GSP ( GST Suvidha Provider ) – Complete Understanding

GSP ( GST Suvidha Provider ) – Complete Understanding

What is GSP?

The implementation of the goods has a service tax regime in India that has been done with the thought of Digital India firmly in mind. The GST collection system is designed in such a way that it requires a digital platform for returns to be filed by the taxpayers. This can be via the direct Government to Business (G2B) software built by the government, but due to limited funds and low expertise, the software is a little cumbersome and difficult to maintain. Consequently, the Govt. has licensed design and implementation of this GST interactive software to private parties who are called GST Suvidha Provider (GSP).

GSPs have the job of creating interactive and easy to use software to enable the ultimate taxpayer to interact with the GST ecosystem in an easy to use way. Ease of use is one of the most fundamental concerns to consider when one of the ultimate goals is to increase the number of taxpayers in the Country.

Why GSP was needed?

Two of the central objectives of the introduction of the GST are to reduce tax evasion, increase transparency and in the long term increase the taxpayer base. To this end, the Govt. has injected some modern features into the GST system such as monthly tax filings, digital record keeping, and digital verification of all invoices in a step by step manner. The tax filing process in GST is divided into several systematic steps to authenticate and verify the information. This requires the development of a large capacity system which is expensive.

Some of the compliances required to be performed while filing GST returns each month include –

- Uploading the data of all the invoices of the taxpayer’s business,

- Uploading GSTR 1 generated based on invoice data supplied earlier,

- Downloading Draft GSTR 2 from the GST Portal which contains data on inward supplies (purchases and receipts) data which has been generated by the System based on submitted GSTR 1,

- Match the list of purchases received from the GST Portal to actual purchases of the business. Then finalize it and upload Finalised GSTR 2.

- File the GSTR 3 which has been created by the system based on GSTR 2 and GSTR 1

Further, the G2B cannot be flexible enough to accommodate the specific requirements of different kinds of taxpayers like SMEs, Large Enterprises, Small retail vendors, Self-employed Freelancers, etc. Such an extensive system is required to check corruption and increase transparency, but it is very expensive and difficult to manage for the Govt. on its own. This is why it has contracted other private entities as GSPs to share the burden of managing the GST infrastructure with the Govt.

Role of GSP in GSTN?

It is important to note that the taxpayer will not be able to connect to the Govt. GST network directly, as it is not available online for security purposes. They can only connect through the official Govt. sponsored G2B application or more commonly, by applications developed by private licensed GSPs.

Every GSP will be provided with a unique license key from the Govt. for authorization purposes. A GSP also has the license to generate more sub-keys. These sub-keys can be provided to third party business partners called GST Suvidha Kendras (GSK), which grants controlled access to the GST APIs. Being a GSK is actually one of the best business opportunities right now as the GST ecosystem is still nascent and the tax base is growing.

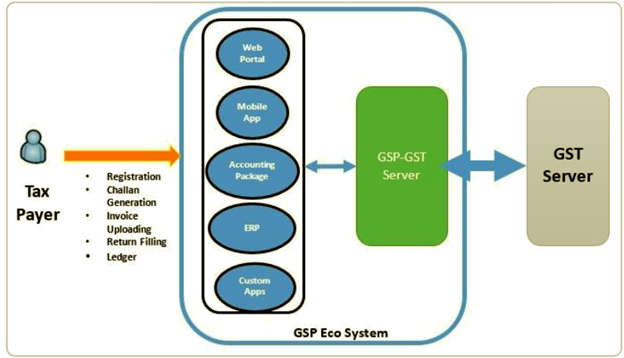

What is GSP Ecosystem?

As mentioned before due to security concerns, the GST Network will not be available over the internet, all individuals must use a software platform provided by a licensed GSP to file their returns. The GSP Software ecosystem consists of Web Portal, Software, Apps, Accounting & ERP software, etc., developed by the GSP. It is a buffer between the taxpayer and the central GST server maintained by the Govt. The taxpayers upload their data first to the servers maintained by the GSP, which is then securely uploaded and transferred with the central GST server.

The GSPs use secure APIs procured from the govt. to build interactive and easy to use applications for the taxpayer to use. The APIs may be based on RESTful, JSON-based and stateless. The production API endpoints can only be consumed via MPLS lines. This will ensure that there is no single point of failure. All APIs will be accessed over the HTTPS protocol.

The integration of API will allow for multiple benefits like:

- A unified interface across PCs, mobiles, and tablets.

- Automation of uploading and downloading of data.

- Agility to change algorithm with the frequently changing taxes and corporate law regulations.

- Ability to integrate with software used by taxpayer businesses such as accounting systems and ERP.

What is ASP?

A GSP’s role is limited to being a secure and Govt. authorized access point for tax-payer data to interact with the Goods and Services Tax Network (GSTN) server. However, the software responsible for the entire interaction of the taxpayers and the upload of their purchase and sales invoices will be made by the Application Service Provider. The ASP’s primary duty is software development, implementation, and coordination with the taxpayers and the GSP.

As a software developer, the ASP has to develop interactive software and Apps, capable of enabling the end-user taxpayer and Agents to upload invoices and verify the information to file a return. The software will categorize and update the invoice data uploaded by the taxpayer by connecting with the GSP system. The GSP will then link the data through secure authorized and licensed APIs. A GSP may decide to dually function as an ASP also, or it can authorize another company to act as an ASP.

Role of ASP?

The role of an ASP is to take raw customer business data on sales and purchases and convert it into a GST returns format.

Services provided by ASP include

- Compilation of invoice data from individual business units.

- Uploading the sales register and supply in form of GSTR 1 within 10 days at the end of the month automatically.

- Downloading inward purchase receipts as DRAFT GSTR 2 generated by the system based on GSTR 1, filled by corresponding suppliers.

- Cross-matching purchases recorded in the books of business with the DRAFT GSTR 2. Then uploading the final GSTR 2.

- Generating GSTR 3 bases on GSTR 1 and 2.

If all this had to be done manually by a business, it would have required a huge amount of manpower and an equally impressive chunk of capital by the business. Fortunately, these are all automated by the software provided by the ASPs.

In addition to GST services, ASPs also provide other value-added financial services in their application, such as income tax filing, audits, business accounting, payment gateway, business registration, digital signatures, e-way bills, utility payments, etc. The idea is to develop a singular ecosystem that can take care of all consumer and business needs. More importantly, the use of services like accounting and audit provided by the GSP software will gather the business data of all taxpayers under a singular platform which is intelligent enough to natively interact with the software. This will make returns filing fast, easy and automatic.

A very important factor to consider however is the role of privacy in the relationship between the ASP and the taxpayer. The ASP would have full access to the customer’s sales and purchaser data. This is more than enough to obtain crucial business data such as the identity of customers based on sales volume and location, nature of goods sold, sale price contrasted with the purchase price and therefore the margin, etc. Hence the relation should be guided by an absolute trust for the ASP’s professionalism plus strict Non-Disclosure Agreements.

We hope that you find this piece of content informative and comprehensive. We are always available to assist you in case you have further queries.