale ventures, independently and bunch mode.

MUDRA, being an activity for advancing smaller-scale ventures, would try all endeavors to draw cooperative energies between NRLM, NULM and MUDRA intercessions for supporting minor undertakings and making practical business open doors for poor people.

The MUDRA Pricing

Access to finance is important and similarly important is the expense of account to the NCSB/extreme recipient. The assets activated by smaller-scale units from the casual sources are at a mind-boggling expense. There is an extension for cost defense. Nonetheless, the justification is unpredictably connected with the expense of assets for the last mile MFIs.

GOI while reporting the development of MUDRA likewise declared a refinance corpus for MUDRA to be distributed by RBI from the Priority Sector loaning deficiency. In like manner, RBI has given the distribution which aids in cutting down the expense of loaning at a definitive borrower level as MUDRA refinance will lessen the normal acquiring cost of the loaning organizations.

The NBFC-MFIs are by and by directed by Reserve Bank of India and RBI has officially recommended itemized rules for edge top in regard to MFIs. The edge top has been pegged at 10% for MFIs having a credit arrangement of in excess of 100 crores and 12% for little MFIs having a loan arrangement of under 100 crores or 2.75 occasions the normal base pace of five noteworthy business banks, whichever is less. In the background of these rules and the way that MFI division has been always attempting to decrease its costs, MUDRA would likewise help MFIs lessen their expenses to cut down the general expense to the end recipients. Further, at the hour of examination, MUDRA would ponder/evaluating individual MFIs on this just like other related parameters and appropriately value its help dependent on such appraisal.

On account of Banks, RBI has additionally stimulated on the loan cost at the Base rate/MCLR for loaning small scale units by Commercial Banks by profiting of MUDRA refinance. Likewise, the RRBs have been given an intriguing top of 3.50% well beyond MUDRA refinance rate, while loaning a PMMY loan by benefiting of MUDRA refinance.

If there should be an occurrence of NBFCs, RBI has additionally stipulated an intriguing top of 6% well beyond MUDRA refinance while they’re loaning to MUDRA fragment.

All these are relied upon to positively affect the estimating of MUDRA loans in the nation whereby the Micro endeavors will almost certainly benefit of credit at a moderate financing cost. Be that as it may, above all else goal is to guarantee the availability of credit.

How to apply for MUDRA bank credit?

29 banks are recorded under this plan. As a candidate, you can go to any of these 29 banks and continue further with the procedure.

- Candidates should visit their closest business or private bank

- Set forth your business thought/plan

- Present your appropriately filled credit application structure

- Extra archives to be submitted-Identity confirmation, address evidence, organization address verification, organization character evidence, station authentication, asset reports, IT returns, deals government forms of the most recent three years, and other apparatus details

- Complete every single further convention and methodology by the bank

- Your reports will be confirmed

- Credit will be authorized

Online Application:

You can register online for a Mudra credit by visiting any official site of the 29 banks which are recorded under this plan. These banks are comprehensive of country, open and private segment banks. You can get an online structure from their official sites, too.

You need to fill out a credit application structure, be it for any loan plan. You may download this credit application structure from some random site of the rundown of bank organizations giving the loan. It is exceptionally advantageous to register for the MUDRA loan application on the web since this will dodge the problem and tumult of heading off to the bank, holding up in line and after that securing the credit application structure. Beneath referenced are basic strides to apply for Mudra credit on the web:

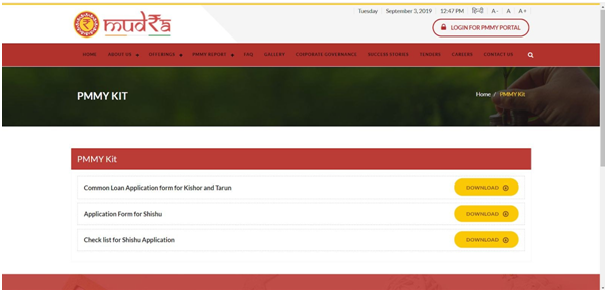

Stage 1: Download the credit application structure from https://www.mudra.org.in/Home/PMMYBankersKit

Stage 2: Fill in the structure details effectively

Stage 3: Find people in general or business area bank

Stage 4: Finish the various customs by the bank

Stage 5: Once this procedure is done, the credit will be endorsed

Sorts of business segments that can profit the MUDRA loan:

- Self-owners

- Organizations

- Administration division firms

- Small-scale enterprises

- Fixing shops

- Proprietors of trucks

- Foodservice organizations

- Merchants (foods grown from the ground)

- Small-scale assembling firms

Documents Required:

- Verification of Identity

- Residency verification

- Hardware stations

- Identification size photos

- Verification of business type

- Evidence of place of work

Here are a few cases wherein you can benefit MUDRA loan:

- Overdraft office

- Dropline overdraft

- Credits for business vans, bikes

- Credits for acquiring apparatus and different assets

- Redesign of workplaces

- Credits required for horticulture-related exercises

Pointers to enable you to fill the credit application structure:

- Each structure will have the name of the kind of the loan referenced at the highest point of the credit application structure. The structure for Shishu loan is unique, while the structure for the Tarun and Kishor credit is the equivalent.

- Fill in completely precise details of the name of the bank and the branch from where you need to get the credit

- Fill your name effectively and obviously

- Fill the details of your parents, whenever inquired

- Fill your contact details. Your present versatile number and address

- Religion and nationality additionally ought to likewise be referenced plainly

- Aadhaar card details to be filled

- Notice the consumption for setting up the business and the normal sum expected to do as such

- Each data of offers made by the organization before, their present deals and their likely deals sooner rather than later

- Give every single appropriate record to help the data given in this structure, this essentially helps the organization in settling on an official choice

- Candidates who go under OBC, SC/ST classifications need to give rank authentications that express the equivalent

- On the off chance that you have connected for a loan before, you have to make reference to the kind of loan, the sum credit, and the loan record details

- Give all your details for verification (Toward the end page of each loan application structure, the whole rundown of the considerable number of reports required for a check is given.)

- Attach two recent photos

MUDRA Loan Repayment Period

Candidates will get the loan sum for a timeframe of 5 years and during these years the candidate should repay the loan in the EMIs decided by the bank. The candidate won’t think that it’s hard to pay the portions since the financing costs are very low.

Along these lines, a MUDRA loan empowers them together develop and build up their business without adding much pressure and bother to their day by day schedule and funds.

List of 29 Banks Under MUDRA Loan Scheme:

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- IndianOverseas Bank

- J&K Bank

- Karnataka Bank

- Kotak Mahindra Bank

- Oriental Bank of Commerce

- Punjab and Sind Bank

- Punjab National Bank

- Saraswat Bank

- State Bank of India

- Syndicate Bank

- Tamilnad Mercantile Bank

- UCO Bank

- Union Bank of India

- United Bank of India

For more information, drop your queries in the comment section and we will get back to you shortly. Stay tuned for similar updates!