Important Points Regarding EPF In India

Important Points Regarding EPF In India

What is EPF?

How is the EPF amount collected?

Is EPF mandatory?

Tax Benefits under EPF

Withdrawal from PF Account

Partial Withdrawal

Full Withdrawal

Applicable Taxes

Forms Required

Other Documents Required

Withdrawal from EPF without Employer’s Approval

What is the EPFO Digital Signature and what is its use?

How to Lodge a complaint with the EPFO

What is UAN?

Documents required to obtain UAN

How to Obtain and Activate your UAN online?

Benefits of UAN

What is the E-Nomination of EPF?

What is the Difference between EPF and EPS?

Some things to note about EPS

What is EPS Scheme Certificate?

Withdrawal of EPS balance and claim of pension

How to transfer EPF online

The Employees’ Provident Fund is a scheme launched by Govt. of India and maintained by the Employees’ Provident Fund Organisation (EPFO) under The Employees Provident Funds and Miscellaneous Provisions Act, 1952. In this article, we give you an overview of the EPF scheme and discuss the most important questions linked to EPF so that you can avail this facility to secure yourself and your family in your future. You can visit our EPF help product page to purchase all assistance in regards to EPFO in regards to your organization.

What is EPF?

Employees’ Provident Fund (EPF) is a social security retirement benefit scheme which is available to all salaried employees in India. The EPF scheme is administered and maintained by the Employees Provident Fund Organisation of India (EPFO). Any organization with more than 20 employees must mandatorily register with the EPFO to provide EPF facility.

All funds in the Employees’ Provident Fund are pooled together which is invested in a Trust that generates an annual interest of about 8 to 12% as mandated by the Government and the EPFO Board of Trustees. The present rate of interest for the financial year 2019 – 19 is 8.65% p.a.

EPF is linked to you and not your employer, thus it is important to update your EPF information in case you change jobs to that your EPF Account continues to receive contributions. The corpus collected is provided as a lump sum amount to the employee after retirement for financial security.

How is the EPF amount collected?

The corpus is collected by deducting a small portion of the salary of the employee every month along with some contribution from the employer also. 12% of your salary every month is deducted from your salary towards EPF contribution. Your employer further contributes equal to 12% of your salary, but out of that only 3.67% goes towards the EPF contribution. The rest of the 8.33% is contributed towards the Employees’ Pension Scheme (EPS).

Is EPF mandatory?

For all employees earning Rs. 15,000 (including basic salary plus dearness allowance), contribution towards EPF is mandatory. Employees earning above Rs. 15,000 may voluntarily contribute towards EPF but there is no stipulation for such.

Tax Benefits under EPF

You are eligible for Income Tax Deductions for your EPF contributions under Section 80C of the Income Tax Act, of up to Rs. 1.5 Lakhs per annum. Further, the lump sum invested in your EPF. can be withdrawn totally exempt from Income Tax after a mandatory period of at least 5 years.

Withdrawal from PF Account

The lumpsum payment under the EPF Scheme can only be accessed fully after retirement. However, you can request for partial withdrawal for major family reasons like ill-health of a family member, repayment of home loan, construction of a house, marriage purposes, education purposes, etc., and full-settlement and clearance from your EPF Account for reasons like discontinuation of business of the employer, settlement abroad, etc.

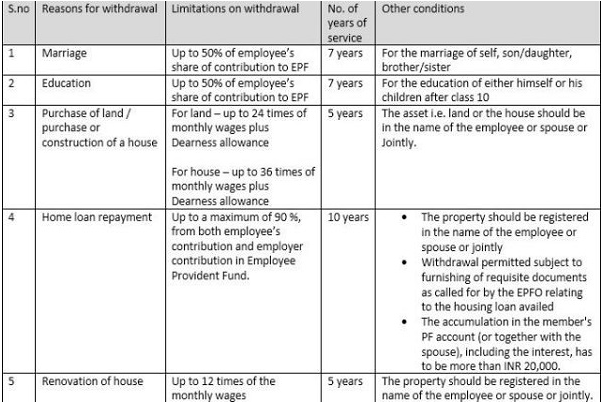

Partial Withdrawal

For partial withdrawal from EPF Account for the reasons such as marriage and education, the employee must have completed 7 years of service. Further, only 50% of the EPF balance is allowed to be withdrawn. For purchase of land or construction of a home, there must have been a minimum period of at least 5 years of service, and the maximum withdrawal limit is 24 times the employee’s last monthly wages for purchase of land and 36 times the wages for construction of a house. The withdrawal for repayment of home loan, a minimum of 10 years of service must have been completed, and the withdrawal limit is 36 times the salary. For major renovations to your home, a minimum of 10 years of service is required and maximum 12 times of the monthly salary can be withdrawn.

Withdrawal from EPF account is permissible for up to three times after completion of service.

Full Withdrawal

The retirement age according to the EPF Rules is 58 years. But you can withdraw 90% of the funds when you turn 57 years of age. Complete withdrawal of the EPF funds is also possible in case of unemployment for more than 2 months. But the fact of unemployment if more than 2 months has to be certified by a gazetted officer.

Applicable Taxes

For a service period of fewer than 5 years, TDS shall be deducted at 10% if the EPF account is linked with PAN, if not then the rate of TDS shall be 34.6%. If the balance is less than 50,000 however, then no TDS shall be deducted.

Forms Required

For withdrawal from your EPF Account, you need to submit a request in Form 11. If you do not have a UAN No., then the withdrawal request has to be submitted in Form 19. Please note, that the UAN scheme has been made mandatory since 2014, and only employees who have made contributions before 2014 can utilize Form 19. However, we highly recommend that you register for allotment of UAN No. as soon as possible.

Other Documents Required

All withdrawal forms and documents have to be submitted to the regional EPFO office. The following are the required documents (as applicable according to the reason for withdrawal).

- Employer’s Acknowledgment for withdrawal

- Loan Documents of the house

- Registration Documents of the house/ Sale Agreement

- Doctor’s Certificate

- Employer’s Certificate that the concerned family member is not covered under the EPF/ESIC facility

- Marriage Invitation Card

Withdrawal from EPF without Employer’s Approval

Often times due to adverse situations and circumstances at work or otherwise, an employee is unable to ask for the employer’s approval or procure his signature before making a withdrawal from his EFP account. Moreover, sometimes employers may reject the claim as an arm twisting power move. This difficulty has been recognized by the EPFO, and since 2017 you can now withdraw from your EPF balance without employer’s approval provided that your UAN and Adhaar info has been linked. You can use Forms 19UAN, 10C UAN, and 31 UAN (as applicable).

What is the EPFO Digital Signature and what is its use?

When an employee changes his job he has to update his EPFO portfolio by notifying the EPFO about the change in his employment. This claim of transfer must be attested by at least his new employer or the previous one. Under the old scheme, the employee needed to submit a copy of Form 13 duly signed by the previous employer and deposit it at the EPFO office.

However, to make this process transparent, easy and digitized, the EPFO has introduced the Digitial Signature Scheme. Employers now have to file a transfer request using a Class 2 or higher digital signature which allows the EPFO to verify the entire process a lot quicker online and with accessible records by all the stakeholders. Using digital signatures has been made mandatory for employers with less than 1,000 employees on the payroll. However, even in the case of employers with more than 1000 employees, the regional offices of the EPFO have been instructed to take maximum efforts possible to get the maximum amount of registrations.

Digital signatures can be purchased for any licensed Certifying Authorities (CA) who have been granted a license by the Govt. to issue Class 2 and Class 3 digital certificates under the Information Technology Act. For a list of all licensed Certifying Authorities click here.

To obtain a digital signature You will need a (1) Valid Identity Proof such as Passport, PAN Card, Driving License, Post Office ID, Bank A/C Passbook containing photograph and attested by Bank Official, etc.; and (2) Valid Address Proof such as ADHAAR Card, Voter ID, Driving License, Water Bill or Electricity Bill (not older than 3 months), Latest Bank Statements (attested by Bank Official), Indirect Tax Registration Certificate, Property Tax Receipts, etc.

How to Lodge a complaint with the EPFO

Employees usually face troubles with their employer in regards to withdrawals from EPF, transfer of EPF Account in event of a job change, settlement of EPF Account and pension and more. However, the good news is the EPFO is very responsive to complaints and has a very cell to help with grievances. Recently the EPFO has completely overhauled the entire grievance architecture. Now the grievance portal has modern features like –

- Online grievance lodging linked UAN integrated to master database online

- OTP Verification

- Lodge multiple grievances for multiple PF accounts linked to one UAN

- PPO number validation/integration (for EPS pensioners) with a centralized database of EPFO

- Reminders for pending grievance

- Check the current status of grievance

- Provide feedback on grievance redressal

- Upload more than one document for each grievance

- Comprehensive categorization of grievances

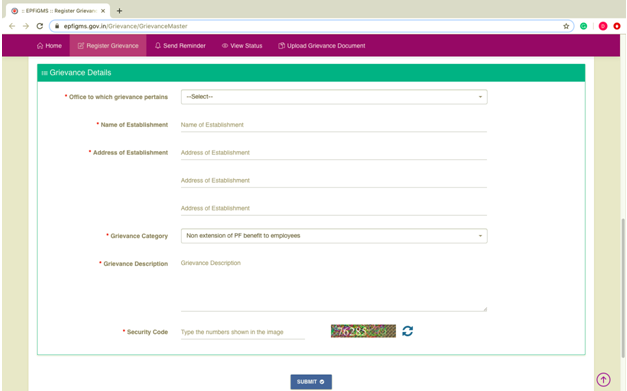

Here is a step by step tutorial on how to register a complaint online with the EPFO portal –

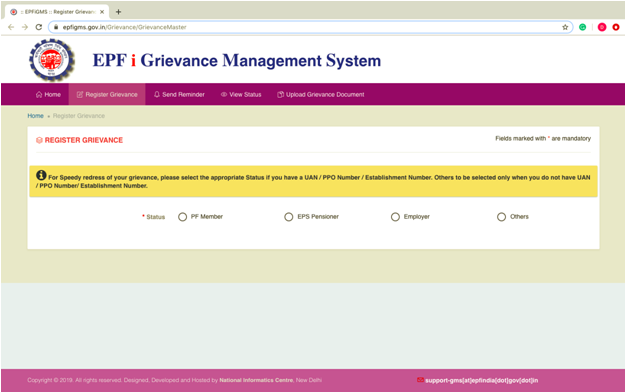

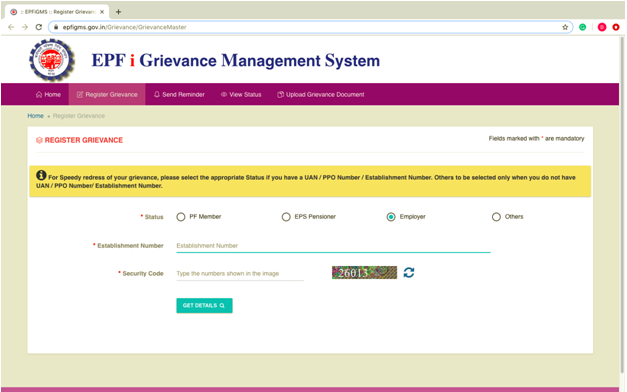

- STEP – 1

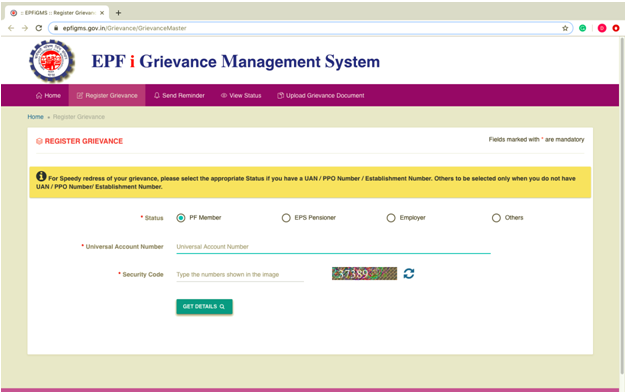

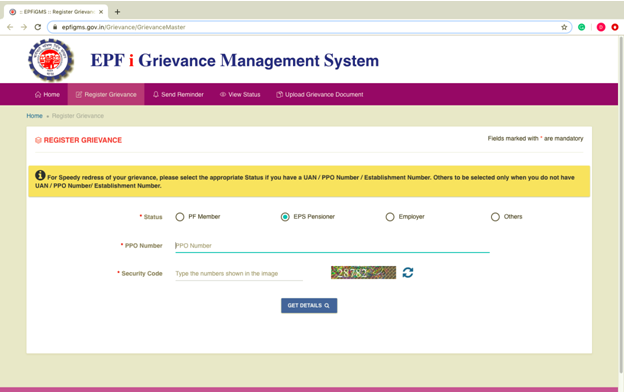

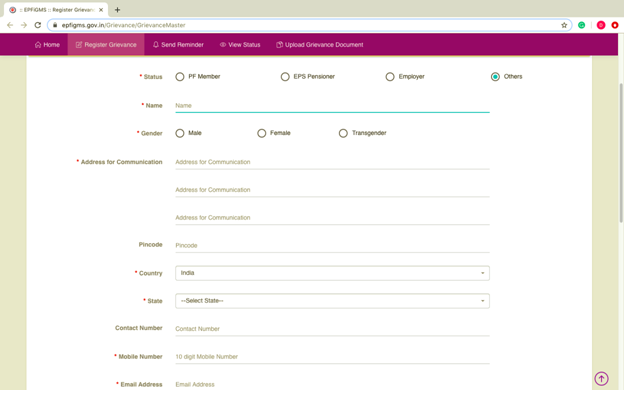

Visit the EPFO grievance portal at https://epfigms.gov.in/Grievance/GrievanceMaster and select your category out of PF member, EPS Pensioner, Employer or “other”.

Enter your relevant information and the security CAPTCHA UAN No. if you are an “Employee”;

PPO No. if you are an “EPS Pensioner”;

Establishment No. if you are an “Employer”;

Or, all details in case of “Others”.

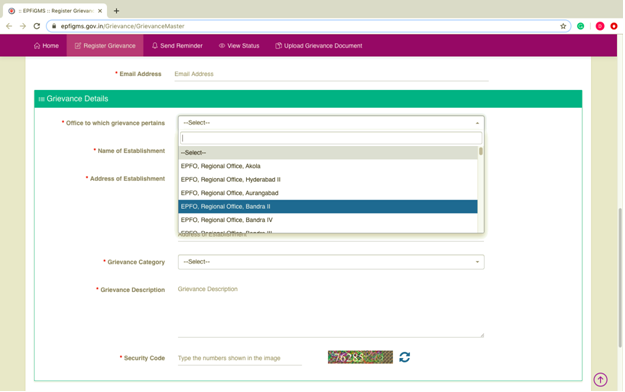

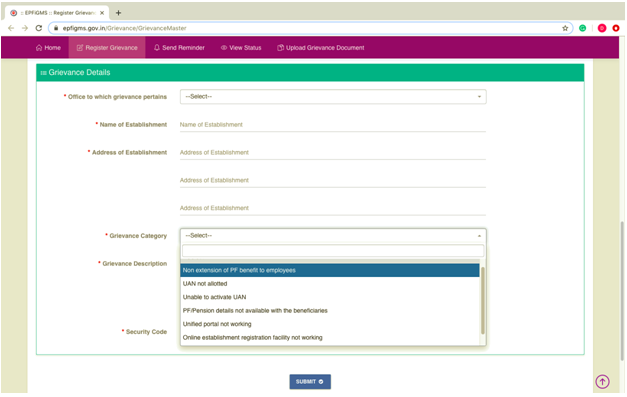

- STEP – 2

Select the EPFO office that has territorial jurisdiction over the grievance from the drop-down list

Select the grievance category from the drop-down list

Enter other details like the address of the establishment, full description of the grievance, etc., type in the security code CAPTCHA and click the “submit” button at the bottom of the screen.

After the grievance has been registered in the database, a unique registration no. and acknowledgment is generated automatically by the system and notified by SMS or email.

What is UAN?

The Universal Account Number (UAN) facility has created by the EPFO to provide better tracking and ease of use of EPF by employees. It is a 12 digit account number that remains constant regardless of the number of jobs changed by the employee. Every time a new job change is registered on the EPFO website, a new member Identification No. (ID) is allocated which is then linked to the UAN. Using the UAN, an employee can bring all his past and current EPF accounts under one UAN. The UAN scheme has also done away with the need for employer approval to make a withdrawal from the EPF account.

Documents required to obtain UAN

- Bank account info – account number, IFSC code, branch name.

- Identity Proof – Any photo ID issued by the Govt. likePassport, Aadhaar Card, Driving License, Voter ID, etc.

- Address Proof: Recent utility bill in your name, rental/lease agreement, ration card or any of the ID proof mentioned above if it has your current address

- PAN card e linked to UAN

- Aadhaar Card linked to a bank account and mobile number, it is mandatory.

- ESIC card

How to Obtain and Activate your UAN online?

Usually, your employer will provide you with a UAN which will be printed on your salary slip too. However, you can also obtain a UAN yourself. Below is a detailed guide on how to obtain UAN yourself –

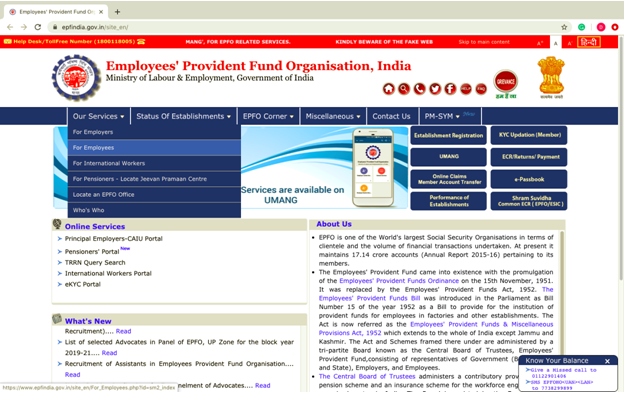

- STEP – 1

Go to the EPFO portal homepage at https://www.epfindia.gov.in/site_en/, hover to the “OUR SERVICES TAB” and click on “For Employees” as shown below.

- STEP 2

Click “Member UAN/Online Service (OCS/OTCP)”.

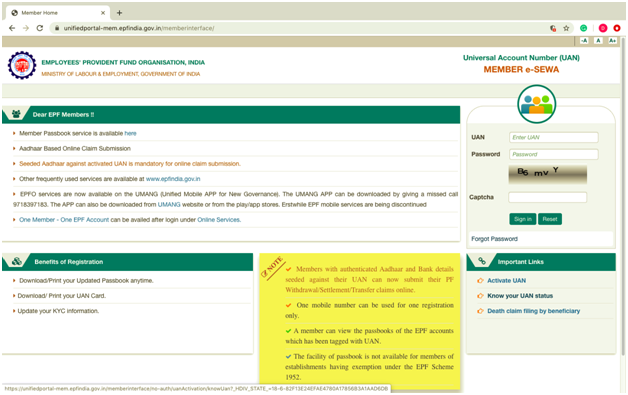

- STEP 3

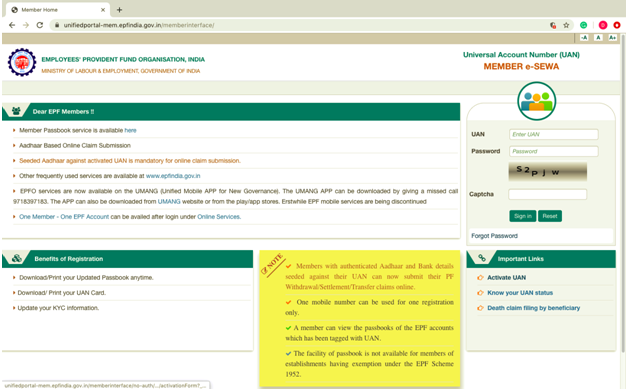

Click on “Know your UAN status” from the “Important Links” section at the bottom right-hand corner of the screen as shown below.

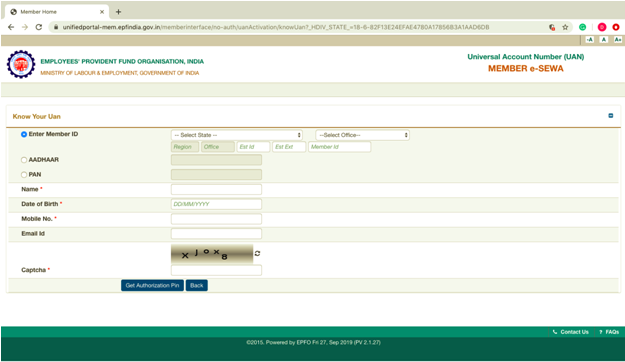

- STEP 4

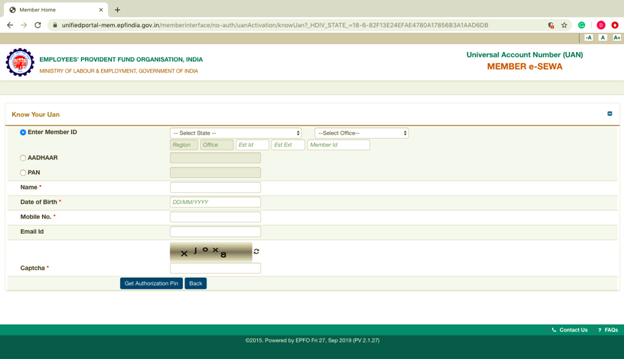

Select the State in which you are working, enter the EPFO office branch which has jurisdiction, and all other details like your EPF no./member ID, DOB, name, mobile no.

You can look for the PF number/member ID in your salary slip.

Finally enter the CAPTCHA code, and enter the tab ‘Get Authorization Pin’.

You will receive a PIN on your mobile number. Enter the PIN and click on ‘Validate OTP and get UAN’ button. Your Universal Account Number will be sent to your mobile number.

You will now need to activate the UAN you have received by following the previous steps

- STEP 5

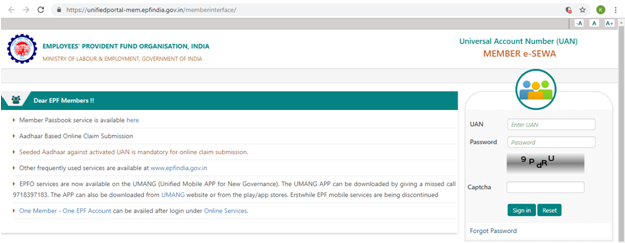

Go the UAN Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and click on Click on “Activate UAN” from the “Important Links” section at the bottom right-hand corner of the screen as shown below.

- STEP 6

Enter your UAN, registered mobile no. and EPF member ID. Enter the captcha characters. Click on the ‘Get authorization PIN’ button. The PIN will be sent to your registered mobile number.

Next Click “I Agree”. Then enter the OTP received on your registered no. Then click “Validate OTP and Activate UAN”.

When your UAN is activated, a password will be sent to your registered mobile no. You can use this password to access your account.

Benefits of UAN

- There is no need for the employee to keep track of multiple EPF accounts. All PF accounts can now be tracked on one UAN in case of multiple job changes

- Reduces the burden on the EPFO in regards to verification of multiple verifications of employees from employers each time there is a job change. There is no need for EPFO to rely on employers to verify the KYC of employees.

- The employee can easily track their EPF Account, check balance regularly, check contributions and generally manage their EPF account online through the EPFO member login portal or the UMANG mobile App.

- The Employee can get their EPF Account statement through an SMS at the registered mobile number anytime they want.

- Employees can now withdraw money from their EPF Accounts with the approval of the employer, which prevents instances of employers deliberately withholding such approval as strong-arm tactics to exert power over the employee.

- Increased transparency – the employee can now check anytime if their EPF Account is being duly credited by the employer.

What is the E-Nomination of EPF?

The EPFO via a circular dated Sept. 2019 extended the facility of inducting a nominee into your EPF account available online by logging into the EPFO member Sewa Portal. As per the EPF Rules, the family members of a member can be named as nominees, and individuals who do not have a family can name anyone as a nominee. For males, “family” includes spouse, children, dependent parents, son’s widow, and their children. For females, family means, husband, children, dependent parents, husband’s dependent parents, son’s widow and their children. However, it is important to note that once you get married, your nomination automatically becomes invalid and you need to make a fresh nomination. If there is no nomination given, then the entire balance shall be over to members of the family including retired parents and excluding sons who have attained majority.

What is the Difference between EPF and EPS?

Employees’ Pension Scheme (EPS) is a sub-scheme under the Employees’ Provident Fund and Miscellaneous Provisions Act. While EPF pays you a lump sum along with interest at retirement, benefits under the Employees’ Pension Scheme (EPS) are doled out on a monthly basis and are survived by you to secure your widow(er) and children also.

Employees are not allowed to contribute to the EPS directly. Out of the 12% of your salary amount matched by your employer, 8.33% goes towards contribution to the Employee Pension Scheme (EPS), subject to a maximum contribution up to Rs. 1,250, the rest of which is redirected towards the EPF Account.Up to a salary of Rs. 15,000 EPS scheme has been made mandatory, and voluntary beyond that.

Some things to note about EPS

- The employee shall start receiving benefits once the age of 58 years has been attained and he has also completed 10 years of service.

- The employee must be a member of the EPFO to start receiving benefits.

- The employee will receive an additional 4% pension every month if he chooses to defer the start of the benefits to 60 years.

- The employee has an option to start pension payments at 50 years, after completing a service period of 10 years, but then 4% shall be deducted for each year short of 58, from the ordinary monthly payment receivable after 58 years.

- The employer can stop making contributions when the employee attains the age of 50 years.

- The maximum period of service calculated for EPF is 35 years.

- One employee cannot receive more than 1 EPS pension.

- No interest is applied to the EPS corpus.

What is EPS Scheme Certificate?

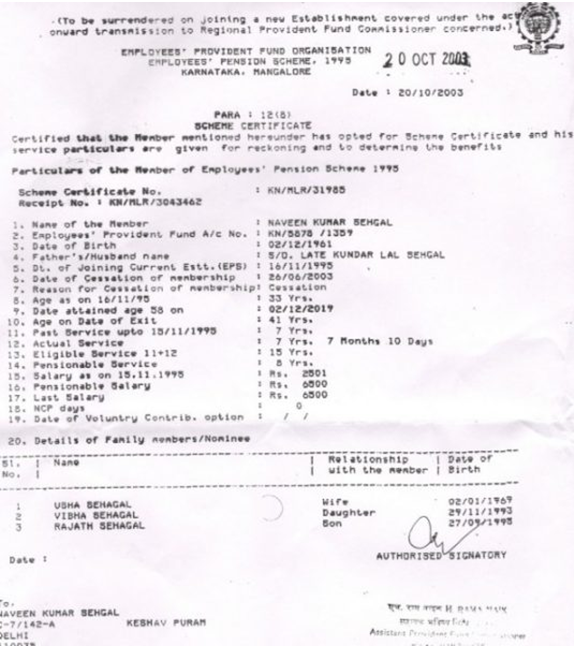

EPS Scheme Certificate is an authentic record of service who notes the length of the service of the employee and family details of the employee who is eligible to get benefits after his death.

You can claim a Scheme Certificate under Form 10C. When joining a new job, you can submit your Scheme Certificate to your new employer to add your past service record with your new EPS Account with the new employer (under the same UAN).

Here is a specimen Scheme Certificate.

Withdrawal of EPS balance and claim of pension

For monthly pension after retirement, you need to submit a claim to the EPFO Office in Form 10D. Withdrawal of the full EPS amount is possible in case of quitting a job, only if you have not completed 10 years of service. If 10 years have been completed, then only Scheme Certificate can be issued, but you may opt for a reduced pension after 50 years of age. Withdrawal of EPS amount and application for Scheme Certificate is done by Form 10C.

How to transfer EPF online

You need to transfer your EPF when you change jobs. Previously, a hard copy of Form 13 needed to be submitted to the employer along with Scheme Certificate, after taking approval from the previous employer, which could be difficult if your didn’t have cordial relations with the previous employer at the time of leaving the job. Now the process has been simplified online. Here is what you need to do to transfer your EPF online.

- STEP 1

Log in to the EPFO member portal online at https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- STEP 2

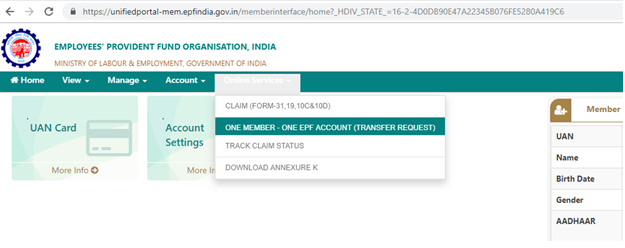

Go to “Online Services” and click “ One Member – One EPF Account (Transfer Request)”.

- STEP 3

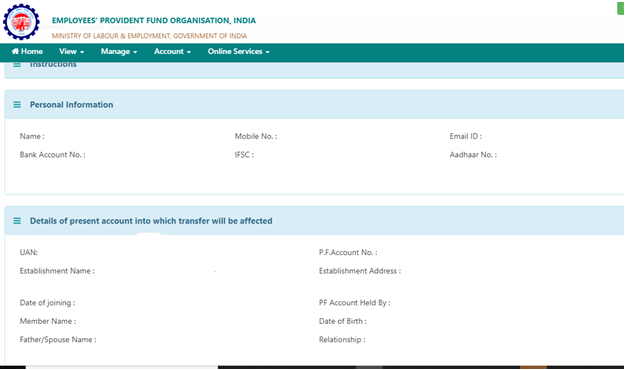

Enter the personal information and EPF account details to which you want to transfer funds to.

- STEP 4

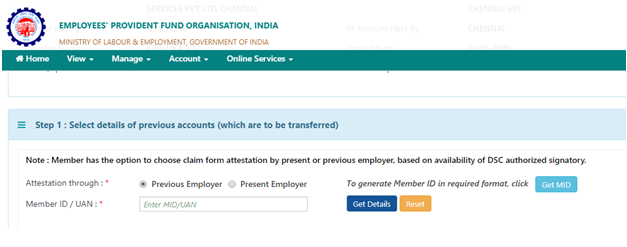

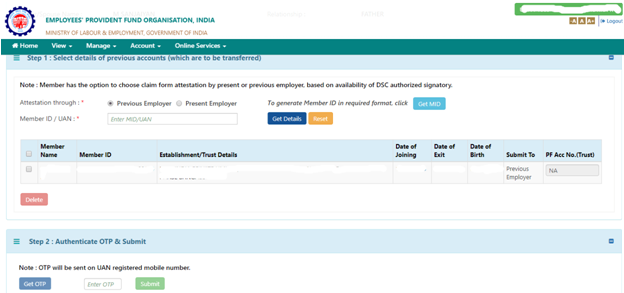

Click “Get Details” to obtain account info of previous employment. Then select “Previous Employer” and fill in previous employment member ID or UAN to obtain details.

- STEP 5

Check whether the correct info of previous employment is displayed. Then click on “Get OTP” which will be sent to the mobile number registered with your UAN. Enter the OTP received and click “submit”.

Know more about GST Suvidha Kendra services & their process.