Everything You Should Know About National Pension System

Everything You Should Know About National Pension System

Table Of Contents

1. Overview/ What is the National Pension System?

2. Who Should Invest in NPS?

3. How to Open an NPS account?

- Online

- Offline

4. Types of National Pension Scheme Account

5. Features of the National Pension System

6. Pros and Cons of National Pension System

- Pros

- Cons

7. High Geared NPS schemes

8. Documents required for Withdrawal of National Pension System

9. Withdrawal Process of National Pension System

10. Comparing NPS Scheme With Other Tax Savings Instruments

11. How to check NPS Balance Online?

12. National Pension Account for NRI

13. FAQ’s

14. Final Verdict/ Conclusion

Overview/What is National Pension System?

National Pension System (NPS) is a government authorized social security initiative for public, private and also for the unorganized sectors, except for the people who are from armed forces. You can also say that this is one of the best solutions or options for retirement planning. It offers you a good old age income at reasonable market prices. The minimum age of investing in NPS is 18 years, and till 60 years of age, you can make an annual contribution, if you choose to invest in NPS.

National Pension System was earlier known as the New Pension Scheme. NPS motivates many people to invest in pension account when they are employed at regular intervals. Once they retire, they are also allowed to take a partial amount from their collection. The rest of the amount you would receive in installments after you retire. Previously, this scheme only covered Central Government employees but now it is open for all citizens of India, who are between the age of 18-60 and should not have a pre-existing NPS account. There is just one condition before applying for NPS that a person should comply with KYC norms.

NPS is considered to be the most affordable retirement plan out of all retirement plans such as compared to all of them including PPF, EPF, FD’s and Mutual Funds.

Who Should Invest in NPS?

You can avail of a deduction of 1,50,000 rupees and an additional benefit of 50,000 rupees under section 80C and section 80CCD. Anyone having a low-risk appetite and who are planning for their retirement early should doubtlessly invest in NPS. It will turn out to be a boon at the time you are retired and you will be getting a regular pension (Income). This scheme is the best for people who are working in the private sector and wish to have a persistent pension after retirement.

Organized and systematic investments on these options could make a huge difference to your financial situation post-retirement. However, employees earning a decent salary who wants to take the benefit of deductions under section 80C, also get allured by this scheme.

How to Open an NPS account?

There are two ways through which you can open an NPS account which is online and offline mode.

Online-

It has become effortless for the individuals who open an NPS account online as it saves a lot of time, and energy. You just need to have an Aadhar, PAN and bank account, then you need to visit any of these 2 websites which are https://enps.nsdl.com/eNPS/NationalPensionSystem.html or https://enps.karvy.com/. These are the CRA’s (Central Record Keeping Agencies) portals in the NPS. The Aadhar, PAN and bank account must be linked with the NPS account. At the time of registration and in order to complete the validation process, an OTP will be sent to the individual’s registered mobile number. You will receive a PRAN (Permanent Retirement Account Number) that you can use further to log in to the portal.

Offline-

If you are considering doing it offline, you will need to visit the bank, post office or the Point of Presence (PoP) center to open an NPS account. Along with KYC documents, the application form must be submitted by the individuals. At the time of making payment of a one-time registration fee of 125 rupees, you will receive the kit along with the PRAN. The kit will contain the password mentioning all login instructions. These details will enable an individual to operate the account.

Types of National Pension Scheme Account

There are 2 primary accounts under NPS which are termed as Tier-I account and Tier-II account. The first one is the default or mandatory account and the second account is a voluntary addition. Here are the details in brief of both the accounts-

Note: Central government employees have to contribute 10% of their basic salary towards the contribution amount to the NPS account. And the NPS scheme is entirely optional for all the citizens of India.

Features of the National Pension System

- Eligibility- All the Indian citizens between 18 to 65 years of age are eligible to invest in this scheme. There is one condition that the individual should not come under any NPS sector.

- Cost of registration- An individual needs to pay 500 rupees at the time of registering an NPS account

- The number Of contributors- The subscribers must make at least one contributor in a year.

- Operating NPS account- All the subscribers are given 12 digits unique identification number which is called PRAN through which individuals operate NPS account

- Offerings to the NRI- NPS offers 2 types of options of the NRI-i) Active choice- The NRI investors have an option to choose the ratio of investment and asset classes.

ii) Auto choice- The investment is done on behalf of the NRI investors, which is based on the age of the investor. - Flexible- It is highly diversified and gives numerous options to the investors to choose the ratio of funds while it is allotted across distinctive investment options such as corporate bonds, government securities, equities, etc. Up to 85% of the funds can be diverted to any of these investment options

- Change of Scheme and Fund Manager- In case, an individual already subscribed for NPS is not content with the comprehensive performance of the scheme, they are even allowed to change the scheme or the fund manager.

- Mode of Payment- An individual can make a payment in the form of a cheque, demand draft, cash, debit or credit cards, and net banking.

Note: While making the investment contribution online towards your NPS scheme, always ensure it’s done through net banking using payment gateways such as e-pay or BillDesk. This will avoid incurring additional charges which will be incurred at the time of making payment through debit or credit cards of around 0.5% by your bank.

Pros and Cons of National Pension System

Pros

There are many advantages that an individual can reap out of the NPS scheme. Some of the predominant perks are as follows-

- Risk assessment- It consists of a cap ranging from 50% to 75% on equity exposure for the NPS scheme. For an individual of more than 60 years of age, this cap is fixed at 50% which stabilizes the risk-return equation for them. If we compare it with EPF and PPF, NPS is the best as it provides much more flexibility in terms of equity exposure. Whereas, PPF and EPF comprehensively refrain from investing in stocks.

- Interests/Returns- While a portion of NPS goes to equities which are not assured to provide returns. Although, it offers much higher returns as compared to the other traditional investment schemes such as PPF. NPS schemes deliver 9% to 10% of the annualized returns.

- Additional Tax benefit- In 2011, an individual can avail tax exemption on dearness allowance (DA) and contribution of up to 10% of basic salary towards the NPS scheme under Section 80CCE. However, it is only applicable if the contribution is done by the employer and it is above 1 lakhs rupees limit. This benefit of tax entices many corporate houses to opt for NPS.

Cons

Some of the major disadvantages of the NPS scheme are listed below-

- Low on equity- It signifies a loss for the individual’s in their late 20’s and early 30’s, as equity shows to offer 14% to 15% returns but they are restricted to have more than 50% exposure to equity.

- Tax on Maturity- There is a complexity about taxation at the time of withdrawal. A subscriber cannot withdraw the entire corpus of NPS after their retirement. You can withdraw up to 60% on maturity while the remaining 40% has to be used to buy an annuity from PFRDA-registered insurance firm. The worst part about it is that the returns you get from this annuity will not be tax-free.

High Geared NPS schemes

All NPS schemes cannot have a fixed interest rate as it is market-linked. The contribution made towards NPS account can be invested in any of these 4 classes which are equities, government bonds, corporate bonds, and alternative assets. Listed below are some top-performing NPS schemes considering all aspects-

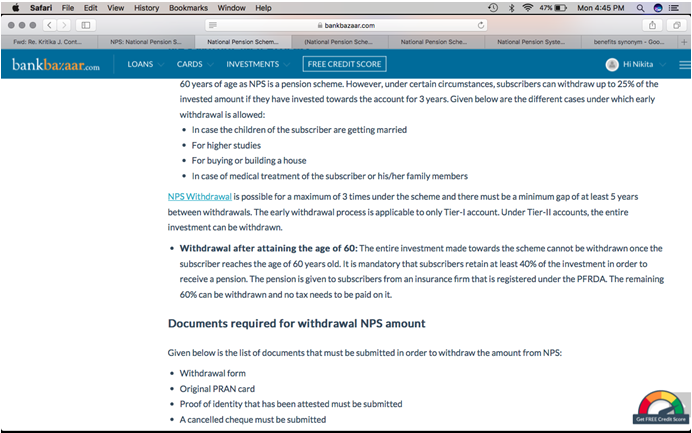

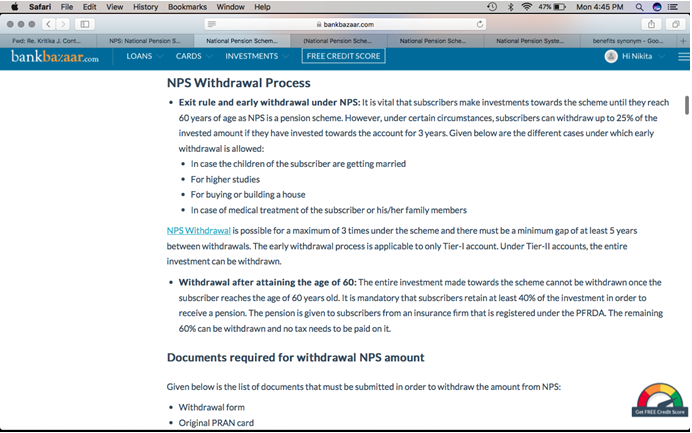

Documents required for Withdrawal of National Pension System

At the time of withdrawal of the amount from NPS scheme, you need the list of following documents-

- NPS withdrawal Form

- Original PRAN card

- Proof of identity

- Canceled cheque to confirm your bank details

Withdrawal Process of National Pension System

Some significant aspects regarding the withdrawal process that should always be considered before investing into the NPS scheme are listed below-

- In the case of the Tier-I account, you can partially withdraw up to 3 times during the entire tenure of the NPS account and that too with the gap of 5 years. Whereas, in the case of the Tier-II account, you are allowed to withdraw the entire investment.

- The entire investment that is attained when you become 60 years old cannot be withdrawn in one go. It is mandatory to retain at least 40% of the amount in order to receive a pension. The remaining 60% can be withdrawn which is totally tax exempted.

- Somehow, you are allowed for early withdrawals in the NPS scheme. It is elementary to invest until you reach 60 years of age. But you can withdraw up to 25% of the invested amount for certain crucial purposes or emergencies if you have already been investing for 3 years. The purposes for which you are allowed to withdraw this amount are buying a house or medical treatment of someone in the family or yourself, and a child’s wedding or higher studies. In the entire tenure, you are allowed to make a withdrawal up to 3 times, but only with a gap of 5 years.

Comparing NPS Scheme With Other Tax Savings Instruments

The traditional tax savings investment options under Section 80C are Fixed Deposits (FD), Equity Linked Savings Scheme (ELSS), and Public Provident Fund (PPF). Let’s compare these investment schemes with National Pension Schemes (NPS) below-

Although NPS can earn a higher return or interest as compared to PPF’s and FD’s, it is not that tax-efficient upon maturity as FD and PPF are. We have already discussed in (6.2), that why is it not that tax-efficient at the time of maturity.

How to check NPS Balance Online?

Now it has become very easy to check your NPS balance within a few minutes online. You need to follow these steps to check the current value-

- Once you have opened the browser, you need to visit the NSDL website’s login page

- At the time of NPS registration, you would have got a PRAN number and a password linked with it. You need to enter the PRAN number as your user id and the same password to log in to your NPS account

- Once you are logged in to the website, you will see a tab termed as ‘Transaction Statement’

- You will get 2 options from the drop-down menu. You can get both the statements that are the ‘transaction statement’ as well as ‘holding statement’

National Pension Account for NRI

Even NRI’s (Non-Residential Indians) can opt for the NPS scheme and reap out the benefits from NPS accounts. The primary aim of the government behind launching the NPS scheme is to ensure the financial security of an individual once they are retired. Listed below is the eligibility criteria for NRI’s if they want to open an NPS account-

- The individual must complete their KYC forms

- The individual must be between 18 years to 60 years of age

- OCI’s and PIO’s are not eligible

- Either NRE or NRO account ought to be used to make the investment contribution towards NPS account

FAQ’s

Q1) Can I exit early from NPS?

Q2) Does Tier-II allow partial withdrawals?

Q3) Can I have two National Pension Scheme account?

Q4) What is the reason behind keeping the minimum balance of 40% of the total investment contribution to buy annuities after retirement?

Q5) What is the name of the body who is responsible for the calculation of the total or partial interest towards the NPS scheme?

Q6) What needs to be done when I face any problem with my NPS account?

Q7) What are the different modes of payment by which we can pay for the NPS premium payments?

Q8) Is there any app for NPS? And if there is, what are its features?

Q9) Who shall receive the investment contribution benefits if the subscriber dies before the age of 60?

Q10) Who provides annuity on maturity or withdrawal under NPS?

Final Verdict/ Conclusion

Only after considering and scrutinizing all the facts elaborated above about NPS scheme, one should invest in NPS. If it matches your investment goal and risk profile, you should proceed in investing NPS scheme. However, if you are open to equity exposure, you may also go for mutual funds. We understand it could be a tedious journey for someone to do legitimate research in all the options, shortlist out of them, and then finalizing the one out of the shortlisted options. We have provided all the vital information that anyone would need to know before and after investing in NPS. Always remember, it is never too late to invest!