How to Become a GST Consultant and Start your own Business?

How to Become a GST Consultant and Start your own Business?

Everyone knows what GST law is, by now. It is an indirect tax law in India. As it is a new law there are a lot of doubts that come in mind regarding its registration, refund claims, return filing and other conditions that come under it. Thus, keeping this in mind Government introduced the concept of GST Consultant, so that they could help the taxpayers in GST compliance.

GST Consultant is a person who offers services to the payers by the online method. He should be registered on the GSTN portal and should also have a certification before he starts his practice. He is approved by the State or Central Government to do the following activities-

- File application for new registration

- Apply to claim or refund

- Also, he can send the request for changes or cancellation of registration

- He can also check the list of taxpayers who are engaged in your account

- Provide you with details of inward and outward supplies

- Can also appear as an authorised representative before any department or office

- Provide you with annual, quarterly or monthly GST returns

- Deposit credit into the electronic ledger system such as interest, penalty, etc.

By now, the role of a GST consultant must be clear to you but the next question that arises is, how to become a GST Consultant?

First, it is paramount to check the eligibility criteria for becoming a GST consultant, so that you can accordingly take the next step. Eligibility Criteria-

- Should be a citizen of India

- Should have a valid PAN Card, mobile number and E-mail address

- An individual should not be adjudged as an insolvent

- One should not have been convicted for any crime and jailed for more than two years

- One should at least be a graduate or should possess an equivalent degree in commerce

- He should have a degree either from an Indian University or a Foreign University that is equivalent to degree examination, that may include-

- Finals of Institute of Cost Accountants of India

- Finals of Institute of Chartered Accountants of India

- Finals of Institute of Company Secretaries of India

Steps for GST Consultant application process

The first thing that you need to do is fill the application form for that-

First, you need to login to the website, you can go to the official website.

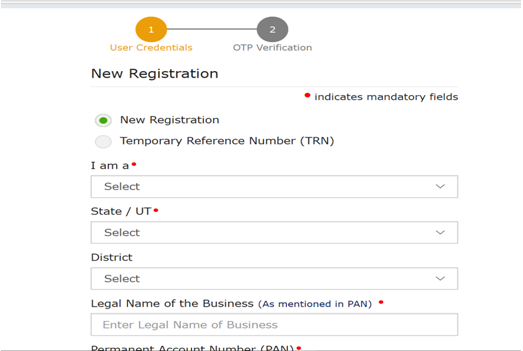

The second step would be to go to the register option. Once the Home page appears, check for the Register Now option and press enter. Once the registration page opens hit the New Registration option.

After that, in the I am the option you need to select a GST Practitioner, then select the state and district that you live in. In the name option, enter your legal name. The other details that you need to fill are PAN Card, email address, mobile number. The next thing is clearing the captcha code and then enter on the Proceed button.

Once the validation is done, you would be directed to the OTP verification page. You would get the OTP on registered mobile number, put the OTP and enter on Proceed button. The application process does not end here. Now, you would receive a 15 digit temporary reference number on your registered email address. Enter the captcha code and temporary reference number, then click on proceed.

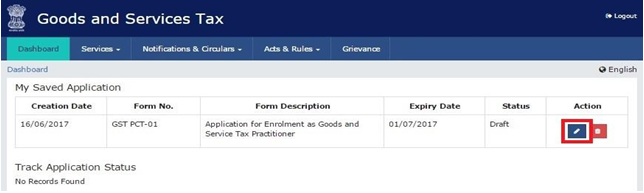

The next step would be entering the OTP which you have received on your mobile number and email address. You would be directed to My Save Application page. You would have to click on the Edit option under the Action Column.

GST Practitioner Exam Procedure

The first thing that you should be aware of is that the exams are conducted by NACIN (The National Academy of Customs and Indirect taxes and Customs).

- Exams are conducted twice a year across the country at certain designated centres. You can choose the centre as per your convenience. The date is updated by NACIN and is uploaded on GST portal

- You can register for the exam online on nacin.onlineregistrationform.org. To log in, you need to enter your user id and password

- The fee for the exam is Rs.500 which you have to pay at the time of enrolment

- The exam would be computer-based and you would get multiple-choice questions

- The results are declared by NACIN, within a month after the exam is conducted and is declared by sending you an email or through the post

- For clearing the exam, minimum 50% score is required. There is no limit of attempts

A page would appear in which you have to fill the general details which comprise of-

- University from where you studied

- Year of passing

- Qualifying degree for registering as a GST Consultant

- Choose the document type under the proof for the qualifying degree

- Upload the documents

- Click on Save

Then comes the section for Applicant Details, here you would have to fill-

- Complete name

- Date of Birth

- Gender

- Aadhar card

- Upload the photograph

- Click on save

In the next section, you have to fill the professional address-

- Insert the residential address with PIN code

- Choose the resident proof that you want to submit

- Upload the document

- Click on Save

Now, you would see the verification page, in which you have to-

- Tick on the checkbox with a verification statement

- Enter the place

- Select the format in which you would submit the documents

Click on the ‘agree’ button, you would receive an OTP, enter that and click on Continue. As the procedure gets completed, you would receive an email comprising of acknowledgement and Application Reference Number within the next 15 minutes. The License that you get for the GST Consultant remains valid till the time the relevant authority does not cancel it due to some unauthentic act.

Any person who is eligible and meets the above criteria can apply for becoming a GST Consultant exam registration.

Examination Syllabus-

It would cover the below-mentioned legislation-

- State-specific Goods and Services Tax Acts of 2017

- The Central Goods and Services Tax Act, 2017

- The Union Territory Goods and Services Tax Act, 2017

- The Central Goods and Services Tax Rules, 2017

- The Goods and Services Tax (Compensation to States) Act, 2017

- The Integrated Goods and Services Tax Rules, 2017

- Circulars, notifications and orders issued up to two months before the date of the exam. For the exam held on 17 November 2019, amendments up to 1st August 2018 were applicable.

- All-State Goods and Services Tax Rules, 2017

- The Integrated Goods and Services Tax Act, 2017

After you clear the form and register yourself as a legal GST Consultant, you can easily start up your office. You can register online and make your own clients and assist them in queries related to GST. If you want, there is another easy way of starting your own business, where you would not have to wait for getting renowned and getting customers.

GST Suvidh Kendra is one company where you can become a GST Consultant and earn a remarkable amount of money. This company is famous for providing excellent services to its customers and has its centres all over the country. The other services which they offer are Bill Payments, Insurance, Travel, PAN Card, GST returns and much more.

Registering with them is really simple. Just fill in some of your personal details, along with 1 photo and copy of a PAN Card and Aadhar card. Once the registration is done you need to pay a fee of Rs.24,000 to get the Super License.

There are loads of benefits that you could avail after paying the fee. Some of the advantages are-

- 100% money-back. You would get 240 coupons for Rs.100 which you can redeem by taking any GST services

- Training Material

- Promotional Material

- Four days of training

- 24X7 help desk services

These were just some of the benefits there are even more in the list. You would be amazed to know the commission that you can earn joining them. They provide you with a 50% commission on all the GST services that you do.

Bottom Line

If you have made your mind and wish to become a GST consultant then GST Suvidha Kendra is the best platform for you. The major benefit to you would be that you would get their existing customers because of the name they have earned. You can register now by filling the form or by calling them.