Why should you have a PAN Card and the eligibility?

Why should you have a PAN Card and the eligibility?

1. Overview

2. PAN card eligibility/ Who can avail for a PAN Card?

3. Documents required to apply for a Pan Card

- Documents required by an individual or HUF (Hindu Undivided Family)

Proof of Identity

Proof Of Address

Proof Of Date Of Birth

- Documents required by a Firm, Company, Local Authority, Limited Liability Partnership, Artificial Juridical Person, AOP, BOI, or Trust

Having their office located in India

Not having their office located in India

4. How to apply for PAN Card?

5. Steps you need to take while applying for a PAN Card

- What steps you need to take when applying for a PAN Card online?

- What steps you need to take when applying for a PAN Card offline?

6. Benefits of PAN Card / Why PAN card is significant for all Indian citizens

7. Duplicate PAN card

- What is a duplicate PAN card?

- How to apply for a duplicate PAN Card in case you have lost your original one?

8. Structure of PAN card

9. PAN for e-KYC (Know Your Customer)

10. FAQ’s

11. Conclusion/ Final verdict

1. Overview

Permanent Account Number (PAN), is allotted to every taxpayer by the Income Tax Department. It is a 10 digit alpha-numeric unique identity number which is very crucial in many aspects. PAN is also used as an identity proof in many banks and various organizations. Owning a PAN is substantial because it is compulsory for numerous financial transactions like for receiving a taxable salary, buying mutual funds, sale or purchase of assets and more.

We can also anticipate that due to this electronic system, all the information related to tax be it a company or a person is recorded against the PAN number. Therefore, two companies that pay tax cannot have one single PAN.

2. PAN card eligibility/ Who can avail for a PAN Card?

Any individual, company, charitable trusts or organizations, or non-resident Indian who earns a taxable income in India can apply for it. This also includes foreign nationals who pay taxes.

3. Documents Required to Apply for a Pan Card

In general, People residing in India need their identity proof, proof of date of birth, and age proof to apply for a PAN card. Furthermore, for availing a PAN card, these documents are required by individual applicant, Hindu Undivided Family (HUF), Company registered in India, Trust formed or registered in India, Limited Liability partnerships formed or registered in India, Artificial Juridical Person Association Of Persons (AOP), and Body Of Individuals (BOI).

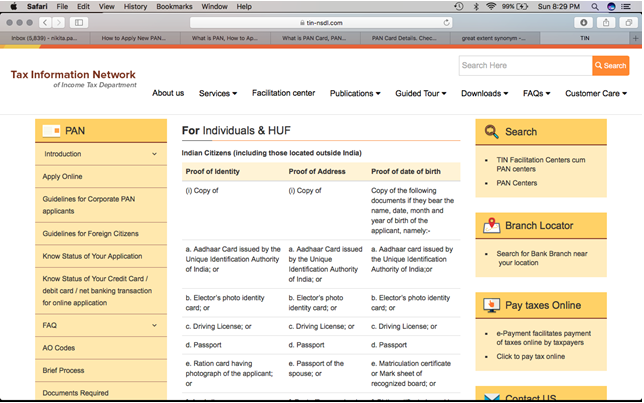

- Listed below are the documents required by an individual who is a citizen of India or HUF-

Proof of Identity-

- Aadhar Card

- Voter ID card

- Driving license

- Passport

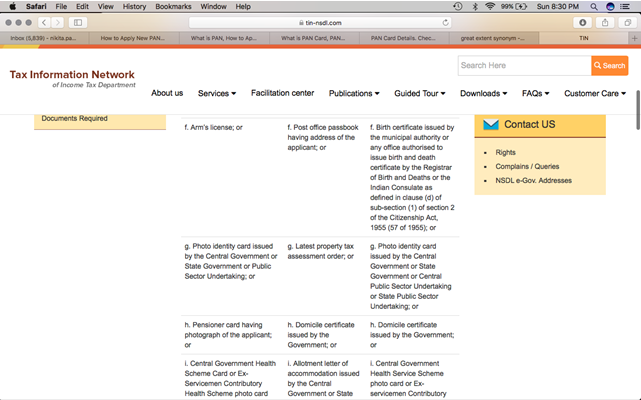

- Arm’s license

- Ration card having a photo of the applicant

- Photo identity card issued by the State Government, Central Government or Public Sector Undertaking

- Pensioner Card having a photograph of the applicant

- Ex-Servicemen Contributory Health Scheme Photo Card or Central Government Health Scheme card

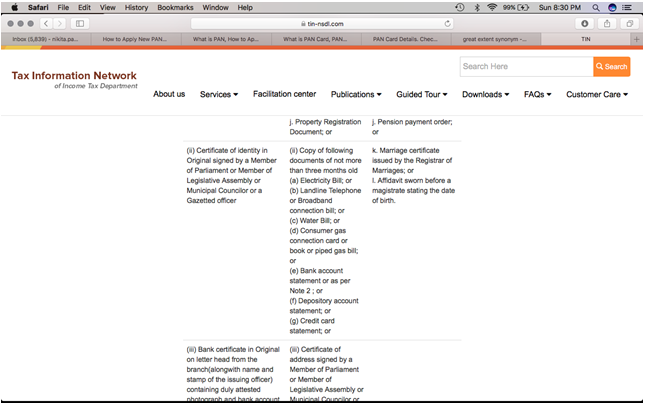

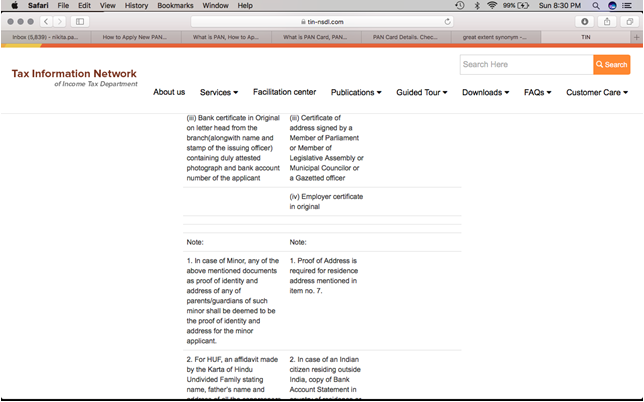

- Certificate of Identity attested by the signature of Member of Parliament or Member of Legislative Assembly or Gazetted Officer or Municipal Counselor

- Bank Certificate in Original Letterhead including a photograph and bank account number of the applicant

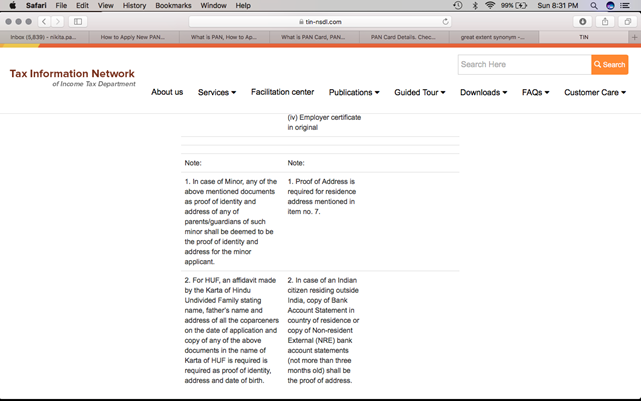

Proof Of Address-

- Aadhar, Voter ID, Passport, or Driving license (Any 1)

- Passport of the spouse

- Post office passbook having applicant address

- Latest property tax assessment order

- Domicile Certificate issued by the government

- Property registration Document

- Electricity, Water, Landline, Bill (Latest by 3 months)

- Consumer Gas connection card

- Bank account or Credit Card statement

- Employer certificate in Original

- Certificate of Address signed by Member of Parliament, Member of Legislative Assembly or Gazetted officer or Municipal Councilor

Proof Of Date Of Birth

- Aadhar, Voter ID, Driving License, or Passport

- Mark sheet of recognized board or Matriculation Certificate

- Birth Certificate issued by the municipal authority

- Photo identity card issued by the Central or State Government, or Central or State Public Sector Undertaking

- Domicile certificate issued by the government

- Ex-Servicemen Contributory Health Scheme photo card or Central Government Health Service Scheme Photo Card

- Pension Payment Order

- Affidavit swore before a magistrate stating the date of birth

- Marriage Certificate issued by the registrar of marriages

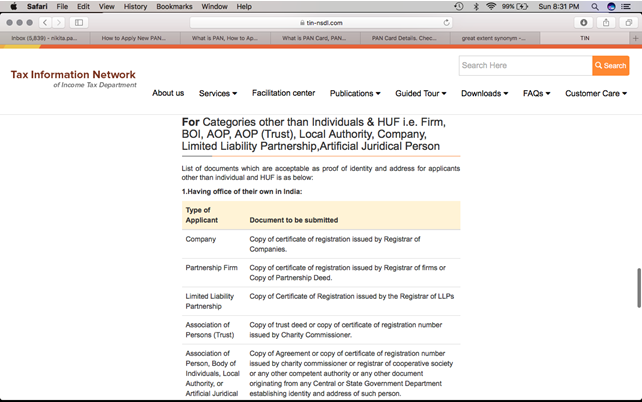

Listed below are the documents required for other categories that are Firm, Company, Local Authority, Limited liability partnership, Artificial Juridical Person, AOP, BOI, or Trust-

There are 2 possible scenarios for the above bodies applying for PAN. The first one is ‘Having Their Office Located in India’ and the second is ‘Not Having their Office Located in India’.

Having Their Office Located in India

- For the Company or the Firm- Certificate of Registration issued by Registrar of companies

- For the Partnership Firm- Partnership Deed, or Certificate of Registration issued by Registrar of firms

- For the Trust- Certificate of registration number issued by Charity Commissioner or Trust Deed

- For the Limited Liability Partnership- Certificate of Registration issued by the Registrar of LLP’s

- For the AOP, BOI, Local Authority or Artificial Juridical Person- Agreement copy, or certificate of Registration Number issued by Registrar of Cooperative Society or Charity Commissioner, or any other document originating from any State or Central Government Department highlighting identity and address of the applicant

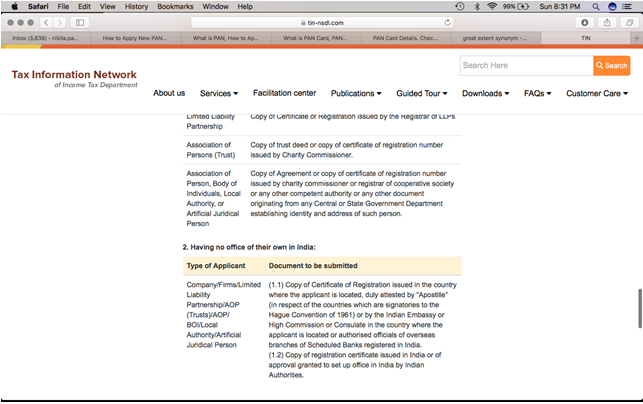

Not having their office located in India

- Certification of approval granted by Indian Authorities to set up an office in India or Registration Certificate issued in India

- Certificate of Registration issued in the applicant’s country attested by Apostille (from where the applicant is located), or by the authorized officials of overseas branches of banks registered in India, or high commission in the country where the applicant is located, or by the Indian Embassy

4. How to Apply for PAN Card

PAN card can either be applied online through the PAN card application process by visiting https://www.panind.com/india/ or offline through the NSDL office (National Securities Depository Limited) or UTIISL office (UTI Infrastructure Technology And Services Limited). You need to fill in and submit the form 49A. However, you can get this form online and offline.

5. Steps you need to take while applying for a PAN card

You need to follow a course of action to apply for a new PAN number. To avail the alphanumeric 10 digit PAN number you need to follow the procedure mentioned in the below steps-

What steps you need to take when applying for a PAN Card online?

- Select the ‘New PAN’ option on the homepage of NSDL or UTIISL website

- Submit the PAN card application form 49A available on NSDL or UTIISL website, depending upon the website you choose

- Apart from the Indian citizens, 49A form can be selected by NRE/NRIor OCI individuals

- Fill in all the relevant individual’s details and read the detailed instructions before finishing them up

- The charges for PAN application is Rs 93 excluding GST for Indian communication address. Whereas, Rs 864 is charged by the Indian Government in case of foreign communication address. You need to make the payment through debit card, credit card, or net banking.

- Once the payment is processed, you get the 15 digit acknowledgment number. Save it for future reference as you may need it to track your PAN card status.

- Once you get the number, PAN no. Verification is done and the card is generated by NSDL or UTIISL PAN verification

- The physical card is sent to the customer’s residential address from 15 to 20 days of the application

What steps you need to take when applying for a PAN Card offline?

- Collect the copy of 49A form from UTIISL or NSDL agents

- Fill in all the details and attach all the documents mentioned above (Proof of identity, the address and the date of birth)

- Submit all the documents along with a fee to the NSDL or UTIISL office

- PAN card will be dispatched to the respective address from 15 to 20 days of the application

6. Benefits of PAN card / Why PAN card is significant for all Indian Citizens

PAN card is indispensable for all taxpayers as it is required to track the inflow and outflow of your gross or net income. A PAN number is needed for managing all the financial transactions. It is elementary while paying income tax, receiving some sort of communication from the income tax department, receiving tax refunds, etc.

From the current year 2019, it has become mandatory to link your pan number with the UIN number (Aadhar) to file an ITR or performing any other task where PAN number is obligatory. As PAN card contains your name, age, and Photograph, it is also considered to be one of the valid ID proofs. There are ample of benefits of having a PAN card unique 10 digit number.

- Pan card is essential for doing any transaction above 5 lakhs related to the sale or purchase of assets, or any immovable property, or during purchase or sale of any vehicle.

- PAN is required to open a bank account in both nationalized and private banks

- PAN Card is required when applying for a new gas connection and phone connection

- When you are making the payment in RBI for acquiring bonds for more than 50,000 rupees

- While purchasing any mutual funds schemes

- Depositing more than 50,000 rupees in your bank account

- Payment exceeding 50,000 rupees to an institution or a company for applying debentures or bonds, or even for acquiring shares

- To make a one-time payment of more than 25,000 rupees while you are traveling abroad or when you are making the bill payment in any hotel or restaurant

- PAN card helps in the reduction of fraudulent transactions and activities. It not only provides transparency between buyers and sellers but also reduces tax evasion.

- Transferring the funds from NRE to NRO account

- When you need to remit money out of India

- It is almost impossible to misuse the PAN card to elude tax or any other unauthentic means.

7. Duplicate PAN Card

Once the PAN card is issued and the permanent account number is allotted, it is valid for a lifetime. And those who lose it due to any reason, need to apply for a new PAN. Although, income tax department issues a duplicate PAN card, in case one has lost it but only after going through the complete procedure which we will talk about below (7.2).

What is a Duplicate PAN card?

People may wonder how to get back such an important document as you may witness the perils of losing it. It is very easy to get a duplicate PAN card as the Income Tax Department has facilitated the whole process significantly. It is the same document as before which is allotted by the income tax department when someone lost, damaged or misused the card.

How to apply for a duplicate PAN Card in case you have lost your original one?

As we have discussed already, getting a duplicate PAN card is hassle-free. You can apply online to this website https://www.tin-nsdl.com or offline in paper form after visiting the TIN- NSDL office. Although, it is suggested to apply for a duplicate PAN card online, as it will save your time, energy and cost. The whole procedure that needs to be conducted is as follows-

- Visit UTIISL or TIN-NSDL website and go to an option for applying for a duplicate PAN card

- Fill in the form 49-AA in case you are a foreigner and Form 49A if you are an Indian citizen.

- Once you submit the form and make the payment, you will get a token number and it will be sent to your email id.

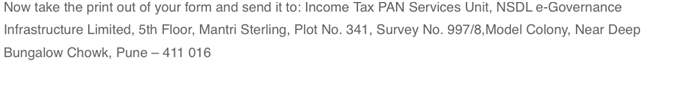

- Now you will get an option of the PAN application form in which you need to fill in personal details and forward the form to below mentioned address-

- You can check the status or track your PAN application by visiting this website i.e https://tin.tin.nsdl.com/pantan/StatusTrack.html using the 15 digit acknowledgment number you will get after submitting the PAN application form to that address

- Your PAN card will be dispatched between 14 to 45 days of the application.

8. Structure of PAN Card

PAN number complies with all the KYC guidelines and contains information such as your name, date of birth, father’s name, etc.

Listed below are the details mentioned in the PAN Card-

- Name of the cardholder- It may be an individual or a company.

- Name of the Father of the cardholder- It is not applicable for the cardholders who have PAN number registered in the name of a company. It is valid only for individual cardholders.

- Date of birth- In the case of a company, the date of registration is mentioned on the card. If it is an individual, the actual date of the cardholder birth is mentioned on the card.

- PAN number- It is a 10 letter alpha-numeric number and each character contains key information. Moreover, every PAN number allotted, be it any person or entity, is unique.

- The first three letters- These letters are chosen between A to Z and are substantially alphabetical. These letters are chosen by the government randomly.

- The fourth letter- It determines the category of the taxpayer. The distinctive entities and their respective characters are listed below-

i) A- Association Of Persons

ii) B- Body Of Individuals

iii) C- Company

iv) F- Firms

v) G- Government

vi) H- Hindu Undivided Family

vii) L- Local Authority

viii) J- Artificial Judicial Person

ix) P- Individual

x) T- Association Of Person For Trust

- The fifth Letter- It is the first letter of an individual’s surname

- Remaining letters- The remaining letters are random in which 4 characters are numbers while the last letter is an alphabet

- Signature of the individual- As a signature is a proof and required for the verification of financial transactions, it is the last detail mentioned in the bottom right. In the case of a company, no signature is mentioned over the card

- Photograph of the individual- In case of the firm or a company, no photograph is present on the card. Only when it is an individual’s PAN card, photograph acts as a photo identity proof of the individual.

9. PAN for e-KYC (Know Your Customer)

Now it has become mandatory to link PAN to Aadhar for verification and to avail e-KYC services and also the benefits from many service providers. It provides a considerable advantage not only to the government but to the end-user as well. Listed below are the benefits of linking PAN to Aadhar for e-KYC verification-

- Paperless and Prompt- It enables a service provider to manage the documents swiftly and efficiently as the e-KYC process is paperless. As the information is shared promptly with the service providers, it has resulted in eliminating long waiting periods which was experienced at the time of physical document requirement

- Secure- The shared information between the service provider and the customer cannot be tampered by someone else. The digital documents are sent through secure channels, that safeguard the user’s information.

- Authorized- All the information shared by e-KYC is considered to be legal, authentic, and acceptable for both the parties involved

- Cost-Efficient- The entire process is paperless making it a time saving and cost-effective process

10. FAQ’s

Q1) Can minors also apply for a PAN card? And what is the minimum age to apply for a PAN Card?

Q2) How should the PAN application form be filled?

Q3) How many photos do I need to submit the PAN application?

Q4) How long it may take to get a PAN card?

Q5) How can you apply for correction or any changes in the PAN Card?

Q6) Do I need to pay any charges for the PAN application form?

Q7) What are the total charges that I need to pay to apply for a PAN Card?

Q8) How would someone apply for a PAN card who is unable to sign?

Q9) Can I also change my photograph by filling up the PAN card correction form?

Q10) Is mentioning the father’s name mandatory in PAN application form for female applicants who are unmarried or even after they got married, separated, or become a widow?

11. Conclusion

Certain websites are being proliferated these days claiming that they would charge extra for providing PAN card in a day. You should not apply for any type of service through these websites. One should also refrain availing services from fraud agents who may disguise you by taking all your details and assuring you to provide instant delivery of the PAN card at an additional cost. These agents won’t provide you the pan card and may even misuse your information.

One must be cognizant that the PAN card is not acceptable as proof of Indian Citizenship as it also issued to foreigners who are just the investors. PAN Card is an essential document that is solely accountable for monitoring all financial transactions of taxpayers, prevents tax evasion, and facilitate calculating the high net worth of individuals.